ILA union members at the port of Montreal have called another strike, starting tomorrow, which is expected to impact operations, says the Maritime Employers’ Association (MEA).

The MEA said yesterday: “Discussions over the past few hours have failed to bring the union back to the table in a constructive manner.

“The longshoremen’s union is therefore preparing to launch an unlimited general strike at the Viau and Maisonneuve terminals operated by TerMont, starting at 11am on Thursday.

“This pressure tactic will quickly lead to major operational upheavals, jeopardising the operations of several companies, as well as the financial health of the MEA, which is already coping with declining volumes.”

The association has gone back to the minister of labour, Steven MacKinnon, and again asked him to appoint a special mediator – a proposal previously rejected. The MEA said a special mediator could be tasked to help the parties reach an agreement by 3 December.

“It is clear that the parties are currently at an impasse. The MEA is appealing for the government to appoint a special mediator to break the deadlock in negotiations as soon as possible.”

In his recent diagnosis of the state of the US trucking industry, American Trucking Associations (ATA) chief economist Bob Costello brought up a factor rarely mentioned in the discussion over the plight of truckload operators: loss of traffic to private truck fleets.

“One of the reasons why freight hasn’t recovered as much is because private fleets have taken some of the share, which by the way, has not happened in a very long time,” he told the ATA Management Conference and Exhibition this month.

To boost network utilisation, some shippers have been courting others to give them their traffic. Arguably the most aggressive has been Walmart, which launched several initiatives to draw in shipments from other sellers. Having established its fulfilment service in 2020, the retailing giant has increasingly opened its logistics infrastructure to online merchants.

In August, Walmart announced it was inviting e-commerce firms to use its ocean shipping infrastructure to move merchandise from China to the US. Walmart Cross Border is a port-to-door service, where shipments are fed into Walmart’s US fulfilment network at the port.

Notwithstanding misgivings about handing freight and data to large competitors, such offerings have resonated with shippers and private fleets have been growing. According to a survey last year by the National Private Truck Council (NPTC), outbound shipments handled by private fleets rose to 75%, the highest in the survey’s history.

On the basis of Federal Motor Carrier Safety Administration Numbers, the NPTC counted 940,280 registered private fleets last year, compared with 1.08 million for-hire carriers, about 90% of which operate fleets of 20 trucks or fewer.

Walmart’s operation probably puts it in the top five of US trucking firms, said Satish Jindel, founder and president of ShipMatrix and SJ Consulting Group.

The challenges of the pandemic convinced many cargo owners of the need to secure access to capacity at affordable cost. Apart from a rise in private fleets, this led to the emergence of collaborative schemes for shippers to pool traffic.

A total of 14,689 China-Europe freight trains operated from January to September this year, up 13 per cent year-on-year, China State Railway Group Co announced on Monday.

During the period, the trains carried a total of 1.57 million twenty-foot equivalent units (TEUs) of cargo, up 11 per cent year on year, the state railway operator said.

In September alone, the trains made 1,633 trips and carried 171,000 TEUs of cargo. Since January, the number of China-Europe rail freight trips has exceeded 1,600 for seven consecutive months.

The railway operator said that it has intensified efforts to increase throughput at ports and transportation channels and improve clearance efficiency, and it has also actively participated in the construction of the cross-Caspian Sea international transport corridor.

At present, China-Europe freight trains serve 226 cities in 25 European countries.

According to customs data, as of September 16, the China-Laos railway has handled 10 million tonnes of cross-border freight since it started operations in December 2021. As an example of tapping the international trade artery and boosting regional trade, the first batch of fresh bananas from Laos arrived in Beijing via cold chain logistics on Sunday.

Also on Sunday, the first “Jinbo” China-Europe freight train for 2024 arrived in Shanghai, carrying exhibits for the 7th China International Import Expo (CIIE), one of the country’s largest trade fairs, to be held in early November, according to local media.

Shpt.Term: FOB

Origin: Bandar abbas(Iran)/or other available ports

Destination: Mersin(Turkey)

Number of container: 50x20 ft GP / Monthly (SOC)

Flexi tank/ Bitumen

Shippers are facing more upheaval at Chittagong Port – transport operators began a 48-hour strike this morning, leaving export and import containers stranded.

The Chittagong District Prime Move Trailer Workers Union’s action will impact 3,000 to 4,000 teu every day at the port

Secretary general of the Bangladesh Inland Container Depots Association (BICDA) Ruhul Amin Sikder told The Loadstar: “If the strike continues, shipment of boxes would not be possible in time. Many containers will miss designated feeder and mother vessels.”

Union president Selim Khan pointed the finger of blame squarely at two of the largest transport operators in the region, Mohammadia Enterprise and Asif International, claiming they had reneged on multiple aspects of an agreement signed in April.

Mr Khan said the operators had not only failed ensure the provision of appointment letters and identity cards, but had yet to meet government-imposed minimum wage requirements.

He explained: “In April the workers union and the company owners signed a deal to implement these demands within 45 days, but the owners are yet to implement these, thus we enforced the strike, and won’t withdraw the strike until a fruitful discussion takes place.

“Many prime mover trailer company owners have implemented these lawful demands, but those who are members of the owners’ association are dilly-dallying to implement the demands.”

Meanwhile, the legality of the strike has been questioned by the general secretary of the Bangladesh Covered Van-Truck-Prime Mover Goods Transport Owners Association, Chowdhury Zafar Ahmed.

He claimed: “There is no mention of appointment letters for goods transport drivers in the Road Transport Act 2018. The union members are enforcing the strike illegally.”

Welcome a new company on MaxModal. You can see Trade Like Solomon services on their business profile, drop them a message, add them to your contacts or submit a special request to them

The railway administrations of Azerbaijan, Turkey, Uzbekistan, Kyrgyzstan, Tajikistan, China and Austria have agreed to establish the Eurasian Transport Route Association with headquarters in Baku. The decision was made after a consultative meeting in the Azerbaijani capital on Friday.

“All official procedures will be completed in the near future and the Eurasian Transport Route International Association will be established,” announced Rovshan Rustamov, Chairman of Azerbaijan Railways CJSC, at a press conference.

The meeting brought together the heads of railway administrations of the participating countries to discuss the framework of the project.

Rustamov emphasised the importance of forming a collegiate body to enhance the competitiveness of the Middle Corridor, also known as the Trans-Caspian International Transport Route (TITR).

This corridor connects China, Kazakhstan, the Caspian Sea, Azerbaijan, Georgia, Turkey and eventually European countries.

“The association has to carry out structured work, develop a corridor concept, formulate a tariff policy and explore the implementation of digital solutions to ensure faster and safer transport,” Rustamov explained.

The aim is to make the Central Corridor more efficient and attractive for international trade and to improve the overall operation of the route.

Despite the well-publicised drought that hampered its capacity, container vessel transits through the Panama Canal this year barely showed a dip, thanks to the carriers’ deep pockets.

According to the Panama Canal Authority (ACP)’s full-year 2024 results, while movements of all vessel types fell 29.4% year on year, to 9,926 up to the end of September, containership transits were basically unchanged, at 2,733 – a reduction of just 14, equating to a 0.5% drop.

However, these figures are for both the original locks and the neo-panamax locks which opened in 2014 – and containership movements through the latter increased, to 1,787, a gain of 2.1% over 2023. This meant the proportion of containerships to total vessels increased from around 20% to 26%.

Shipping analyst Alphaliner explained that the newer locks were proving increasingly popular with container carriers, which over the past few years had introduced scores of neo-panamax vessels (of up to 14,000 teu) to services that transit the waterway, particularly on the Asia-US east coast strings. Of all the box vessels transiting the canal, 63% passed through the neo-panamax locks, compared with 48% in 2023.

“Cash-rich container carriers were able to take advantage of a stricter reservation system introduced by the canal authority during the drought, including expensive auctioned slots, while other ship types, particularly dry bulk, opted to re-route leaving more slots open,” Alphaliner writes today.

The drought from a lack of rainfall began to impact water levels in the canal in the early months of last year, reached a nadir towards the end of 2023 and the authority warned transits could be slashed by as much as 50% by February this year.

However, careful water management and a welcome return of rain this year has seen ACP now offering 35 daily transits, slightly below its design capacity of 36 to 38.

Meanwhile, in a speech given to the New York Maritime Forum yesterday, ACP administrator Ricaurte Vasquez said the organisation’s efficiency measures in response to the drought had resulted in 1% reduction in vessel wait times. That translated to an average of 15 hours less wait, a 1% reduction in transit times from when a vessel arrives at the first lock until it exits the last one, a 4% reduction in time spent in the canal, with an average decrease of 16 hours, and a 5% reduction in water usage per transit for neo-panamax vessels.

And despite the reduced traffic, ACP saw 2024 revenue increase 9%, to $3.5bn, up from $3.2bn the year before.

Last month, Mr Vasquez told the Panama Stock Exchange’s 2025 Investors Forum: “We designed a different pricing structure based on the locks used by ships, thereby establishing a value for water usage.

“Other countries place an economic value on oil or minerals, and we have established the economic value of fresh water from the lake. This way, our strategy, adapted to the environmental reality, allowed us to optimise revenues, reduce operating costs and maintain our competitiveness in the market.”

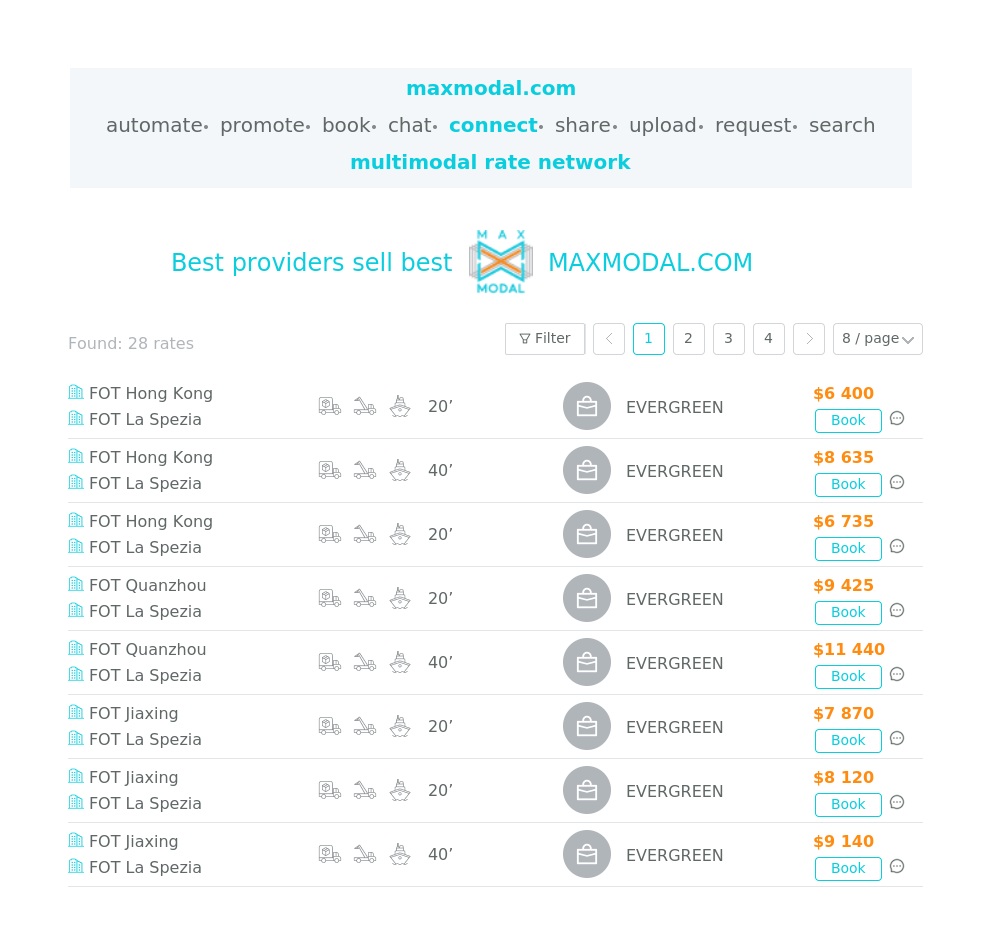

Get the link for freight rates by many providers on maxmodal.com

Welcome a new company on MaxModal. You can see Colibri Shipping Logistics LLC services on their business profile, drop them a message, add them to your contacts or submit a special request to them