Forwarders are growing increasingly concerned over the wave of storms battering the southern US states, as fears of long-lasting fallout from last week’s port strike recede.

Dockers agreed to suspend the strike for new negotiations, but the three-day action on the east and Gulf coasts led to concern that supply chains could experience major delays.

However, it appears that the fallout from the strike has been negligible – in part thanks to supply chain operators thinking ahead and front-loading goods in and out of the ports.

Jackson Campos corporate director at Brazil-based forwarder AGL Cargo, told: “Our average delay has been a week, but we’ve seen shorter too.

“We front-loaded and sought to get goods into the US ahead of schedule, but we also had goods on the water as the strike was unfolding and have seen some of our goods get in as planned.”

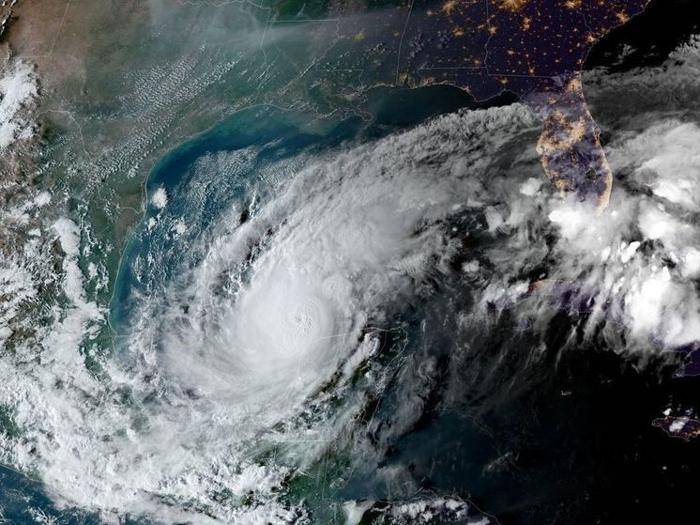

But Mr Campos expressed more concern over the impact of the current hurricane season. When Hurricane Helene made landfall across Florida and Georgia in late September, there were port closures and delays at airports.

Today, Hurricane Milton – said to be the one of the most powerful for almost a century – is moving into the Atlantic, leaving behind floods, storm surges and violent winds across the ‘Sunshine State’.

More than three million homes and businesses are without power and a number of deaths have been reported. Ports including Jacksonville remain closed.

“As things stand, airports like Miami have remained open but we have been warned by carriers to expect delays,” Mr Campos continued.

“Atlanta was hit by last month’s hurricane but where possible we have been attempting to divert volumes destined for Miami that way, but we are certainly more concerned by these climactic events than we have been by the strikes.”

Airports closed on Tuesday ahead of the storm and responders are now attempting to open major highways and arteries; at the height of the storm, with winds of up to 150mph spawning a number of tornadoes, it was considered too dangerous for emergency services to respond to callouts.

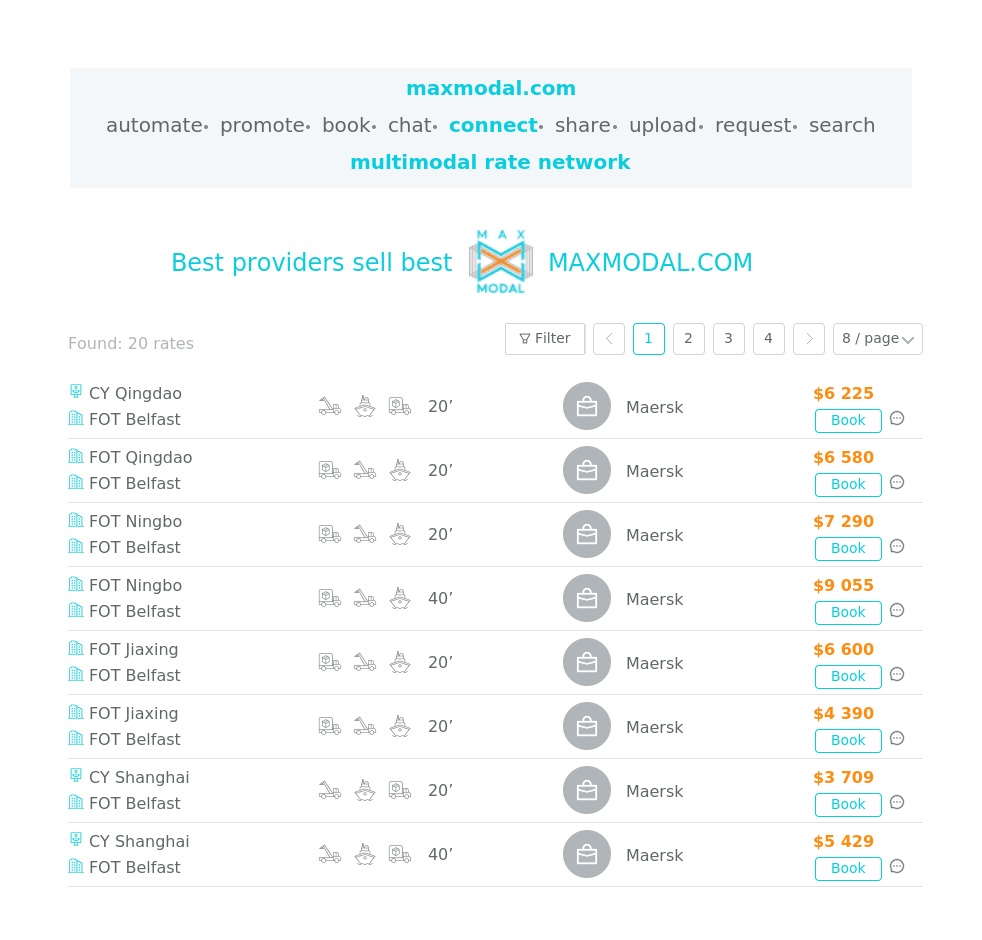

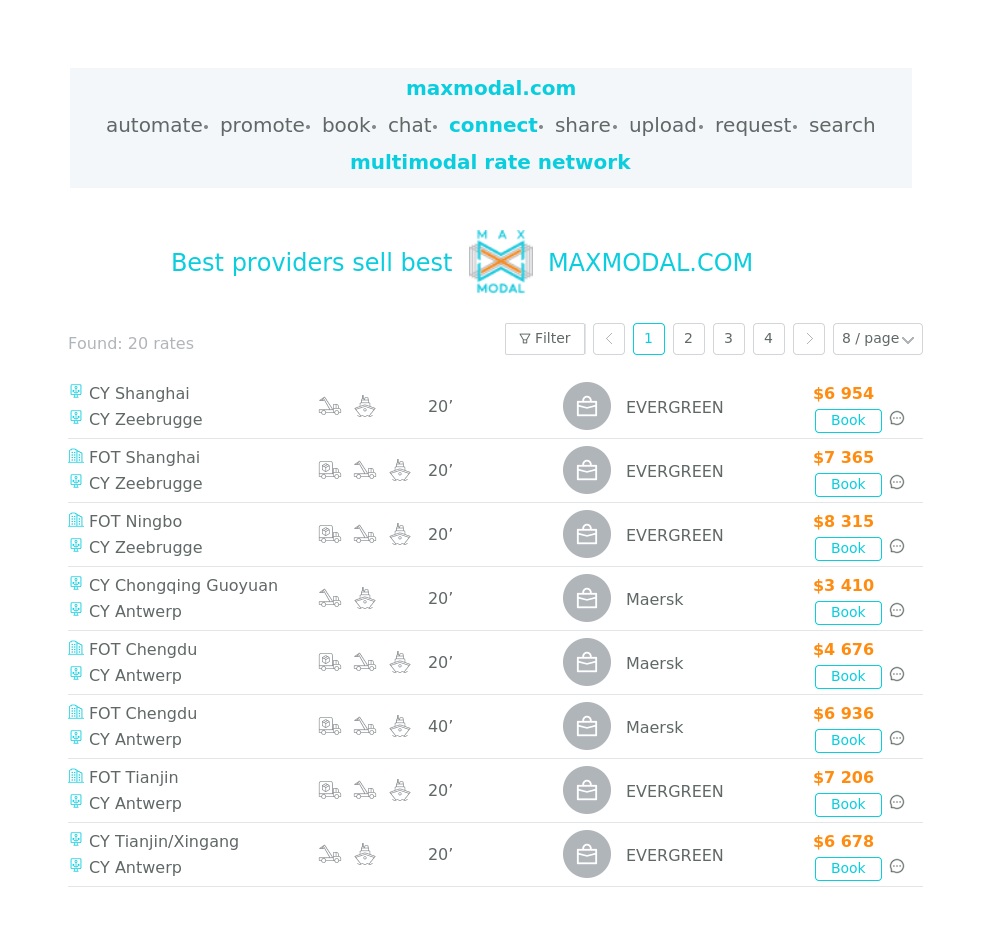

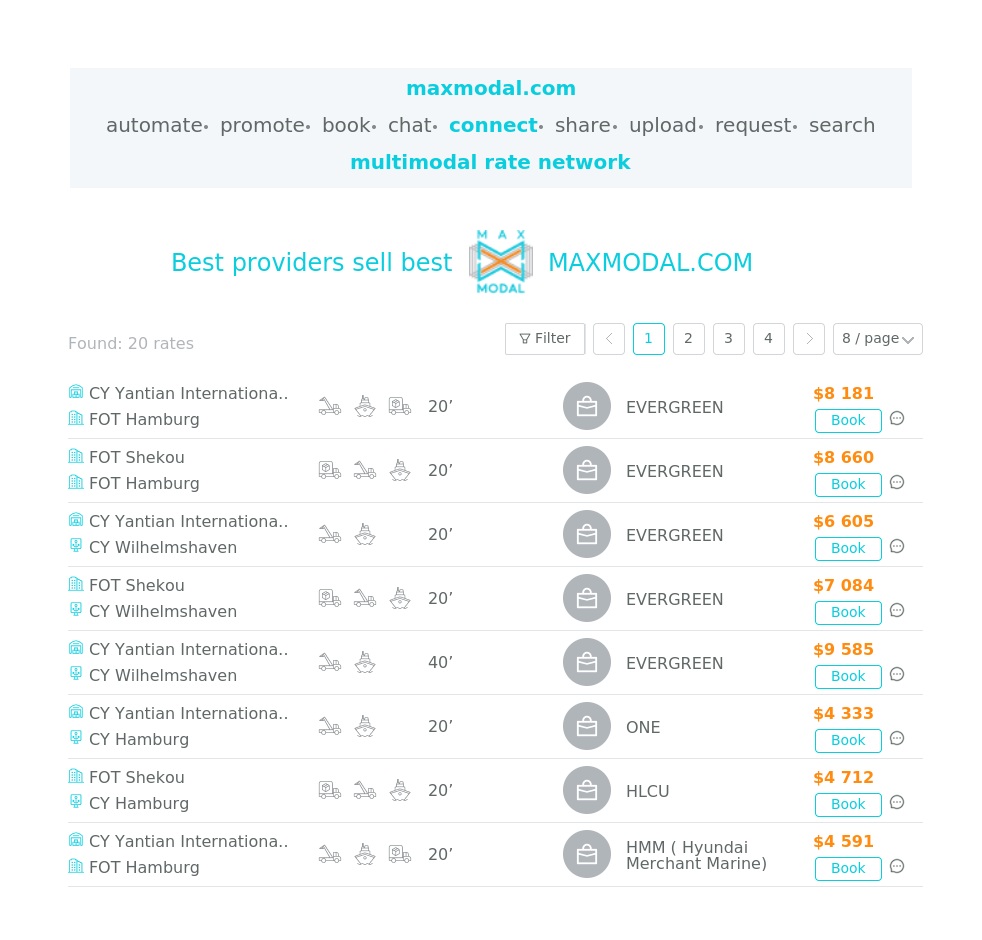

Get the link for freight rates by many providers on maxmodal.com

Hello All

Please see below LCL - Consolidation Ocean Freight Rates ex all major ports in China to Durban Port, South Africa.

1 - 20 CMB @ R 2600.00 / CMB

20 - 30 CMB @ R 2400.00 / CMB

30 - 40 CMB @ R 2200.00 / CMB

50 - 60 CMB @ R 2000.00 / CMB

60 - 70 CMB @ R 1800.00 / CMB

Valid until 31/10/24

Indian apparel industry stakeholders appear to have tasted some early incremental gains from the turmoil plaguing Bangladesh trade after the recent political upheaval that dethroned the government.

According to the latest data, India’s ready-made garment (RMG) exports, by value, in August surged 12% year on year, the highest monthly expansion in the fiscal year that began in April.

“While the global garment sourcing [sector] is realigning, we are ready to play a significant role,” said Sudhir Sekhri, chairman of India’s Apparel Export Promotion Council (AEPC).

“The recent surge in RMG exports is a testament to the increasing trust global brands have started reposing on India-made products.”

The AEPC chief said the higher growth was especially significant as it had come in a challenging environment, squeezed by the persistent Red Sea crisis and increased logistics costs.

“There is a need for the right push and support from the government, especially when the world is looking for options to switch its sourcing from conventional destinations, due to the changing geopolitical considerations,” Mr Sekhri added.

In contrast, Bangladesh’s export trade, which historically thrives on RMG verticals, seems to have slowed after the domestic crisis hit the business community badly.

According to available data, Chittagong Port has seen fewer export containers in the past two months, a sign that RMG exports were under stress, as global importers remained wary of shouldering the risk of unpredictable production schedules and delivery commitments from the political tension.

Bangladesh’s main cargo gateway saw containerised exports in September dip to 75,603 teu from 78,146 teu in August. However, import flow ticked up, to 117,402 teu from 114,708 teu, as origin points seem to have cleared some input goods order backlogs that had to be suspended earlier, data shows.

“The unrest has had a crippling effect on the Bangladesh RMG industry,” a shipping analyst in Dhaka told The Loadstar. “Violent protests by workers have forced the closure of large swathes of production for months. It will take time to recover.”

Back in India, there is a general view that local exporters – battling a slowdown in demand – must exploit the opportunities from potential trade shifts from Bangladesh, despite the inherent competitive challenges in the absence of duty-free access in major markets.

AEPC and other fellow representative bodies, supported by the government, have been trying to break into new target markets, with some results. Indian RMG exports to Japan, Korea, Australia, Mauritius and Norway recorded significant gains in fiscal Q1, according to industry data.

India’s overall merchandise exports took a hard beating in August, down 9% year on year, after a moderate fall in July, so any additional RMG demand becomes a boost for the country, especially as trade challenges heighten due to the tense West Asia situation.

Get the link for freight rates by many providers on maxmodal.com

South Korea traded 367,000 TEUs of containers with eight other Asian economies in August, translating to a 12% year-on-year increase, accomplishing the second highest monthly volume after 368,100 TEUs in April.

Exports accounted for 161,300 TEUs, representing a 5% growth, while imports were increased by 18% to 205,600 TEUs.

Exports and imports increased to and from six of the eight countries and regions, of which those to and from four swelled notably in double digits.

Container movement was greatest to and from the Vietnam, amounting to 126,700 TEUs, up 18%. Those to and from Indonesia totaled 54,090 TEUs, up 16%; to and from Thailand, 51,500 TEUs, up 5%; to and from Malaysia, 38,800 TEUs, up 1%; to and from Taiwan, 33,900 TEUs, up 19%; and to and from the Philippines, 26,300 TEUs, up 37%.

In contrast, containers to and from Hong Kong fell 2% to 18,400 TEUs, finishing in seventh place, and to and from Singapore, 11% to 17,090 TEUs, coming in eighth. Exports to and imports from Hong Kong, which continued to decrease for two years and 11 months from October 2021 to August 2024, moved up to seventh place for the first time in three months since May, as those to and from Singapore continued to incur double-digit contractions for two consecutive months.

As the port strike on the US east and Gulf coasts enters its third day, container supply chain analysts are beginning to calculate just how many vessels and how much capacity might find itself ensnarled in mounting congestion.

While the key factor will be the length of the port closures, Sea-Intelligence Consulting has forecast that the strike’s first week could lead to around 60 vessels at anchor off the US east and Gulf coasts awaiting berths, with around 775,000 teu of capacity tied up in the region.

And Sea-Intelligence chief executive Alan Murphy stressed that should the industrial action continue into the remaining weeks of October, that capacity would increase in a more incremental fashion.

He explained: “In the first week the capacity loss is at its highest – around 775,000 teu – due to the vessels already stuck on the US east coast, plus incoming vessels, with the subsequent three weeks showing a loss of around 443,000 teu, as only the “new” [ship] arrivals are being counted.”

But he warned that the longer the strike continued, the more the lost capacity would be felt on a global level.

“Should the strike last four weeks, causing almost 7% of the global fleet to be tied up along the US east coast, the overall impact on the supply and demand equation will be very significant,” he said.

Sea-Intelligence said it had “identified a total of 331 deepsea container vessels scheduled to make a total of 981 distinct port calls in 20 distinct US and Canada east coast ports from 1 October to 20 October”, and that they were “deployed across a total of 68 deepsea liner services into the North America east coast, of which six services serve exclusively Canadian ports, 54 serve exclusively US ports, and eight serve a mix of US and Canadian ports”.

Removing the influence of Canadian ports from the situation, Sea-Intelligence concluded there were 62 liner services directly affected by the strike, and under that scenario, a further 400,000 teu-plus of capacity every week would be tied up.

“Should the strike last for the entirety of October, then 2.22m teu of container shipping capacity will be unable to move, equal to a loss of 7.2% of the global container shipping fleet,” it noted.

And the longer the strike continued, the greater the effect on trades outside the region, it added, using capacity-freight rate pricing models developed during the pandemic.

“Throughout the pandemic and Red Sea crisis periods, we consistently proved a +90% correlation between the loss of global fleet capacity and spot rates, both for global indices and for individual trade-level spot rate indices.

“We found that for each percentage point increase in the loss of global fleet capacity, spot rates on Asia to US east coast would increase $993 per 40ft, while Asia to US west coast spot rates would increase by $805 per 40ft.

“If this relationship still holds true, then it would suggest that the first week of strike would see spot rates increase $2,000 per 40ft on Asia-US west coast and $2,500 on Asia-US east coast.

“For each subsequent week of the strike, this model suggests spot rates will increase by $1,100 per teu on Asia-US west coast and $1,400 per teu on Asia-US east coast,” it said.

However, with volumes from Asia representing around half of US east and Gulf coast volumes, this rate spike effect could spread to other trades.

Get the link for freight rates by many providers on maxmodal.com

US docker’s union, the International Longshoremen’s Association (ILA) has confirmed that tomorrow’s strike will begin at midnight local time, with union members downing tools at east coast and Gulf ports.

The ILA has a total of 85,000 members across North America, but any hopes of relief from Canadian ports were dashed with an announcement that Montreal dockers will also begin a three-day stoppage, closing down some 40% of the capacity at Canada’s largest east coast facility.

An ILA statement said: “United States Maritime Alliance…refuses to address a half-century of wage subjugation.”

The United States Maritime Alliance (USMX) filed an Unfair Labor Practice (ULP) charge with the National Labor Relations Board (NLRB) requesting “injunctive relief” in an attempt to force the ILA back into negotiations.

An ILA statement argued that by filing charges, on a Friday, four days before the expiration of the existing Master Contract, illustrates how poor the union’s “negotiating partners” have been.

“The ILA regards the suit as another publicity stunt by the employer group, and countered that foreign owned companies, represented by USMX set up shop at American ports, earn billions of dollars in revenues and profits, take those profits out of country, and fail to adequately compensate the ILA longshore workforce for their labor are engaging in a real ‘unfair labor practice’ and have been getting away with [it] for decades.”

USMX is the employers’ association, which has 40 members, including all top ten container lines, port operators and port associations,

Xeneta’s chief analyst Peter Sand said he expected the US Government to allow the strike to go ahead for at least five to seven days, but argues that the administration will need to find a resolution reasonably quickly.

“The Democrats claim to be on the workers’ side, but they can’t let the strike go on forever, after five to seven days an intervention from government could be seen as neutral,” said Sand.

According to Xeneta the ILA and USMX could reach a settlement on wages, with Sand pointing out that a similarly high wage deal was agreed with the ILA’s union counterparts on the West Coast, but the main obstruction to a settlement in the dispute is the levels of automation that terminal operators want to introduce.

Automation of ports and terminals could see dramatic reductions in port labour, with terminals expected to improve productivity substantially through the introduction of terminal operating systems that can have a single operator overseeing a number of cranes from a computer terminal in an office.

“Unions are aware that they are fighting the wind,” as far as automation goes explained Sand, and they have said they would not accept automation or semi-automation of terminals, however, he added: “If unions give in to something it will be semi-automation.”

In order to achieve this, however, negotiations with the unions must actually take place and while USMX has filed an Unfair Practice charge, on 26 September, three days earlier the employer’s association had also indicated it was open to mediation.

“USMX has received outreach from the Department of Labor, the Federal Mediation & Conciliation Service (FMCS), and other federal agencies and we will keep them up-to-date on the status of negotiations. We would be open to working with the FMCS, as we have done successfully in the past, but that is only possible if both sides agree to mediation,” said a statement.

According to the Global Freight Monitor report by HSBC Global Research, US east coast and Gulf ports handled 57% of US imports last year. However, USWC ports have seen some freight diverted as the strike date approached, reducing 2024 volumes to date to 55.5% of total US imports.