We are an asset-based trucking company actively looking for intermodal drayage loads.

Email to reach: ben@bmbunited.com

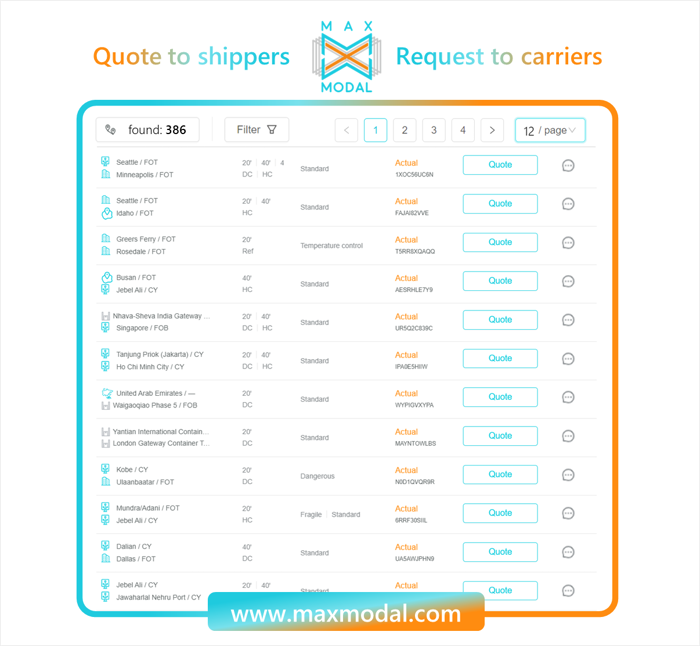

These are just a few examples of new requests of clients from across the world. To get more fresh inquiries and\or best quotes click here or push the «request management» button in the left menu.

Hi,

I am an Account Executive for ARI shipping Corporation, an American based transportation company with over 30 years of experience. I see that your company has a lot of need when it comes to shipping, what if I could help save you some money and provide you better service? We are giving 10% off and free custom clearance to new customers as part of a new promotion. Because of our history and strong relationships with all major shipping lines, we can match or beat any competitor’s price, guaranteed. If you are interested , provide me the following details below to my company email address at the end of this correspondence :

Name of the shipper:

Address and contact info:

Origin port:

Destination port:

Commodity/weight/dimensions:

Intended ship date:

Please let me know if there’s any shipment I can quote you for. I look forward to hearing from you and if you need anything, please let me know.

I wish you a happy day.

Thanks.

Regards,

Md. Mahamudul Alam

Account Executive

ARI Shipping Corporation

80 Sheridan Blvd, Inwood, NY 11096

Email: alam@arishipping.com

Mobile and WhatsApp: + 8801706076388

Bring on the fair game!

Freight rates on major trade lanes have stopped dropping so drastically, falling just by 1% which may signal a possible ease of the rate erosion seen in previous months. However, experts warn that rock-bottom prices are not good for anyone, as they can lead to overcapacity and financial stress for carriers, while shippers may face service issues due to carriers cutting corners to save costs. Moreover, the current supply chain disruptions caused by the pandemic have resulted in a shortage of containers, which is driving up prices and further complicating the situation. Experts suggest that a balance needs to be struck between fair pricing and maintaining healthy competition in the market.

Hot topic

Employees of German rail company Deutsche Bahn have expressed dissatisfaction with the company's collective bargaining offer, which they feel is insulting and insufficient. The offer includes a wage increase of 2%, which union representatives say is not commensurate with the hard work and dedication of railway workers, particularly in light of the challenges posed by the COVID-19 pandemic. Negotiations are ongoing, and unions have not ruled out the possibility of industrial action if a satisfactory agreement is not reached.

Routes and services

- Maersk has announced improvements to its Oceania and Americas service with a new direct call to New Zealand and increased capacity to the west coast of South America. The rotation will be: Seattle (US) – Oakland (US) – Long Beach (US) – Auckland (New Zealand) – Sydney (Australia) – Melbourne (Australia) – Tauranga (New Zealand) – Papeete (French Polynesia) – Surrey (Canada) – Oakland – Long Beach – Auckland – Sydney – Melbourne – Adelaide (Australia) – Tauranga – Seattle.

- The capitals of China and Russia have been connected for the first time on a new rail route under the Belt and Road Initiative, creating a direct freight service from Moscow to Beijing.

- Italian intermodal company Arcese has launched a new triangular rail freight service between Italy, Austria, Germany, and Romania to connect the regions with faster and more sustainable transport.

- Eurotunnel has introduced FIRST, a new subscription service to give priority to trucks that want to hop on the rail freight shuttle to cross the Channel Tunnel between France and the UK.

- Hapag-Lloyd’s new Vietnam Indonesia Straits (VIS) service will replace the old VNF and SPL services. The rotation will be Cat Lai – Singapore – Port Kelang – Belawan – Penang – Port Kelang – Singapore – Cat Lai.

- MSC has introduced a new container service that connects Saudi Arabia with India, Pakistan, and Sri Lanka, with the first sailing to begin in April.

- The Valencia rail port has seen a 13.6% rise in container traffic, handling over 145,000 TEU, during the first two months of 2023. The increase in container traffic has been attributed to the growing trend of shippers opting for rail transport as more sustainable and less congested.

Other

- FMC has adopted a new rule that expands shippers' eligibility for carrier refunds for service failures. Under the new rule, the FMC requires ocean carriers to amend their rules governing service contracts to allow shippers to claim refunds for failures in container delivery or return. The rule also provides greater transparency for shippers by requiring ocean carriers to publish their refund policies and procedures.

- The Jawaharlal Nehru Port Trust in India is facing operational challenges as it deals with a surge in cargo volumes due to the festive season and the year-end rush, leading to congestion and delays in cargo handling. To address the challenges, JNPT is implementing measures such as increasing the number of cranes and streamlining processes to improve efficiency.

- Union workers at the Panama Canal have gone on strike, protesting the use of tugboats operated by non-union workers to guide larger vessels through the canal. The Panama Canal Authority has defended its use of non-union workers and proclaimed that safety standards are being met. The strike has caused delays in canal operations, affecting the transit of vessels through the canal.

- The US Surface Transportation Board has approved Canadian Pacific's acquisition of Kansas City Southern, creating the first rail network linking Canada, the US, and Mexico.

- Freight forwarding and logistics firm Expeditors has sued its long-term client, footwear company Skechers, for unpaid invoices totaling nearly $20 million. Skechers has disputed the charges, claiming that the invoices are inaccurate, and the case is now being heard in a US court.

- Freight forwarding and logistics firm Expeditors has sued its long-term client, footwear company Skechers, for unpaid invoices totaling nearly $20 million. Skechers has disputed the charges, claiming that the invoices are inaccurate, and the case is now being dealt with in a US court.

These are only several changes that occurred in more than 250 bn freight rates across 25 million routes with more than 1 million market players. Want to share some news about your company, services, and routes? Just post them on MAXMODAL, a multimodal network that digitally connects routes and rates worldwide to automate sales and operations across container transportation & logistics industry. Join to innovate.

Post request and many providers will quote best. Saving logistics costs made easy.

Canadian Pacific (CP) and Kansas City Southern (KCS), two of the largest railway companies in the United States, finalised a merger that will result in a new company called Canadian Pacific Kansas City (CPKC). This union will create the first railway network connecting Canada, the US, and Mexico, which will stretch for over 32,000 kilometres.

CP’s network crosses southern Canada from Vancouver to the Bay of Fundy with connections in the northeast of the United States. KCS, on the other hand, can count on a network through the southern part of the country all the way to the Mexican port of Lazaro Cardenas. As the map below shows, the two companies’ current networks overlap in Kansas City, at the heart of the United States.

Connecting Canada to Mexico will be advantageous for all countries involved, as CP pointed out. The company said that the Canadian market can count on 128 million consumers in Mexico as well as new market opportunities in Kansas City and Texas. On the other hand, the Mexican market appeals to 38 million consumers in Canada and will benefit from new connections in Louisiana, Chicago, and Detroit. The new network also allows bypassing Chicago, thus creating new capacity on US railways.

A new company to boost modal shift and improve safety

The agreement for the merger was first announced in March 2021 and completed the following December. Now that the STP has given its approval, the initiative can be finalised with the creation of CPKC. More specifically, CP is acquiring KCS for a little over 29 billion euros. CP and KCS are the two smallest Class I railway companies in the US. The new CPKC will still be the smallest of the group, when it comes to revenue, but will be able to rely on a much larger network, as CP pointed out.

The decision for the merger was recently approved by the US Surface Transportation Board (STB) and will be effective as of 14 April. The STB claimed it expects the merger to shift around 64,000 trucks from North America’s roads to the rail. The Board also pointed out that this union could enhance rail safety in the United States since CP has been nominated the safest railway company in North America by the Federal Railroad Administration for 17 years in a row.

Exports from the Chinese dry ports of Khorgos, on the China-Kazakhstan border, and Manzhouli, bordering Russia, will be stopped until 26 March. The suspension started on 11 March, with some exceptions made for specific trains and key material containers.

A number of industry insiders highlighted that China Railways has issued a suspension order, claiming the congestion at the stations of the ports as the main reason. Concerning the Manzhouli dry port, the exemptions include China Railway Express, containers, and key materials. As for Korgos, the exemptions include China-Europe and Central Asia trains, containerized commercial vehicles, and key materials.

Such suspension orders are not uncommon. On 2 July 2022, China Railway issued an emergency suspension order, announcing that all the goods loaded at the Alashankou and Khorgos border crossings at all stations along the road will be suspended. This suspension was a little shorter than the current one in Khorgos and Manzhouli, having lasted for less than a week.

The cause may be wagon shortages in Russia

The industry insiders said that the current suspension may be linked to wagon management in Russia. Russian Railways needs to schedule the supply of wagons for domestic and transit transport, leading to a lack of wagons for international transport. The goods, therefore, cannot enter Russia and consequently cause congestion at the border crossings involved. Chinese dry ports are not the only example of this type of congestion: transit countries are as well.

For example, Mongolia had about 2,100 40-foot containers waiting for transshipment at the Zamyn-Uud port, in the southeast of the country on 14 February. In order to solve the congestion, the railway representatives of Mongolia, Russia, and China held consultations at the China-Mongolia-Russia Railway Representative Meeting in early February and decided to increase the number of trains exchanged daily will to 15 broad-gauge trains and 8 narrow-gauge trains, adding three trains in total.