China Railway Signal & Communication has signed a memorandum of understanding (MoU) with state-owned Vietnam Railways Corp for railway development in the Southeast Asian country, the government said on Wednesday.

Vietnam has turned to China for funding and technology for its massive railway development projects, including three railway lines linking the capital Hanoi with China and a high-speed railway from Hanoi to the southern economic hub of Ho Chi Minh City.

The agreement between the two companies will pave the way for cooperation in railway planning, construction, training and operation, the government said in a statement.

Deputy Prime Minister Tran Hong Ha said on Tuesday that Vietnam wanted to speed up the construction of three new railways linking the two countries.

On 17 December, Vietnamese Deputy Prime Minister Tran Hong Ha met with Lou Qiliang, Chairman of China Railway Signal & Communication in Hanoi.

German container terminals are adopting Steelpaint’s innovative corrosion protection system, Stelcatec, to restore and maintain the paintwork on ZPMC ship-to-shore cranes, following the system’s certification by the Chinese manufacturer in 2023.

Stelcatec, the world’s first isocyanate-free, low-VOC polyurethane coating system, is being utilized to repair damaged coatings on ZPMC cranes at container terminals in Hamburg, Bremerhaven, and Wilhelmshaven.

Adamium, a German maintenance contractor, has already completed works on cranes at Wilhelmshaven and is set to begin similar restoration projects at terminals in Hamburg and Bremerhaven over the next two to three years.

Dmitry Gromilin, Chief Technical Supervisor at Steelpaint, commented: “When protective coatings on ship-to-shore cranes get damaged a two-component epoxy is typically used for spot repairs, but if you don’t get the mixing right, the paint will blister and be ineffective in protecting against corrosion. It’s a long process and curing takes time.”

Traditional two-component epoxy coatings often delay crane operations for weeks due to their long drying times, which are influenced by substrate and ambient temperatures. Adverse conditions can further extend the application timeline, making them less practical in colder or fluctuating climates.

“Taking a ship-to-shore crane out of commission costs the terminal money, delaying container loading/unloading operations. They wanted a ZPMC-approved one-component system that would obviate mixing errors, reduce material waste, speed up the drying process and reduce the time cranes are out of service,” mentioned Steelpaint Sales Director Frank Müller. “With Stelcatec-L, the coating can be applied and cured within a working day,” he added.

The decision to implement Stelcatec followed successful trials on equipment operated by one of Europe’s largest container terminal and logistics groups. These trials, combined with rigorous testing by ZPMC, led the original equipment manufacturer to certify Stelcatec for use on both existing cranes and new builds.

Achim Wallat, Adamium Project Manager, explained: “Terminal operators want an effective, reliable and safe corrosion protection system capable of reducing maintenance costs and downtime. Compared to two-component epoxies, Stelcatec-L is a very impressive, durable coating system that we now specify for all our crane refurbishment projects.”

Developed over four years of research and development, Stelcatec is a single-component, moisture-curing paint that eliminates the use of isocyanates. With very low solvent content, it can be applied by brush, roller, or spray in a wide range of conditions, including temperatures from -5°C to 50°C and relative humidity up to 98%.

Designed to protect steel in corrosivity category C5, Stelcatec meets ISO12944 standards, offering up to 25 years of protection. Its rapid drying times and high dry film thickness (DFT) of 80-120µm make it a highly efficient solution for crane maintenance.

“It is ideally suited for maintenance projects where time is of the essence,” noted Müller. “As Stelcatec can be applied 24/7, nighttime repairs are possible, reducing the time and costs associated with touch-up work. Terminal operators no longer have to take a crane out of service for weeks for coatings work.”

Steelpaint is now extending Stelcatec technology to the Asian market, where operators are conducting patch tests. The company anticipates receiving full coat application orders in the near future.

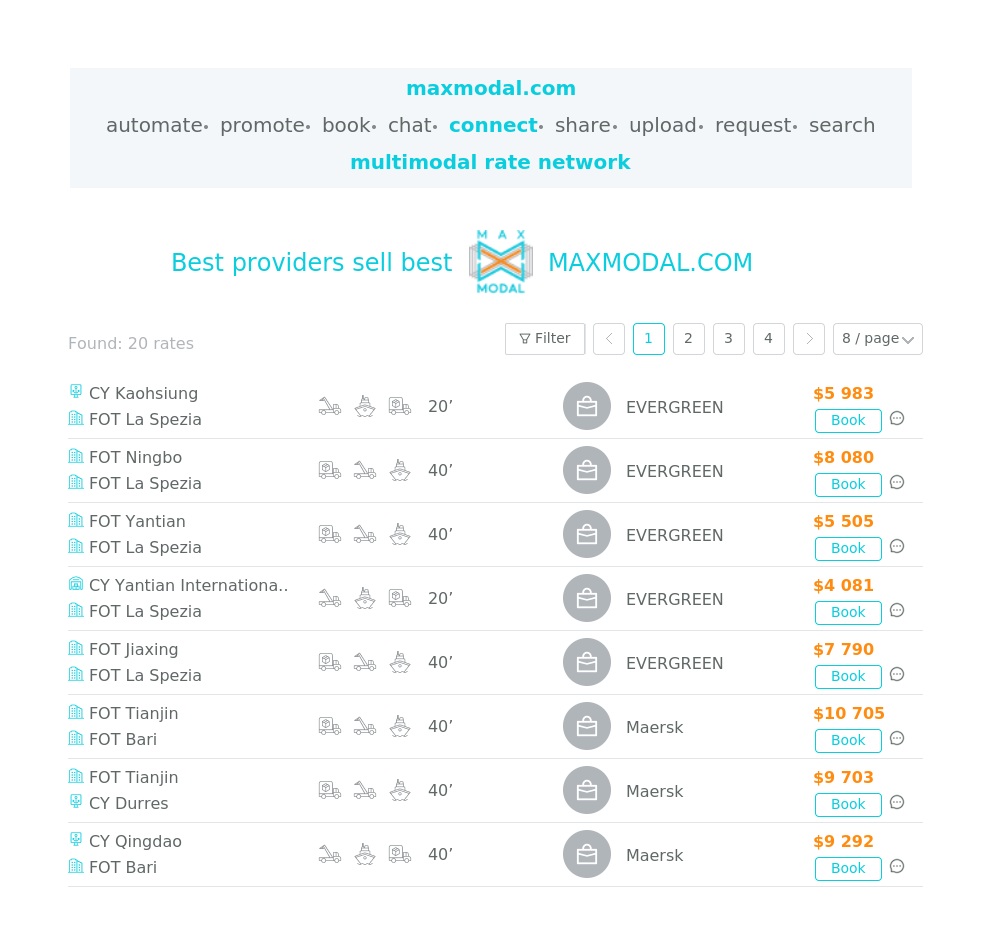

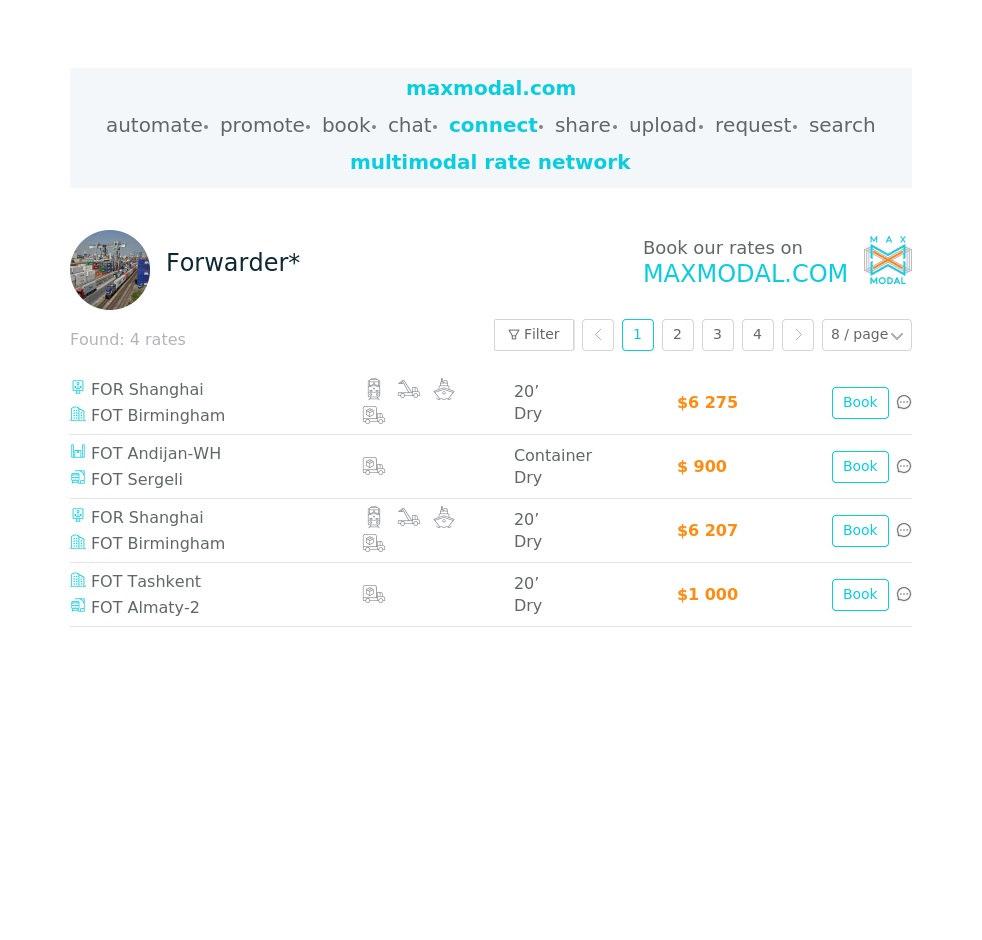

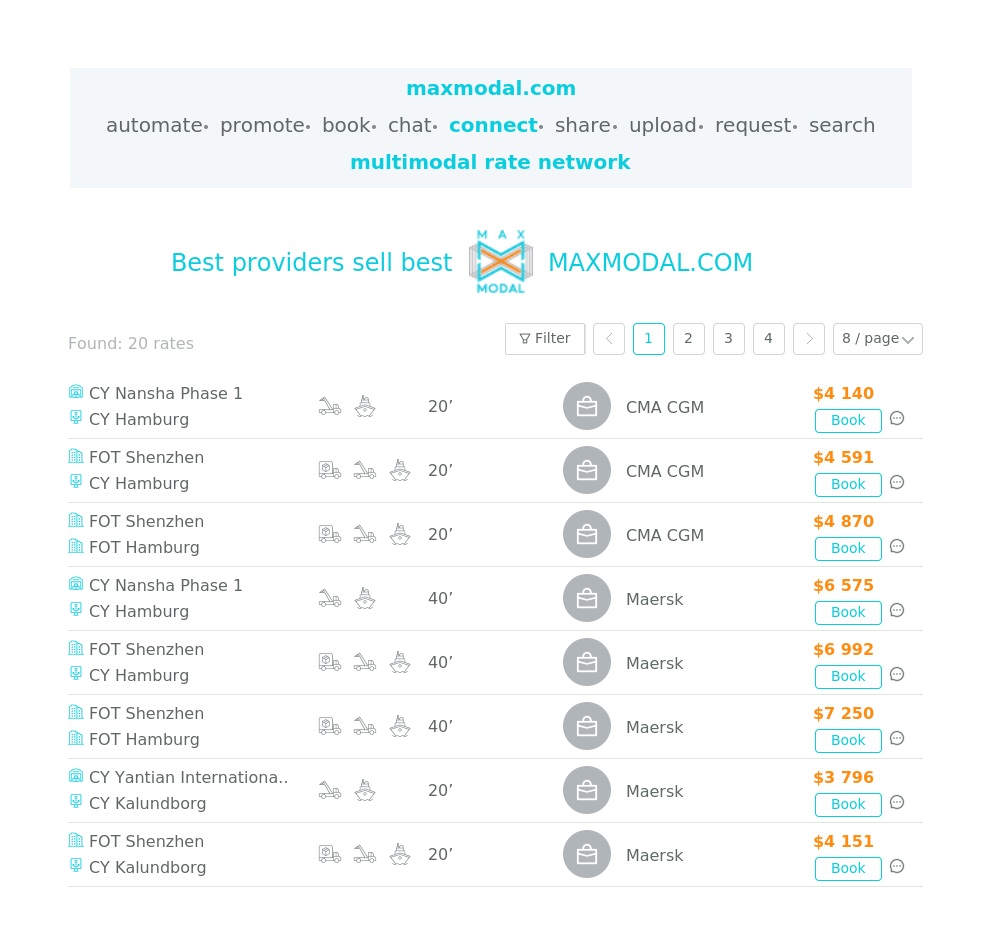

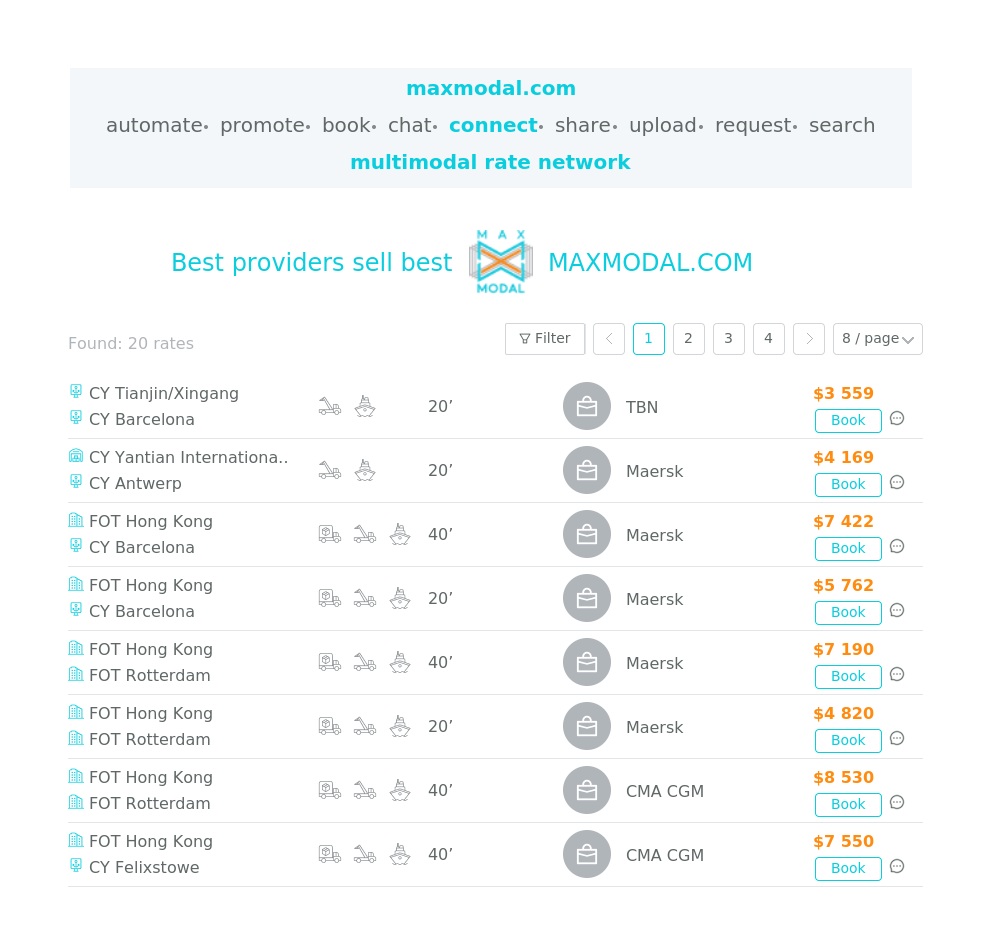

Get the link for freight rates by many providers on maxmodal.com

US perishables exporters say they are struggling to secure enough temperature-controlled containers and trucks and face tight capacity and particularly strong demand for reefer boxes.

Recently logistics providers have reported a serious shortage of reefers at the port of Houston and less-pronounced availability problems at Philadelphia and Virginia.

This has been largely blamed on a double-digit surge in refrigerated imports from Asia, led by a 30% increase in seafood.

And this coincides with the start of produce exports from the southern hemisphere: carriers have reported strong volumes out of Argentina and Chile amid expectations of large crops.

Shippers there also face a shortfall of available reefer equipment. According to specialist Metro, South American exporters have struggled with a 73% shortage of reefer boxes.

Other markets are facing difficulties too. Vietnam-based logistics provider Seahorse Shipping notified customers that reefer capacity had become increasingly tight, pointing to an estimated 10% increase in global demand this year. And Europe has seen a 19% shortfall in reefer containers, Metro reported.

In DHL Global Forwarding’s update on the ocean reefer market in the fourth quarter, it warned shippers of equipment shortages in Oceania and India, and also signalled low availability in South America and South Africa. And Hong Kong-based forwarder Dimerco reported the supply shortage had also affected intra-Asian traffic lanes.

Longer transit times, owing to the extended routings out of Asia to avoid the Red Sea, have exacerbated the problem. According to DHL GF, this has removed 7% of global capacity.

In addition, worries about a second US east/Gulf coast port strike may have prompted US perishables importers to bring in supplies early to avoid disruption, further straining capacity. DHL told customers to consider conversion from ocean to air cargo, especially for critical lanes.

Shortages of reefer trucks have also been reported on US roads this month; they were in short supply in the states of Idaho and Washington, and previously there were occasional shortages in Florida and the Chicago area.

One factor behind this has been fewer trucking providers after small players left the market under the strain of the lasting freight recession that has depressed rates. Cancellations of carrier authorities have averaged about 7,000 a month this year, according to DAT Freight & Analytics.

US reefer shippers have also seen a rise in tender rejections from trucking providers. Since early October, these have averaged over 14%, up from 8% in October 2023. Predictions of a cold winter, which would increase the need for temperature-controlled transport, suggest that the coming weeks may be even tougher for shippers to navigate.

And it is doubtful if 2025 will bring much relief.

“Shippers must carefully plan and adjust their supply chains to mitigate delays and shortages, as reefer container availability remains strained well into 2025,” Metro warned.

According to DHL, reefer volumes are expected to grow at 2.2% CAGR through to 2028.

Welcome a new company on MaxModal. You can see AMBER LOGISTICS & TRADING Co., Ltd services on their business profile, drop them a message, add them to your contacts or submit a special request to them

Get the link for freight rates by many providers on maxmodal.com

Liner operators are reporting full bookings for Far East-Mexico/South America slots into the new year.

Shippers are anxious to get goods from Mexico into the US ahead of president-elect Donald Trump’s impending new tariffs, and before Chinese New Year, in January.

A spokesperson for South Korea’s flagship carrier, HMM, told: "The demand for shipments from the Far East is robust, and we anticipate it to remain strong leading up to the early Chinese New Year holiday.”

Mexico is emerging as a production base due to near-shoring and, ahead of new tariffs, it is anticipated that shipping of semi-finished products will be expedited into the new year.

Korea Customs’ figures show that 263,400 teu was shipped between South Korea and Central/South America in October, up 24% from a year ago.

South Korean exports increased 35%, to 196,300 teu, and imports were up marginally, to 67,100 teu. Most of the container flows were to Mexico, which took in 89,300 teu, up 29%, with Chile, Peru and Brazil the second-, third- and fourth-largest South American trading partners.

Automobiles, electronics and chemicals are South Korea’s main exports to Mexico.

While Far East-South America freight rates have corrected after rising all year, they remain high. Last Friday, the Shanghai Containerised Freight Index showed Shanghai-Santos rates at $5,346/feu, up 2% on the previous week, but below 1 November’s $6,359/feu.

The Korea Composite Container Index showed the South Korea-Latin America East Coast rate averaged $6,021/feu on Monday, down 2% from the previous week, while the South Korea-Latin America West Coast rate averaged $3,807/feu, a 1% dip.

Xeneta chief analyst Peter Sand wrote in a recent blog post that the China-Mexico West Coast lane was “an immature trade”, as opposed to the China-US West Coast route. China-Mexico shipments peaked at 135,724 teu in June and have levelled off.

Mr Sand noted that, while volume growth into Mexico had been exponential in 2021, 2023 and 2024, real container shipments were still lower than mature markets. The volatility could be seen in China-Mexico West Coast rates peaking six times this year, compared with three times for China-USWC rates.

He wrote: “Volumes on this trade show it’s an increasingly attractive option for shippers, but this volatility means it comes with the risk of unpredictable freight spend.”

Since 2022, the Trans-Caspian International Transport Route, or Middle Corridor, has gained significant traction as an alternative trade route between the European Union (EU) and China, particularly in response to shifting geopolitical dynamics. The Middle Corridor is a multimodal land and sea transport route that connects China with Europe by utilizing a combination of rail and sea transport. It stretches from China’s western border through Kazakhstan, across the Caspian Sea via Azerbaijan and Georgia, then through Türkiye, and into the EU.

Amid the ongoing crisis in the Red Sea and the Russia-Ukraine war, the Middle Corridor has emerged as a stable route for China. The Middle Corridor was officially launched in 2013 through multilateral cooperation involving Azerbaijan, Georgia, Kazakhstan, and Türkiye. Its primary aim was to enhance East-West trade connectivity and facilitate the interaction of member countries with key economic hubs such as the EU and China.

Despite the completion of critical infrastructure projects—such as the Trans-Kazakhstan railway in 2014 and the Baku-Tbilisi-Kars (BTK) railway in 2017, which significantly strengthened the corridor’s hard infrastructure—China’s engagement with the Middle Corridor remained minimal during this period. Beijing’s perception of the Middle Corridor can be divided into two phases: the first from 2013 to 2022, and the second from 2022 to the present.

Get the link for freight rates by many providers on maxmodal.com