“Where big sports go, investments flow” is the axiom for the upcoming Winter Olympics. For many, it is the opportunity for further infrastructure boost.

Big sporting events are not only about athletic excellence, but also about infrastructure improvements, and the upcoming Winter Olympics in Beijing is no exception. In the wake of the event, Argentina has been incorporated in The Belt and Road initiative in the framework of which the country will receive significant investments in its transportation sector. China will share the development of the opportunities. The pacific tiger has also announced its willingness to take an active part in the construction of a logistics hub in Poland and help Poland become a key node in the China-Europe supply chain. In addition, China is planning to focus on its relations with Pakistan, in particular on the China-Pakistan Economic Corridor investment program to build roads, power plants, and other infrastructure.

Besides the rail sector that has seen a glimpse of light in the past week, it seems like at sea there is a subtle breeze of change as well. Finally, after months of overcrowded ports in North America, there is an improvement. Thanks to the closure of factories in Asia for the Lunar New Year holiday, the terminals have had an opportunity to reduce congestion. For the first time since November, the number of ships waiting at berths at the Port of LA has dropped to 80, which corresponds to a 77% reduction, while at the Port of Long Beach there is a 56% reduction of waiting vessels. The spot rates did not take long to react and showed a slight drop. Big players are alarmed and quick to secure the majority of their volume under long-term contracts. The thing is, many have introduced carriers offering sailings with space guarantees when the rates were high, and if they fall back to around $10,000 per 40ft, the services would struggle to break even on voyage round-trips. Experts already started saying that the days of the ad-hoc carriers are numbered.

With a slowly improving flow of cargo, the question of demurrage and detention fees has flown to the surface. These charges are still, to some extent, a gray area, hence FMC has proposed to consider any charges assessed by common carriers and marine terminal operators using terminal space or shipping containers as demurrage and detention ones. The initiative obviously targets new regulations of ocean carriers. The commission is currently collecting feedback on what information must be listed in the bills. In turn, industry players react by stating that the government overlooks the roots of the problem - lack of capacity and soaring demand - and new legislation will only make congestion worse. Meanwhile, terminals are experiencing a major boom in profits. Big companies have managed to benefit from it because operating costs rose at a smaller magnitude than revenue, which meant more money was flowing to them. Potentially the comfortable position may result in further consolidation of the major allies, to the dismay of FMC. At the same time, such giants as Maersk are not missing further opportunities to expand the sector of their specialization and extend its integrated logistics offering. The company is going to acquire Pilot Freight Services and get a grip of a booming e-commerce sector.

In Indonesia, maritime authorities also dive into co-operation with Singapore for the sake of the development of human resources and environmental protection. Among the latest breakthroughs of the latter - environmental initiatives - is CMA CGM Group’s commitment to drop plastic from vessels, it will no longer be transported. The company has become a pioneer, setting the tone for the industry.

Among all the proclaimed sustainable plans, there was an intention to transport more goods by rail. France calls presidential candidates for the upcoming election to take a stand on this objective. Industry representatives talk about more investment. In general, European rail is in need of financial support especially since in 2021 the overall losses have amounted to 4 billion euros. The Hungarian government is going to invest 35 million euros in the region bordering Ukraine, right after Russia’s commitment to bypass Budapest. Hungary plans to strengthen its position on the railway roadmap. Britain’s focus on rail continues to pay off. There is now a new bulk flow operated by GB Railfreight, which is the next step on the way to improving the local economy. In the meantime, CLdN Cargo brings the Netherlands and Itay together by launching its own intermodal rail connection. For Italy, it is a great opportunity to break into the market.

Емец Валерий Николаевич назначен Генеральным директором ООО «Феникс». Решение об этом было принято Федеральным агентством по управлению государственным имуществом (РОСИМУЩЕСТВО), которое выступает от имени Российской Федерации – единоличного участника ООО «Феникс».

В. Н. Емец закончил Николаевский кораблестроительный институт, Академию внешней торговли. Работал в Министерстве морского флота СССР, занимал должности связанные с организацией перевозки грузов. Многие годы проработал в сфере транспортной логистики.

Кадровые перестановки направлены на усиление позиций компании в транспортной отрасли Российской Федерации, сопряжение с планами развития морского, железнодорожного и автомобильного транспорта Санкт-Петербурга и Ленинградской области, осуществление практического взаимодействия всех участников рынка, решение социально-значимых задач для региона.

Дальнейшее развитие портовой и транспортной инфраструктуры, а также техническое оснащение единственного государственного терминала в Санкт-Петербурге особенно важно для поддержания международной торговли, увеличения доли несырьевого неэнергетического экспорта РФ в условиях экономической и политической нестабильности. Для партнеров и клиентов порта это обеспечивает возможность долгосрочного планирования производства и сбыта, а также действенной кооперации в области устойчивого транспорта.

Опыт проектирования, строительства, запуска в эксплуатацию и успешного коммерческого старта ММПК «Бронка» является уникальным и высоко востребованным в современных условиях, в том числе при дальнейшей реализации «Транспортной стратегии Российской Федерации на период до 2030 года».

ООО «Феникс», как оператор ММПК «Бронка», осуществляет перевалку контейнеров, накатных, генеральных грузов и добросовестно выполняет все взятые на себя контрактные обязательства.

Команда ООО «Феникс» во главе с новым Генеральным директором – Валерием Николаевичем Емецем – продолжит работу по повышению эффективности и прогнозируемости бизнеса, усилению сервисных возможностей компании, развитию ключевых для рынка направлений.

ARRC Line is glad to inform you about publishing of "ARRC EUROSERVICES" tariffs in the MAXMODAL Multimodal Network.

You can get them in the ARRC profile. We accept your freight requests via MAXMODAL.

If you have questions, we are ready to answer them in the messenger of MAXMODAL.

Shopping for basic necessities may be a serious problem in 2022 with shortages storming over the most important sectors. Which has been affected the most?

The setup for the product shortages appeared in 2021 and with ongoing constraints, it is not going to ease its grip. However, companies are becoming better at forecasting and trying to make the impact of the skyrocketing demand, the pandemic, and congestion less pronounced. Most of all, tight supplies are expected to affect semiconductors - such big companies as Toyota already report missed production targets - anything that requires aluminum and plastic for production, the food sector, and building materials. With defined pain points, companies will be able to achieve some sort of predictability, however, experts say that 2022 will not be the year when they combat shortages. One thing is to produce necessary products but the other is to have them delivered to the required destination which is an additional riddle to solve. The liner schedule remains under a serious drop since last year when it decreased to 35.8%. Only a few big players managed to keep the rate above 40% with the rest performing rather poorly. Besides, there are incidents that cannot be predicted such as situations when a vessel can run aground like it happened recently with Maersk’s boxship. New legislation contributes to the increased waiting time as well - South Korean ports will be inspecting dangerous cargo with more precision for the sake of safety. Alternatives means of transportation are not the ones to rely on for delivery either as when it comes to roads, surging fuel prices, driver shortages, and increased demand are driving the rates through the roof.

The global community is gravitating to the opinion that the current chaos will last at least throughout 2022, with some predictions going for 2023. Meanwhile, container vessels changing hands are increasing with supersonic speed. Updates report the number of container ships sold last year was 26% higher than the prior record in 2017. This time the number amounts to an insane 1.94 million TEUs. Hence, substantial fleet growth will be the defining trend of 2023 and 2024, and it is the “red-hot” second-hand vessels that will form the majority of it because none of the players wants to waste time waiting for the newly-built vessels. What about congestion? If it does not ease up, there will be 15% more capacity waiting in the queue in the troublesome ports, but the shipping sector acts like it is not its problem with some of the players arguing that overcapacity is not a threat. However, the data proves different - in the Port of LA, the land capacity is 90%, which means that there are too many trucks and people to move around efficiently. Overall, the U.S. ports are responsible for approximately 80% of the global disruption, and many fear the situation getting worse as well as the rates increasing. The shipping sector is at a very vulnerable phase and no wonder that even the big ports are becoming victims of cyber attacks on top of facing all the challenges. The rising costs are resulting in more forwarders setting their carriers and beginning to run their liner services to guarantee space to their customers. In an attempt to increase capacity at the local ports, the Indian government, in turn, is going to develop new cargo terminals in the span of the next three years and aim for the facilitation of multimodal logistics parks. At the same time, DPWorld London Gateway’s expansion has been completed. The overall site capacity increased from 4,000 TEU to 7,400 TEU. Germany is investing in infrastructure as well by planning to contribute 13.6 bn euros to the railway networks.

Apart from contributing to delays, the busy ports are the ones causing the most emissions, and the recent initiative benween the Port of LA and the Port of Shanghai is dedicated to the creating of a green corridor on one of the busiest routes. In addition to decreasing GHG emissions from vessels in the corridor, the partners will reduce supply chain emissions from port operations to improve air quality in the facilities. Another ally may be on the way - Cargotec and Konecranes. The two companies want to merge but it can potentially present problems to the competition, hence, the authorities have not given the green light to the initiative yet. Meanwhile, CMA CGM continues strengthening its presence in the logistics sector by acquiring a 51% stake in the Colis Privé Group.

Lithuania - Belarus ping-pong game is becoming more intense as the latter has responded to Lithuania’s decision to ban transporting Belarusian potash fertilizers through its territory. Stopping trains coming from Lithuania is the first step of the Belarusian response. The country is planning to rely on the internal rail network that it has been investing in during the last several years. Poland has already announced that it will transport its goods to Ukrain through Lithuania, omitting Belarus.

More carriers deploy more capacity as they buy and lease more ships and boxes

It’s seemingly inevitable: As ocean carrier profits soar — and they’re now reaching historic heights — the highly consolidated liner industry will face growing accusations of unfairness and wrongdoing.

The Hill reported Wednesday that Sen. Amy Klobuchar, a Senate Judiciary Committee member, “is working on antitrust legislation related to the shipping industry.” The same day, the watchdog organization Accountable.US accused shipping lines of charging “abusively high fees.”

Social media posts this week alleged that ocean carriers are “profiteering” and “ripping people off.” Over recent months, ocean carriers have been referred to as a “cartel.” In November, Business Insider reported that it received an email from the White House referring to “price gouging by the ocean shipping cartel.”

And yet, the data implies ocean carriers are competing more, not less, with freight prices rising as demand continues to exceed supply chain capacity despite higher carrier competition, not because of artificially lower competition — the definition of a cartel.

Trans-Pacific competition rises

The trans-Pacific is the key trade for U.S. cargo shippers. According to Drewry, Shanghai-Los Angeles spot rates (excluding premium charges) are currently up 152% year on year.

But there are more ships serving the trans-Pacific trade than there were before rates started to surge, and this higher number of ships is being operated by a larger pool of competitors.

According to Gene Seroka, executive director of the Port of Los Angeles, 10 new entrants in the trade served his terminals during the latest peak season.

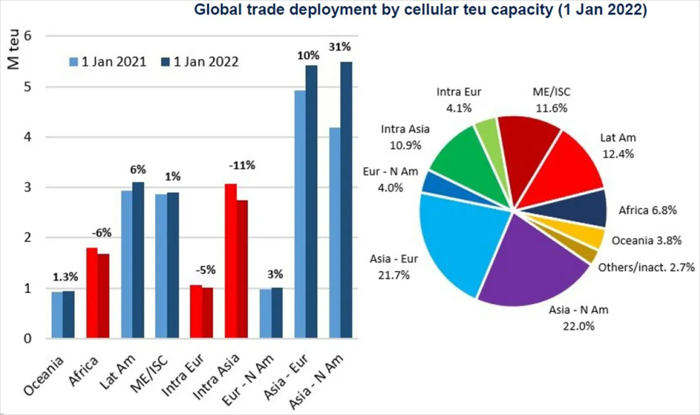

Alphaliner reported a “massive shift” in carrier deployments in 2021, with 22% of global capacity placed in the Asia-North America lane, making it the largest trade in the world after it stole capacity from other routes. Carriers hiked Asia-North America capacity by 1.3 million twenty-foot equivalent units year over year, “a staggering 31.2% increase.”

Alphaliner said that carriers shifted “as much capacity as possible to the trans-Pacific” to chase “irresistible” rates that were higher per nautical mile (including premiums) than in any other mainline trade.

Alphaliner pointed out that the capacity added to the trans-Pacific far exceeded last year’s increase in cargo volume. Traditionally, that would lead to price competition, yet in this case, excess ship capacity has been soaked up by port congestion.

“The capacity increase was needed to compensate for the huge efficiency loss as many ships faced long waiting times at anchorages,” maintained Alphaliner.

A new report this week from Sea-Intelligence highlighted how the recent era of spiking trans-Pacific spot rates coincides with a sharp decrease in market share of the three carrier alliances (2M, Ocean Alliance, THE Alliance).

In 2012-2020, the trans-Pacific balance was 15%-20% non-alliance and 80%-85% alliance. According to Sea-Intelligence CEO Alan Murphy, “Over the past 18 months, there has been a very substantial increase in the share of capacity offered outside the alliances. We are now at the point where 35% of the capacity offered is on non-alliance services.” The non-alliance share has doubled. Chart: American Shipper based on data source: Sea-Intelligence.com, Sunday Spotlight, issue 549

Scramble for container and vessel capacity

One way carriers supported freight rates in the past was by “blanking” or canceling sailings to artificially limit transport supply (a practice carrier alliances are specifically allowed to coordinate under U.S. regulations). They did so in Q2 2020, when demand abruptly sank due to COVID lockdowns, and they’re likely to do so in the future when demand falls, extending the duration of rate strength.

But over the past year, as freight rates have skyrocketed, carriers have been doing the exact opposite: scrambling to inject whatever vessel and container capacity they can buy or rent into the market. The more ships and containers a carrier has controlled, the more money it has reaped from historically high rates. Virtually any container ship in the world that can float is now in service; the global inactive fleet fell to a fresh low of 2% in mid-January, said Alphaliner.

On the equipment front, containers are ordered at Chinese factories by liner companies or by companies that lease containers to liners. According to data from Drewry, last year’s new container production was by far the highest ever. A total of 7.18 million TEUs of new containers were produced, up 130% from the year before and 62% higher than the previous record set in 2018.

While it can take four months from order to delivery for new containers, it takes far longer — two or more years — from order to delivery for a new container ship. To compete for future market share, carriers went on an ordering spree. Alphaliner told American Shipper that tonnage on order is now 23.3% of on-the-water tonnage. At one point in 2020, it was down to the single digits.

To compete for near-term market share as they wait for their newbuilds, carriers have been leasing and buying ships at an unprecedented pace. Charter rates reached all-time highs last year — with some ships leased for as much as $200,000 per day — and average rates have further increased in early 2022. Meanwhile, a record 1.94 million TEUs traded hands last year in the secondhand sales market.

Another way to bolster near-term market share: Don’t scrap aging ships you otherwise would have. According to Alphaliner, container-ship demolitions collapsed to just 16,500 TEUs in 2021, “well below the 194,000 TEUs recycled in 2022 and a far cry from the 417,000 and 655,000 TEUs demolished in 2017 and 2016, respectively.”

MSC’s capacity had surged by 411,000 TEUs or 10.7% by the end of last year as the company bought over 100 vessels in the secondhand market. In early 2022, additional fleet gains pushed MSC past Maersk and MSC won the title of world’s largest ocean carrier.

Evergreen’s capacity jumped 15.6% last year. Zim’s (NYSE: ZIM) rose 14.9% as a result of charters. Capacity of Cosco, ONE and Pacific International Lines fell.

“Our year-on-year capacity comparison of the top 12 carriers shows major discrepancies between the winners and losers,” said Alphaliner.

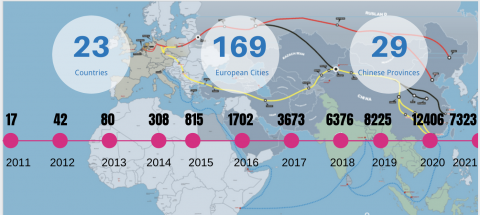

Right before China transitioned into the New Year according to its calendar, it saw another reason to celebrate. On 29 January the 50,000th China-Europe train embarked on its journey towards the west.

According to Xinhua News Agency, the departure of train X8086/5 from Chengdu Chengxiang station marked the magic number of 50,000 trains since the beginning. This

beginning was around ten years ago, when the first China-Europe trains

pioneered across the continents. In the year 2011, a marginal 17 trains were

counted on the New Silk Road.

Doubling every year

This number saw a big boost when in 2013 China’s President Xi Jinping officially

launched the Belt and Road initiative, with the aim of increasing the

connectivity between China and Europe. The train was to play a central role in

this. Over the years, the figures more than doubled every year, and more and more cities

were added to the Eurasian corridor. At present, the China-Europe train reaches

180 cities in 23 European countries. In 2021, the number of trains between

Europe and China amounted to 15,000, a year-on-year increase of 22 per cent.

Quality over quantity

It is going well with the China-Europe train, that is clear for everyone to see. At

the same time, it has been pointed out by many players that it is not all in

the number of trains. The quality of the service must also be maintained, and

the number of trains should be of secondary importance, is a generally held

belief in the industry. This is especially true in the current situation, where the corridor is congested and delays are more frequent than in the years before. Bundling cargo to

make better use of capacity, route expansion as well as infrastructure upgrades

are just some of the solutions at hand.