Hello!! We just want to introduce to you our company Franklin Logistics Company Limited, Based here in Dar Es Salaam Tanzania, Our company deals with Clearing And Forwarding, Import & Export, Overland Transport, Consultants And Commission Agents, Dear customer if you need to Import or Export any goods through Dar Es Salaam Port please don't hesitate to contact us, We work in a good way that we are assured you to handle the business in a nice and interesting way....You are most welcome to start to work with us.

Our Contacts:

Call/WhatsApp: +255754749889

Telephone: +255 22 2863132

Emails:

Regards,

Frank Kivenule,

Chief Executive Officer,

Franklin Logistics Company Limited.

I'm Tony from Amber log Vietnam(Wca id 125411)

For your Logistics and Customs Clearing inquiries at Vietnam pls contact me:

WhatsApp: +84394117864

I'm Tony from Amber log Vietnam(Wca id 125411)

For your Logistics and Customs Clearing inquiries at Vietnam pls contact me:

WhatsApp: +84394117864

I'm Tony from Amber log Vietnam(Wca id 125411)

For your Logistics and Customs Clearing inquiries at Vietnam pls contact me:

WhatsApp: +84394117864

We looking for Customers, freight forwarders and connections that needs containers to be moved in South Florida. We are located near Port Of Miami, FL and available to go anywhere. In and out of State! 20'/40' or PowerOnly Door to Door "Moves" Drop & Hook "All of the above".

We Have 10 Trucks and 13 Chassis, there's only one way to deliver and that's safe and on time

I'm Tony from Amber log Vietnam(Wca id 125411)

For your Logistics and Customs Clearing inquiries at Vietnam pls contact me:

WhatsApp: +84394117864

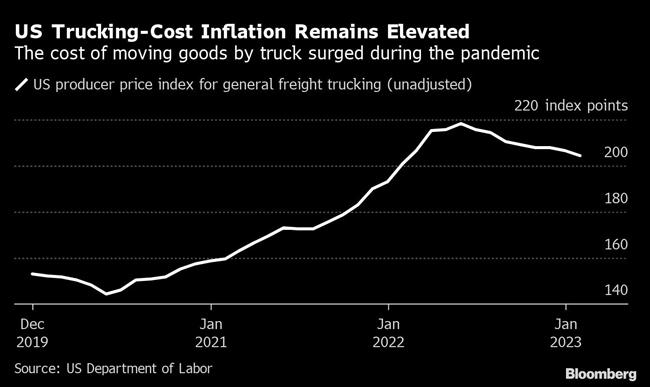

Supply chains across the world are healing up almost as fast as they broke down. That doesn’t mean the pressure they’re exerting on inflation will disappear as quickly.

Take the cost of shipping containers. Spot rates from Asia to the U.S. West Coast increased more than 15-fold during the pandemic and have since returned to pre-COVID levels as trade between the world’s two largest economies cools from a frenzied pace.

But the relief is uneven. Short-term prices for containers from Europe to the U.S. East Coast are still more than double what they were in late 2019, according to data from Freightos Ltd.

What’s more, an estimated 70% of goods transported in steel boxes on giant ships do so under long-term contracts — not the spot market — and those deals were renegotiated in 2021 and 2022 at much higher rates. Big retailers and manufacturers may not be seeing enough shipping-rate reductions yet to warrant slashing prices further.

“We need to be cautious about the drop in spot prices for containerized freight,” said Jason Miller, an associate professor of supply chain management at Michigan State University. “Most freight moves under contract prices that are still well above pre-COVID levels.”

Such stickiness may help explain why inflation in some regions remains stubbornly high. U.S. producer prices rebounded in January by more than expected, underscoring persistent inflationary pressures, and another closely watched gauge of consumer costs came in hotter than forecast on Feb. 24. In the euro area, underlying inflation hit a record in January, revised data showed earlier in February.

Another reason the cost of living is slow to fall: It’s easy to underestimate how long it can take for inflationary trends to work through supply chains. That’s partly because companies don’t like to change their pricing more than a couple of times a year, according to Chris Rogers, head of supply chain research at S&P Global Market Intelligence.

“Whilst the underlying prices have been coming down, it could take quite a long time for that to feed in,” Rogers said. “We’re still seeing some of the inflationary hangover coming through to product pricing now and it could take much of the rest of the year for that to flow through to prices, whether it’s producer or consumer.”

I'm Tony from Amber log Vietnam(Wca id 125411)

For your Logistics and Customs Clearing inquiries at Vietnam pls contact me:

WhatsApp: +84394117864

The global shipping industry continues to struggle with declining freight rates and high demand to secure long-term contracts with shippers. Carriers brace up to do whatever it takes to maximize profits while the situation allows it. They are offering long-term contracts to shippers while cutting rates even more to attract more customers and fill up the vessels. This strategy is expected to continue in the near future, even as the oversupply of container capacity persists and new mega-ships are added to the fleet, resulting in ongoing rate pressures.

Utilization rates have also been dragging freight rates down across most shipping routes, except for the Atlantic. Back in the day, when utilization was at 90%, spot rates skyrocketed. Now this rate is at the pre-pandemic level and spot rates remain low. As a result, containership lay-ups are continuing to increase due to the demand slump, and major ports are experiencing a significant drop in handled volumes. Nevertheless, the Port of Los Angeles is hoping for a rebound in the second half of 2023, although together with the Port of Long Beach, they are dealing with shrinking container volumes. In Europe, the brightest example of the same trend is the Port of Rotterdam which started to see a decline in throughput in 2022.

In addition, starting in March, the shipping industry is about to face an avalanche of new ultra-large container vessel (ULVC) newbuilds, which will bring a whole new set of challenges for carriers such as the need for infrastructure upgrades, higher operating costs, and the risk of overcapacity.

Rotes & services

- Regardless of the market situation, MSC increases rates from March 1 to March 31 across major ports in Asia and Europe. The rates will be up to $1450 for 20 DV and up to $1700 for 40 DV & HC depending on the destination.

- The new rotation for Samba/SAFRAN and BossaNova/SIRIUS services that are run together by Maersk and CMA CGM: London (UK), Rotterdam (Netherlands), Hamburg (Germany), Antwerp (Belgium), Tanger (Morocco), Santos (Brazil), Paranagua (Brazil), Buenos Aires (Argentina), Montevideo (Uruguay), Rio Grande (Brazil), Paranagua, Santos, Tanger, and London. In addition, BossaNova/SIRIUS will no longer call the Rio Grande port.

- ZIM, Hai An Transport, and Stevedoring Joint-stock Company created a joint venture to operate domestic shipping services in Vietnam.

- SŽDC has upgraded an important for multimodal transport bridge and tunnel near Děčín to allow larger freight trains to operate between the Czech Republic and Germany.

- France plans to increase combined transport volumes by 60% by 2027 shifting freight from roads to rail and waterways. The plan includes measures such as developing intermodal terminals, investing in rolling stock, and increasing the capacity of rail and waterway infrastructure.

- Hupac has launched a new rail service between the ports of Antwerp and Basel, Switzerland as an alternative, sustainable transportation option for goods traveling between the two countries.

Other

- The Dutch-flagged container ship Escape got into the fire in the Gulf of Riga in Latvia. The cause of the fire is still unknown.

- MDL Forwarding has launched a new direct shipping service connecting Russia and Latin America.

- The Iskenderun terminal in Turkey is expected to resume normal operations within the next three months after a fire broke out on a vessel following the earthquake, causing damage to the terminal's pier and infrastructure.

- MSC is set to become the largest shareholder of Trieste Marine Terminal, after acquiring a 49% stake in the company. It will significantly boost MSC’s presence in the Mediterranean region and increase its operational capabilities.

- According to the new data, nearly half of all maritime incidents in 2022 occurred in ports and terminals, with cargo and container handling operations being the most common cause of accidents. Experts underscore the importance of safety protocols and risk management measures in port and terminal operations.

These are only several changes that occurred in more than 250 bn freight rates across 25 million routes with more than 1 million market players. Want to share some news about your company, services, and routes? Just post them on MAXMODAL, a multimodal network that digitally connects routes and rates worldwide to automate sales and operations across container transportation & logistics industry. Join to innovate.

Motor carriers experienced a financial slowdown in the final months of 2022, as trends that indicate a return to normalized levels of business for the year ahead took hold, industry analysts said.

“The Q4 results in general weren’t great,” Evercore ISI analyst Jonathan Chappell said.

“Old Dominion [did] a phenomenal job, and Schneider [did] much better than expected. But everyone else was basically in line to worse than expected, for all the reasons that we anticipated coming in — slower volumes, pricing decelerating, etc.”

Chappell noted that carriers expressed optimism for the coming year, as they are anticipating a bottoming of volumes early on, normalization of inventories in the second quarter and a bottoming in pricing midway through the year.

“A lot of optimism about a return to normalcy, and that was the thesis that most investors hung onto,” Chappell said. “It didn’t really matter if you had a great Q4 or a terrible Q4, you were kind of thrown into this bucket of, ‘Things are about to stop getting worse and at least bottom before they start getting better.’ ”

Cowen and Co. analyst Jason Seidl noted that Q4 truckload rates dropped amid easing supply chain congestion and predicts that rates may decline further in the first quarter as carrier bargaining power erodes. He also expects less-than-truckload rates to gradually abate.

“The fourth quarter went about as expected in terms of the commentary that was coming out of both the LTL and the truckload players,” Seidl said. “The outlook remains challenging, but I think — as a group — the truckers were more optimistic on seeing a rebound as early as spring and as late as the back half of the year.”

Seidl noted that some of the Q4 downturn was tied to consumer-related companies that experienced an inventory drawdown, but added carriers are already seeing some of those customers build back inventory.

I'm Tony from Amber log Vietnam(Wca id 125411)

For your Logistics and Customs Clearing inquiries at Vietnam pls contact me:

WhatsApp: +84394117864

Ahead of the traditional transpacific annual contract rate negotiating season, there seems no slowing of Asia-US container spot rate erosion.

The failure of ocean carriers to halt the decline by capacity management blank sailing programmes– at the same time counterintuitively heavily discounting short-term rates – has left the transpacific lines exposed to conceding huge reductions in tenders for new contracts commencing in May.

This week saw the Freightos Baltic Exchange (FBX) Asia to US west coast component shed another 4.6%, to $1,181 per 40ft, which when compared with the average FBX reading for the same week of last year of $15,898, provides a stark reminder of how far and how fast the US market has imploded.

Meanwhile, the hitherto more robust Asia to US east coast tradelane is seeing its premium spread advantage over west coast ports shrink, Drewry’s WCI US east coast reading slipping another 4% this week, to $2,881 per 40ft, for example.

Moreover, the breakeven point for Asia USEC carriers will be significantly higher than for their west coast services, due to the longer transit times consuming considerably more fuel and the high cost of Panama/Suez Canal toll fees, which have to be factored into voyage calculations.

Elsewhere, on the Asia-Europe tradelane, carriers are also seeing their previously healthy margins vanish with every round-trip voyage.

The lowest Asia-North Europe spot rate this week was recorded on Xeneta’s XSI at $1,548 per 40ft – down 5% on the previous week, 13% on the month and comparing with around $14,500 12 months ago.

However, the market is awash with offers from China-based forwarding agents offering much lower FAK rates, with a validity for shipment through to the end of March, utilising all the major carriers. A Felixstowe-based NVOCC contact told this week he was receiving lower rate offers “virtually every day”.

He added: “I can even pick and choose the carrier for the best transit times, and there is no longer a surcharge for UK ports. In fact, some lines will give me extra free time on the berth and will waive any demurrage on the box if I need it longer.

Supply chain investments shifting to US East and Gulf coasts, according to shipper lobbyist

Uncertainty caused by almost eight months without a labor contract on the U.S. West Coast is resulting in investment decisions that could alter supply chains and end up costing the ocean carriers customers, according to a shipper lobbyist.

“We’re seeing some investments being made at East and Gulf Coast ports due to one factor — the uncertainty of what’s going to happen” with [West Coast labor],” said Peter Friedmann, executive director of the Agriculture Transportation Coalition (AgTC).

Speaking Global Supply Chain Week, Friedmann said a strike by the International Longshore and Warehouse Union or a lockout by the employers is always a possibility given that provisions preventing those events do not exist without a contract in place.

“We’re pleased there has not been disruption, and I don’t expect a major disruption on the West Coast,” he said. “But bit by bit this uncertainty continues. Investment decisions have to be made, capital is being raised, and it is going to be deployed where there’s less uncertainty.