Speed up your consignment delivery through All City Cargo Logistics in Nigeria because we provide complete solution far all your Air & Ocean both export and import contact me on

+2349026313204. ibusayo36@gmail.com

Hi,I'm freihgt forwarder from china.Do you have copperation with china?

The container shipping market is still experiencing falling spot rates, indicating that it has yet to reach the bottom of the cycle, although, in comparison to other tradelanes, the trans-Atlantic market continues to outperform the trans-Pacific. The dynamic is due to a combination of factors including overcapacity, port congestion, and weak demand. Another signal that the market is bottoming down is how fast vessels are changing hands and older tonnage is being scrapped.

A new round of alliance restructuring among container shipping companies may occur following the separation of the 2M Alliance. One of the predictions implies that the Ocean Alliance of CMA CGM, Cosco, and Evergreen could be next, but CMA CGM refuted this statement.

The tough market situation makes ocean carriers expand their services, which puts feeder operators under increased pressure and potential threats to their business. As carriers begin offering direct services on smaller trade lanes traditionally served by feeders, this shift could lead to a consolidation of the feeder market and increased competition among carriers.

Ever since the pandemic, air freight has been struggling to recover. Maersk Air Cargo has been forced to idle new freighters due to decreased demand for air cargo services and focus on shipping activities as the company seeks to minimize losses during the ongoing crisis. The situation highlights the challenges faced by the air cargo industry in maintaining profitability and sustainability amid fluctuating demand and changing market conditions. Another example is a Japanese shipping company NYK that plans to sell its air freight division in a bid to focus on its core ocean shipping business.

Hot topic

- Another train carrying hazardous materials has derailed on Norfolk Southern's tracks, leading to renewed calls for improved rail safety regulations in the US. The incident has highlighted concerns about the risks associated with transporting hazardous goods by rail, particularly given the recent surge in traffic volumes.

- MSC panamax boxship lost more than 40 containers overboard in bad weather on the way from Boston in the US to the Dominican Republic.

- A near-collision of OOCL Utah‘s vessel with a Panama Canal lock gate highlights concerns about the safety of shipping in the narrow waterway, with experts warning that an accident is waiting to happen due to the increasing size of vessels and inadequate infrastructure.

- Pakistan's logistics sector is facing severe challenges as a result of the country's forex crisis, with a backlog of cargo piling up at ports and trucks unable to move due to a shortage of fuel and spare parts.

- MSC ISTANBUL cargo vessel has been refloated after being stranded in Egypt’s Suez Canal for two hours.

Routes and services

- An increasing number of non-vessel-owning companies are buying or chartering their own ships to take advantage of lucrative Russia’s trade. The move is motivated by rising freight rates and limited vessel availability.

- Yilport has improved its train shuttle service in Sweden to offer better connectivity to inland locations. The upgrade includes a new weekly train service between Yilport's terminal in Gavle and Hallsberg, and the deployment of eco-friendly locomotives.

- China is increasingly using Kazakhstan as a transit country to Europe as it offers faster and more reliable connections compared to the Black Sea route. The advantages include reduced transit time, fewer administrative procedures, and lower logistics costs.

- The Erenhot port in China has seen 500 freight trains transporting goods to Europe since the beginning of 2023. The port's strategic location and efficient customs clearance procedures have contributed to its increasing role in facilitating trade between China and Europe via the Belt and Road Initiative.

Other

- The Port of Riga has opened two new warehouses, increasing its storage capacity by 5,000 square meters, in response to the growing demand for logistics services in the Baltic region.

- Amazon, Patagonia, and Tchibo have teamed up with the Aspen Institute to launch the Zero Emission Shipping Alliance to help decarbonize the shipping industry. The alliance aims to promote the development and adoption of zero-emission shipping technologies by 2030, and support industry-wide efforts to achieve net-zero emissions by 2040.

- There is a slow but steady shift in sourcing away from China by western companies, as they try to diversify their supply chains due to the pandemic, geopolitical tensions, and rising costs. However, China's infrastructure, skilled workforce, and favorable policies continue to make it an attractive option for many companies.

- Deutsche Bahn has hired three investment banks, namely Goldman Sachs, JPMorgan Chase, and Rothschild & Co., to find potential buyers for its logistics unit DB Schenker, as part of its restructuring efforts.

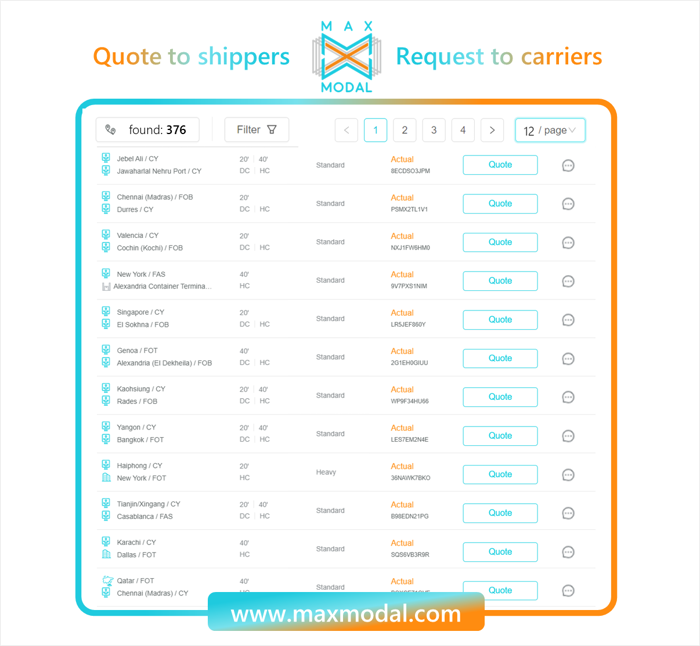

These are only several changes that occurred in more than 250 bn freight rates across 25 million routes with more than 1 million market players. Want to share some news about your company, services, and routes? Just post them on MAXMODAL, a multimodal network that digitally connects routes and rates worldwide to automate sales and operations across container transportation & logistics industry. Join to innovate.

A.P. Moller – Maersk has announced that it has restarted direct bookings to Ukraine from across the world after monitoring the country’s situation and its level of safety.

The Danish carrier launched a new, weekly barge service from the Port of Constanta, Romania, to the Port of Reni, Ukraine.

Maersk has stated that its systems are updated and ready to accept direct customer bookings to the Port of Reni.

This service is now fully operational across two routes – via the Constanta or Danube Channel and the Black Sea – with a transit time of approximately 1.5 days.

The shipping giant formed this route to provide some container connectivity to Ukraine, even though logistics operations remain challenging in and around the country amid the ongoing war.

Bookings will be subject to operational capacity and the correct documentation being submitted, which includes the legal acceptance of a Ukraine clause due to the ongoing risk in the area, Maersk stated.

These are just a few examples of new requests of clients from across the world. To get more fresh inquiries and\or best quotes click here or push the «request management» button in the left menu.

The German rail industry is quite upset with the recent comments made by representatives of the Federal Government regarding the Deutschlandtakt and its timetable. The German Federal Commissioner for Rail Transport Michael Theurer was quoted by German media ZDF as saying that the Deutschlandtakt is a project that might take over 50 years to realise. The main issue is that the project was planned to be ready by 2030.

The Deutschlandtakt entails that the national rail infrastructure should be expanded with priority and make it reach as far as possible. RailFreight.com contacted the rail freight association Die Guterbahnen (NEE), which counts 67 companies as members, for comments. “These statements from the Ministry of Transport are incomprehensible and the political signal is devastating”, said NEE’s executive director Peter Westenberger.

The traffic light coalition is not keeping its word on the Deutschlandtakt

One of the complaints exposed by Westenberger and the NEE is that the current ‘traffic light’ government coalition is not keeping its pledge to significantly improve the German rail network. “The current ruling traffic light coalition promised extensive acceleration steps and a priority expansion of rail in the coalition agreement of December 2021. However, nothing has happened yet”, Westenberger stated. He added that the statement made by Theurer came out of nowhere and may be a sign that the current ruling coalition is no longer supporting the Deutschlandtakt.

In 2016, the legislature at the time approved the Federal Railroad Expansion Act, which included 180 expansion measures. However, “this ministry prefers to continue and even accelerate highway expansion”, Westenberger claimed. In addition to railway infrastructure enhancement, the Deutschlandtakt also includes the creation of a target timetable for all trains. A new implementation plan is supposed to be drawn up for the period after 2025, which according to Westenberger would cause a revision of the target timetable project. “It is clear that this will still identify additional infrastructure needs”, he concluded.

The outlook for ocean carriers is a sharp decline in earnings this year, as average freight rates fall and inflation drives cost increases hitting bottom lines.

Last week, both CMA CGM and Hapag-Lloyd posted record results for 2022 and warned that this year would be very different.

On Friday, CMA CGM reported a net profit of $24.9bn for last year, but said there had been a “marked slowdown” in the fourth quarter that was expected to continue in 2023.

The group saw a 33% increase in revenue, to $74.5bn, of which $59bn was contributed by its core liner shipping activities, noting an average rate of $2,711 per teu, compared with $2,055 in 2021.

Liftings were down just 1.3% on the previous year, to 21.7m teu, an above-par performance compared, for example, with OOCL’s volume decline of 5.6% and Maersk’s 14%.

Nevertheless, the Q4 demand contraction resulted in CMA CGM transporting 5.4% fewer containers in the period, and its average rate sliding to $2,402 per teu.

Group CEO Rodolphe Saadé said: “As trade returns to normal and freight rates decline, our strategy and recent investments will prove all the more relevant, and allow us to look forward to 2023 with confidence.”

CMA CGM’s logistics business saw a steep 48% year-on-year rise in turnover, to $16.1bn, boosted by an expansion of its freight management business and recent acquisitions, for a 39% increase in ebitda of $1.2bn.

Meanwhile, Hapag-Lloyd updated preliminary results announced in January, posting a net profit of $18bn for last year.

Revenue was up 38%, year on year, at $36.4bn, achieved by a best-in-class flat transported volume of 11.8m teu, for an average rate of $2,863 per teu. This compares with an average of $2,003 the previous year.

I'm Tony from Amber log Vietnam(Wca id 125411)

For your Logistics and Customs Clearing inquiries at Vietnam pls contact me:

WhatsApp: +84394117864

The pressure persists.

Spot rates for container exports from Shanghai have fallen on all major shipping routes despite capacity adjustments that resulted from shipping lines’ decision to favor blank sailings. On east-west trade lanes, spot rates for containers from Shanghai to Europe fell 3.1% to $882 per TEU. Average prices fell 3.1% to $1,234 per FEU on the route to North America's west coast. The Asia-Europe trade saw the lowest on-time performance, while the intra-Asia trade saw the highest percentage of delays.

Although schedule reliability increased in 2022, the new year started off bumpy with a 3.8 % decline. In January 2023, Maersk was the most reliable out of all the top 14 carriers followed by MSC. Overall, the pressure on supply chains persists worldwide.

Routes and services

- Hapag-Lloyd has divided its Gulf Caribbean Service into two new services. The North Loop will have the following rotation: Houston (US) – Altamira (Mexico) – Veracruz (Mexico) – Puerto Barrios (Guatemala) – Puerto Cortes (Honduras) – Caucedo (Dominican Republic) – Kingston (Jamaica) – Houston. The South Loop will have the rotation: Cartagena (Colombia) – Manzanillo (Mexico) – Santo Tomas / Puerto Barrios (Guatemala) – Puerto Cortes (Honduras) – Puerto Limon (Costa Rica) – Cartagena (Colombia) – Caucedo (Dominican Republic) – San Juan (Puerto Rico) – Cartagena.

- ZIM has withdrawn its China Los Angeles Express (CLX) service, which connects China, South Korea, and the US West Coast.

- Hong Kong-registered OVP Shipping plans to strengthen ties with Russia by launching its first China to St Petersburg service.

- KTZ tries out a new rail route for China-Europe cargo transportation via Azerbaijan and Georgia to bypass the congested Black Sea. The train was sent from Jiaozhou, in eastern China, to the port of Koper, in Slovenia.

- A new rail service connecting Rennes and Lille in France is set to be launched soon by LaHaye Global Logistics, which will improve the transportation of goods between the two regions and support the development of the French rail freight sector.

- CMA CGM will be serving Comoros via Mtwara in Tanzania. The rotation will be: Colombo – Jebel Ali – Berbera (1/2) – Mogadishu – Mtwara – Beira (1/2)- Nacala – Port Victoria – Colombo.

- Two new shipping services are set to launch in April and May to connect East Africa, the Red Sea and Saudi Arabia (to link Jeddah Islamic Port and King Abdullah Port to the trade hubs of Djibouti, Mombasa, and Dar Es Salaam) by MSC.

- Maersk has removed Doha's call on the revised Arabian Star Service to deliver more efficient and reliable services.

- CMSA has launched a new block train service in Mexico in partnership with CMA CGM and Walmart.

- PIL has introduced an intermodal service in South Korea. The inland connection to Pugok is via rail service. we For Gunsan, Gwanju, Hwaseong, Incheon, Kwangyang, Pohang, Seoul and Yongin, the linkage is via truck service.

- WEC Lines has expanded its services to Liverpool, UK, with the addition of new port calls in Northern Spain, Portugal, North Africa, and the Canary Islands.

- ONE has launched a new direct service linking the United Arab Emirates), Bahrain, and Kuwait.

Rates

- Hapag-Lloyd will increase rates from the Middle East to the US in the range of $450-$500.

- Several ocean carriers, including Maersk and MSC, have announced a General Rate Increase of $500 per TEU for all cargo from India to the US, citing increased demand and rising costs as the reasons.

- CMA CGM updated rates for container shipping services from the Indian subcontinent, Middle East, Gulf, Red Sea, and Egypt to the US East Coast and Gulf of Mexico. Quantum per 20': US$50 and per 40': US$600.

Other

- US exporters are calling for more regulatory scrutiny and enforcement to protect against potential abuses by carriers as high freight rates and capacity constraints continue to disrupt supply chains, causing significant financial losses for exporters.

- Finnish dockworkers have reached an agreement with the Finnish Port Operators Association to end the strikes. The work will be renewed soon.

- Cosco has acquired the remaining 25% equity interest in Xiamen Haicang Investment Co Ltd, in a move to increase its control over the Xiamen Port's Terminal and expand its presence in the Fujian province of China.

- MAWANI has launched a new shipping service that connects King Abdulaziz Port in Saudi Arabia to ports in India and Iraq.

These are only several changes that occurred in more than 250 bn freight rates across 25 million routes with more than 1 million market players. Want to share some news about your company, services, and routes? Just post them on MAXMODAL, a multimodal network that digitally connects routes and rates worldwide to automate sales and operations across container transportation & logistics industry. Join to innovate.

I'm Tony from Amber log Vietnam(Wca id 125411)

For your Logistics and Customs Clearing inquiries at Vietnam pls contact me:

WhatsApp: +84394117864