Welcome a new company on MaxModal. You can see Indaiá Logística Internacional e Integrada Ltda services on their business profile, drop them a message, add them to your contacts or submit a special request to them

Forwarders have lambasted the Canadian government for its “late intervention” in the stand-off between dockers and their employers across the country’s ports.

Responding to labour minister Steve MacKinnon’s order to the Industrial Relations Board (IRB) this week to extend existing collective bargaining agreements and impose arbitration on all parties, one forwarder told: “The big question here is why the government waited until the damage was done before stepping in.

“It was clear to everyone they’d have to get involved and, once again, they waited until the strike was in full effect before coming to the rescue.

“Industry is pleased that goods will be moving again, but probably more annoyed that it’s kind of too late, the damage has been done.”

Despite the intervention, unions, including the Longshoremen’s CUPE Local 375 at the port of Montreal, have vowed to fight the action in the courts.

Similarly, the International Longshore and Warehouse Union Local 514, representing dockers in British Colombia, warned the government it would “not forget how employers and this federal Liberal government have attacked all of labour”.

The forwarder we spoke with said this action could impact the government’s relationship with unions, adding: “It’ll be interesting to see if the unions truly do remember this.”

Nor is this the first time Mr MacKinnon’s timing has been considered off, his August decision to use the IRB to resolve a dispute between rail workers and their employers was criticised.

As in the present situation, the labour minister forced members of the Teamsters Union into binding arbitration with railroads Canadian Pacific Kansas City (CPKC) and Canadian National (CN), again provoking unions, who said Mr MacKinnon had been “manipulated” by the carriers.

The forwarder said that situation had played out “almost exactly like this, with government getting involved too late… The difference here is timing, the port strike is in the busiest season”.

“I don’t think it’s a coincidence this has happened during the holiday rush. The impact will be significant. Unfortunately, the only ones who end up paying for all of this are consumers. That’s where all of the additional cost has to trickle down.”

At Montreal, the dispute centres around terminals operated by Termont, responsible for some 40% of the port’s volume, and has been rumbling on since 31 October, with carriers having sought to bypass the situation by rerouting services into Halifax.

Warning “while there may be some progress” with this diversion, the forwarder said, carriers could face cargo backlogs there.

“It only works if union members in Halifax agree to offload the containers, because in previous scenarios other ports refused to accept ships originally destined for ports that were on strike.

“It’ll take weeks to clear the backlog and, during the holiday season rush to get goods on the shelves, a lot of them won’t make it on time, and the cost will increase significantly.”

In a warning to shippers, the forwarder noted that, while the cost may flow down to consumers, given the seasonality of products coming in, it may “be much more difficult to pass the cost on after the holiday rush”.

Cargo stakeholders using Adani Group container terminals at the south Indian ports of Kattupalli and Ennore are reporting growing delays, impacting productivity levels for vessels.

Amid historical infrastructure bottlenecks at Chennai, Kattupalli and Ennore had become the focal points for liners serving India’s east coast.

According to industry sources, the roll-out of new terminal operating systems by Adani had featured glitches in applications that typically connect vessel, yard and gate operations, hobbling the entire supply chain system.

Customs brokers serving the gateways said the delays had reached “alarming proportions”, with no tangible results from a series of meetings with various authorities, including Customs.

“Operational challenges at Kattupalli and Ennore have become unbearable to the trade,” the Chennai Customs Brokers Association (CCBA) told its members, and called on them to share their pain points for submission to officials.

The association complained that customs service providers were particularly frustrated with delays getting “equipment interchange receipts”, a document issued by a carrier for empty container allotments to the shipper, and “Form 13s”, which allow trucks to enter the terminal.

According to CCBA, the disruption is causing longer container dwell times and additional costs for exporters and importers.

“The delays have considerably hampered the gate-in of export shipments and the issuance of import delivery orders,” reported a source.

Other sources also noted a significant slowdown in container scanning, due to the system disruption, creating long truck queues outside terminals.

When containers remain on-dock beyond their allotted free storage time, cargo owners inevitably are charged port ground rent and carrier detention fees, in addition to other potential business losses.

Kattupalli and Ennore together handled 134,210 teu in September, down from 139,437 teu in August, according to industry data.

Adani has boosted its container terminal presence in southern India in recent years, as India’s production verticals have diversified. The region in and around Chennai is seeing rapid manufacturing investments, particularly for electronics and hi-tech products.

Meanwhile, container transhipments through Adani’s Vizhinjam Port are growing at a brisk pace, hitting some 100,000 teu in just four months after it began trial operations in July. The new terminal has seen some 46 containership calls, including several ultra-large vessels in MSC’s fleet.

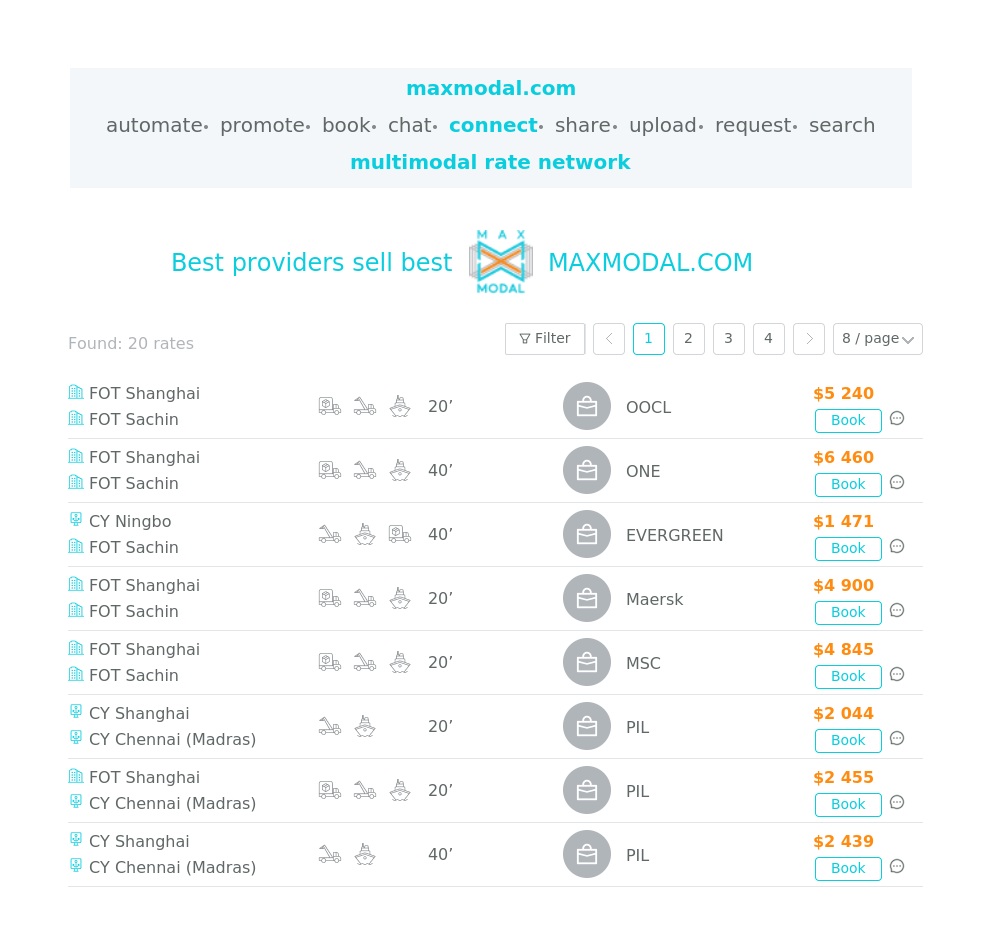

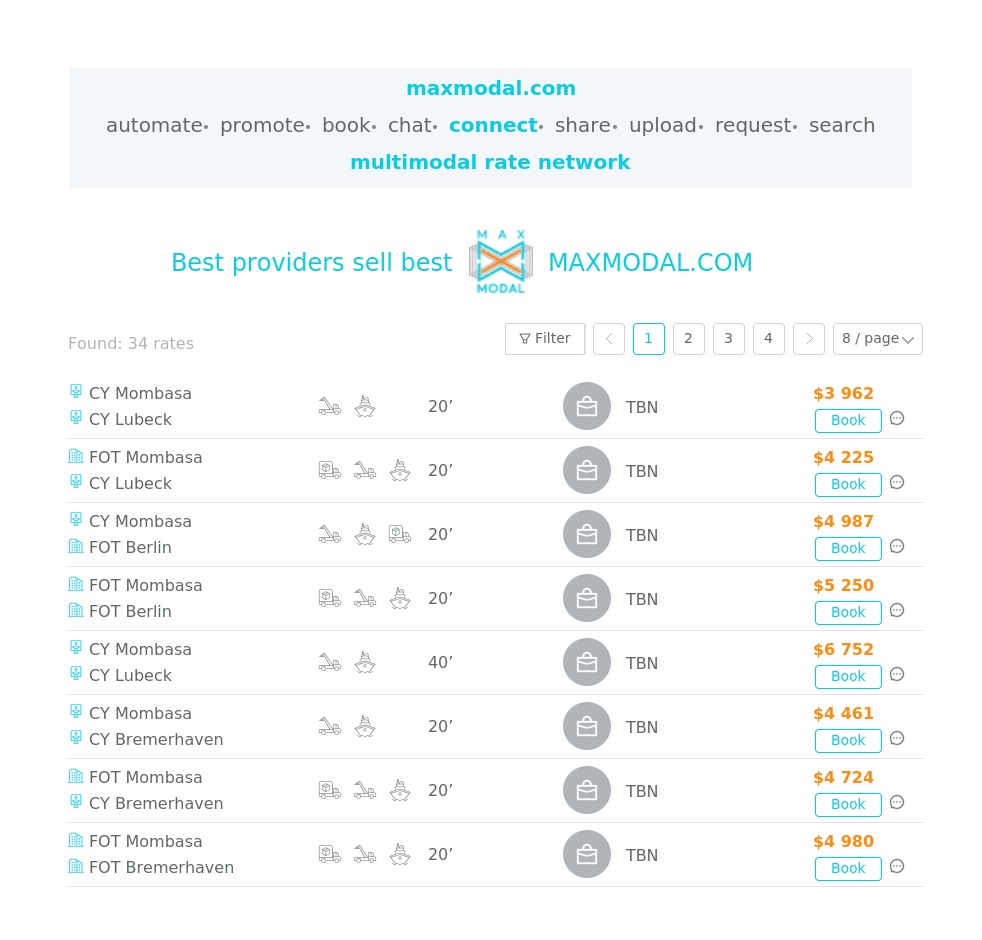

Get the link for freight rates by many providers on maxmodal.com

Despite generally weak cargo demand, spot rates on the Asia-Europe trades continued to show gains this week, as carrier capacity management combined with port congestion left space at a premium.

Following a series of general rate increases on 1 November and a new round of freight all kinds (FAK) levels due on 15 November, carriers are adopting a bullish tone in what is traditionally one of the weaker periods of the calendar.

“In the wake of the Golden Week national holiday period in China, demand out of Asia traditionally weakens, with seasonal stock already approaching European shores. However, we are seeing demand bounce back a lot stronger, with higher call for ocean capacity,” Maersk said in a trade analysis yesterday.

This week’s spot rates, sourced from Drewry’s World Container Index (WCI) and Xeneta’s short-term XSI, would appear to show recent pricing supporting this.

The WCI’s Shanghai-Rotterdam leg grew 16% week on week, to finish at $3,954 per 40ft, while the Shanghai-Genoa leg jumped 21%, to $4,399 per 40ft.

“Spot rates on the Asia-Europe tradelane increased for the second consecutive week and Drewry expects this uptrend to continue next week” it noted.

Similarly, Xeneta’s Far East-Europe leg of its XSI saw a 25% week-on-week jump, to $4,105 per 40ft.

Meanwhile, North European ports have continued to struggle to clear backlogs – Hamburg’s port modernisation programme at HHLA’s Altenwerder and Burchardkai terminals remains ongoing and has forced the operator to introduce controls on export containers out of the former.

A Hapag-Lloyd operational update this morning noted that Altenwerder’s storage capacity was at 100%, while its yard utilisation remained high, at 85%.

Maersk added that the approach of winter was also causing issues – heavy fog in Rotterdam could lead to lengthening vessel queues, while in Antwerp, it said, “vessel waiting times remain high due to late arrivals from previous ports”.

In addition, maintenance work on the Belgian port’s quays is expected to last until the third week of December, “contributing to an increased yard density at the terminal”.

As a result, 2M partners Maersk and MSC have had to slide their joint week 48 AE55/Griffin Asia-North Europe sailing by a week.

Meanwhile, it was a very quiet week on the transpacific and Asia-US east coast trades, as everyone waited for the results of the US election, and spot rates on the two trades remained flat for a second consecutive week.

As US shippers digest the implications of a second Trump presidency, however, renewed activity can be expected during the remainder of the year.

Forwarders are focusing on building improved relationships with smaller container lines amid deteriorating relationships with the largest operators.

Multiple forwarders said Covid-19 had “permanently” upended the balance of power between the two sides , with increasing digitalisation further eroding the possibility of seeing relationships improved.

“All carriers have moved to some form of online model, which further restricts the possibility for human interaction,” one UK-based SME told.

“And that relationship is never going to return to the pre-Covid status, with carriers having invested in additional ships, leaving them with the whip hand over the container market, especially considering the protections given to them to operate alliances.”

Recognising some benefits of the alliance system, the forwarders spoke to nonetheless said it unfairly disadvantaged them, and compromised the ideals of free trade.

Amid deteriorating relationships, the SME source pointed to an increasing focus on box ship operators with smaller fleets, as they were more receptive to the idea of reaching agreements with forwarders based on the long term.

Echoing the UK-based forwarder, another, operating out of Portugal, said availability, capacity and reliability were undoubtedly important, but “the most critical factor is maintaining a relationship grounded in mutual respect and professionalism”, and added that it was “essential” carriers were not allowed to bypass forwarders and engage directly with their customers.

Asked whether that meant they opposed moves by ocean lines into the airfreight sector, the Portuguese forwarder said it “wasn’t as simple as that”, and explained: “There’s potential for a positive impact if these carriers adhere to IATA standards and uphold established ethical norms. When done correctly, this expansion can bring advantages, such as enhanced multi-modal capabilities that offer comprehensive logistics solutions.

“Success in this new arena will likely depend on collaborating with forwarders to ensure regularity and consistency in service offerings.

“But if ocean carriers adopt aggressive competitive tactics similar to those that they deploy in shipping, directly challenging forwarders by circumventing established client relationships, they may face significant obstacles.”

Even so, the sense among many is liners moving into airfreight is part of a broader push by carriers to use pandemic-induced profits to establish a one-stop shop for shippers.

The forwarders told that while this idea may appeal to the bigger shippers, the bulk of freight moved belonged to smaller shippers that have also expressed fears over the consolidation of the transport sector.

Get the link for freight rates by many providers on maxmodal.com

The Baku-Tbilisi-Kars (BTK) railway marked its seventh anniversary this week, celebrating the transformative role it has played in regional connectivity since its inauguration on 30 October 2017.

This strategic rail corridor connects Azerbaijan, Georgia and Turkey, linking Europe and Asia along the Trans-Caspian International Transport Corridor, also known as the Middle Corridor. The BTK provides a faster and more efficient route for transporting goods across the Eurasian continent.

Over the past seven years, the BTK has helped to strengthen economic ties, facilitate trade and promote sustainable development in the region. As a key component of the Middle Corridor, it has also enhanced Azerbaijan’s position as a strategic transit hub, supporting efforts towards sustainable transport and further integration into global logistics networks.

The completion of Azerbaijan Railways’ $250 million modernisation project on the Georgian section of the BTK in May this year has increased the railway’s overall throughput capacity from 1 million to 5 million tonnes, with plans to increase this to 17 million tonnes in the future.

The 826-kilometre BTK line, which connects Azerbaijan’s rail network with Turkey’s rail network, provides a faster and more accessible rail link between China, Central Asia and Europe. Running from Baku through Georgia’s capital, Tbilisi, to Kars in northeastern Turkey, it significantly reduces the overland journey between China and Europe to just 15 days, compared to the previous 25-45 days.

In September, ADY signed an agreement with Chinese companies to facilitate freight deliveries via the BTK line on the Middle Corridor. Since the beginning of 2024, more than 210 container block trains carrying 420,000 tonnes of import and transit goods from China have arrived in Azerbaijan. By the end of the year, more than 300 block trains are expected to travel west from China to Azerbaijan and European markets. The ultimate goal is to send 1,000 trains a year.

President Ilham Aliyev recently stated that the sharp increase in freight traffic through Azerbaijan’s territory encourages additional investment in projects to increase the capacity of the international corridors that cross the country.

Welcome a new company on MaxModal. You can see WODA Supply Chain services on their business profile, drop them a message, add them to your contacts or submit a special request to them

We have comprehensive feasibility study for any container shipping line planning to deliver to Yemen ports. An intensive demands is increasing . Despite the security concerns on red Sea but we can guarantee the safety. Moreover , Aden port is safe .