The Turkish State Railways (TCDD) have evacuated close to 40,000 people from the earthquake-stricken area in Southern Turkey over the past few days, while they have also dispatched multiple freight trains with goods for the people experiencing the disaster. At the same time, ADY Container sends aid trains to Turkey via the BTK railway line.

Railways have been back in the spotlight for getting people to safety and transporting first-aid commodities from the onset of war in Ukraine one year ago. Back then, it was Ukrainian Railways working around the clock to evacuate civilians, while companies like DB, RCG, PKP, Rénfe, SNCF, Mercitalia, FS Group, and more ensured that humanitarian aid would reach Ukraine by rail.

Now, TCDD is doing the same as Ukrainian Railways, albeit from an earthquake-stricken area. The company has executed 210 evacuation trips to date, getting 39,500 citizens to other areas. On top of that, according to transport minister Adil Karaismailoglu, 33 freight trains with aid goods have reached the area already.

Meanwhile, the first repairs to the 1,275 kilometres of affected railway lines in Kahramanmaraş province have been carried out. Near Fevsipasa in Gaziantep province, repair works are also underway. The line out of the hard-hit port city of Iskenderun in Hatay province is still in operation, enabling citizens to reach Adana, Mersin and Konya.

American Trucking Associations’ Intermodal Motor Carriers Conference said it secured a significant initial win over ocean carriers as a Federal Maritime Commission administrative law judge ruled that requiring motor carriers to use specific intermodal chassis providers to move containers violates the Shipping Act.

“This victory has been a long time coming,” said IMCC Executive Director Jonathan Eisen. “The decision is the first step in putting a stop to the practice of foreign-owned shipping lines forcing American drivers and motor carriers to use specific equipment providers to move goods – which will help reduce supply chain delays and cut costs for carriers and consumers.”

IMCC filed its complaint against the Ocean Carrier Equipment Management Association, Consolidated Chassis Management, and the world’s largest ocean carriers with the FMC in 2020, alleging, among other things, that they have denied motor carriers the ability to choose their provider when leasing this essential equipment, heaping unjust and unreasonable prices upon trucking companies.

“The ocean carrier’s practices of prohibiting motor carriers from using the provider of their choice when they are paying for the chassis has held U.S. motor carriers hostage and forced them to subsidize the shipping lines,” Eisen said. “We are pleased the judge agreed and we look forward to ending these unreasonable and unjust practices permanently.”

Nebraska issues another hours of service waiver for fuel haulers

Nebraska Gov. Jim Pillen has issued an emergency declaration as a result of fuel shortages due to high demand, prompting an hours of service waiver for fuel haulers in the state.

Drivers transporting gasoline or gasoline blends, diesel, fuel oil, ethanol, propane and biodiesel in Nebraska are exempt from the hours of service regulations in 49 CFR Part 395 through Feb. 28.

Pillen noted that the declaration was necessary because “commercial motor vehicles and motor carriers are engaged in the business of transporting fuel from further distances and waiting longer at terminals in order to meet needs.”

Nebraska was one of eight states included in a Regional Emergency Declaration issued by the Federal Motor Carrier Safety Administration in January, effective through Feb. 15, for drivers hauling gasoline, diesel and jet fuel.

Get more fresh rates from many providers from across the world. Just search providers and their rates in one #multimodalnetwork to save time on booking and supply chain management.

#Maxmodal is #connectingtheworld of transportation & logistics via routes & rates.

Click on «Search rates on the market».

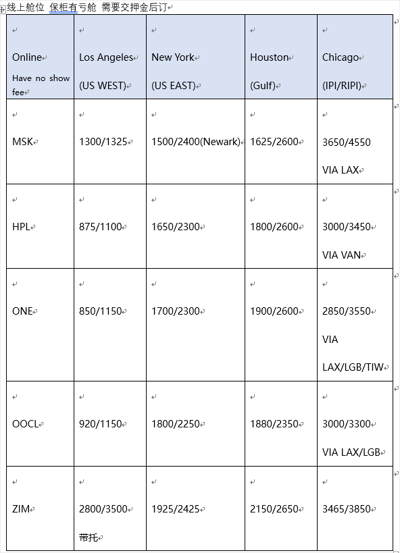

Price up date from china YT-US/Canada value till 2.28 gate in ,more detail please don't hesitate to ask,24 hour online Whatsapp +8615900097843 Wechat 15900097843

For shipment from China to the USA, please contact me. We provide ocean freight, customs clearance, trucking, duties, DDP, and FOB services.

For enquiries,please contact richard.song@topsealand.com

#chinausalogistics #freightforwarding #logistics #logisticssupplychain #logisticssolutions #internationallogistics #transportation #supplychain #shipping #commerce #supplychainmanagement #usa#Seafreight #Oceanfreight #EXPORT

The "new hierarchy of needs" for market players.

As contracts negotiated in 2022 are close to expiring, everyone is perplexed about at what rates the new ones will be arranged. It is expected that contract rates will be as low as spot rates. The composite global spot index now stands at $1,997.22 per FEU. Even if in the second half of the year the volumes could potentially recover, the rates will be still under pressure from the high capacity when the new vessels come into the game, so the situation will not improve in the coming months. For now, carriers are hoping for the lasting effect of last year’s contracts that secured the long-haul volumes. However, they will soon disappear and that is when the new order will unfold.

On estimate, global box volumes can slide by 2.5%. With the continuous fall of spot rates, backhaul trades have also decreased. Competition for backhaul cargo may risk turning into the next Hunger games. Carriers are trying to benefit from the empty containers racking-up huge storage costs at depots around the world. Now they no longer want to reposition their equipment to China where it used to be the most profitable direction. Delays made Asian ports less favorable.

Not only Asia is hitting the rocks. The US Intermodal traffic has had the worst January in the past 10 years. Domestic trailers slumped 29.7%, while the domestic container count sank 4.2%. No change is expected in the near future.

Following the separation from the MSC, Maersk has confirmed the rumors that it will not form any other alliance. The company plans to focus on integrating its ocean business into logistics by elevating operational control over the services it provides.

The Iskenderun Port will be closed, most likely, after the Turkey - Syria earthquake. Evergreen and other carriers already announced that they would divert their cargo. The ripple effects are expected to spread to other ports and destabilize supply chains.

Routes & services

- CMA CGM is almost done with the acquisition of La Méridionale, a ropax operator with 3 ships that will become the part of CMA CGM.

- FMC has MSC on its radar demanding an explanation of why the company charged SOFi Paper Products a congestion fee. If there is none, the refund must follow.

- Rail freight services between the Rail Service Centre in Rotterdam and the Contargo terminal in Mannheim run by Hupac will restart on Feb 13.

Other

- The Indian container market is becoming the carrier’s new target in attempts to redeploy their tonnage to improve capacity utilization and elevate profits. MSC’s Asia-US west coast connection will include calls at Nhava Sheva (JNPT) and Mundra in India and Cosco/OOCL consortium is beginning a West India-US east coast routing.

- It is no secret that Asia was disrupted by the supply chain shocks which cost ASEAN economies an estimated $17bn a year, according to data. However, studies show that regardless of the constraints, the economies are on the growth track. In the case of China, for example, the growth will be due to the strategy of diversification. The country has put some of the production centers and warehouses outside China.

- The Port of Riga is going through a major increase in throughput containers in the aftermath of the geopolitical situation. The port has handled 460,700 TEU which is 16% more than the last year’s KPI.

These are only several changes that occurred in more than 250 bn freight rates across 25 million routes with more than 1 million market players. Want to share some news about your company, services, and routes? Just post them on MAXMODAL, a multimodal network that digitally connects routes and rates worldwide to automate sales and operations across container transportation & logistics industry. Join to innovate.

New operating results from four Asian shipping lines were released Friday, pointing to steep performance declines in the fourth quarter and ongoing market erosion in the first month of this year.

Orient Overseas Container Line (OOCL), the Hong Kong-listed subsidiary of China’s Cosco Group, disclosed revenue and volume data for Q4 2022. Taiwan’s Evergreen, Yang Ming and Wan Hai released monthly operating stats for January.

More than one-third of logistics companies will increase their prices this year, owing to high energy costs, cratering demand and supply chain disruptions, according to Ti’s 2023 Agility Emerging Markets Logistics Index

The index, which analyses and ranks countries based on their attractiveness for investors, according to various criteria, seems to demonstrate growing de-Chinafication.

It found that South-east Asia (13.6%), India (13.4%) and Europe (13.1%) were all destinations for business in 2023 – asked: “Do you plan to move production/sourcing activities to any of the following regions?” – with China lagging at 12.6%, where it would have been well ahead in previous years.

Indeed, Malaysia, Indonesia, Thailand and Vietnam were all in the index’s top 10, the latter having moved up a spot. Even if China remains in the lead for now, 20.5% of respondents said they would be moving production and/or sourcing out of China and 18.4% said they would be reducing investment there – strict anti-covid policies being the chief reason.

“That China is quickly losing its allure as an investment destination isn’t just talk,” Ti noted. “A number of manufacturers have started moving at least some manufacturing out… survey results show that many businesses have made structural changes to their supply chain networks, including implementing multi-shoring, on-shoring, near-shoring or friend-shoring strategies, in order to increase network resilience.”

In fact many of the businesses involved in Ti’s survey appear to be shaken by experiences during the pandemic. Moving production and sourcing to domestic shores (19.4%), or to nearby countries (16.7%), proved popular, but by far the more favoured strategy was diversification rather than relocation, with 24% saying they moved production and sourcing to numerous locations (‘multi-shoring’ in Ti parlance) to reduce risks. Just 10.8% of respondents said their post-Covid supply chain plan “looks about the same”.

Latest reports from Iskenderun Port in Turkey suggest that the fire following Monday’s earthquake, has been brought under control.

Turkish maritime authorities told a combined effort from the air and sea had managed to quell the blaze, which began when a container stack collapsed after the horrific shocks that have killed thousands and wrecked supply chains.

However, vessels heading for Iskenderun have been warned to divert to other ports, as the southern Turkey facility remains closed.

A local source told “The flames had not spread to the area where flammable materials were stored, and the nature of the fire, which has unleashed a huge cloud of black smoke over the city, was still unclear.

“We suspect it is plastic raw material or chemical, but we could not clearly determine it, as the containers collapsed and scattered,” added the source.

terrible :(