Морская доставка сборных грузов из Китая в Украину!

+380672456169

Николай, добрый день. Вы можете создать профиль Вашей компании (Zomax Solution Limited), чтобы заводить сервисы, тарифы, откликаться на запросы других участников, а также принимать, размещать заявки и подписывать договоры на отдельные виды перевозок с помощью ЭЦП. В льготный период пока есть возможность воспользоваться всеми функциями бесплатно.

From Germany to Belgium - China is going west, but more activity requires more capacity, which is now equal to gold.

When China announced the major project at the Port of Hamburg, it was only the beginning of its extensive plans to strengthen positions in the EU. Now it is going west towards the Port of Zeebrugge in Belgium, a major asset for maritime logistics, thanks to the freshly extended agreement of COSCO and the aforementioned port. The new strategy will increase port activity which will require additional capacity. Meanwhile, capacity shortage remains a burning issue on intra-Asia routes, which is pushing rates further. Some of the indexes showed an increase from an average of around $500 to $700 per TEU. On the positive side, there are carriers that managed to introduce extra capacity to the Indian Subcontinent and Middle East trades. Indonesia will build a new container port in the Batam Free Trade Zone with a focus on environmental impact. Zim has also reported that it had secured the necessary capacity to meet growing demand and decided to reset its relationship with the 2M alliance.

Overall, the rates’ growth on major Asian indicators had leaped by 780% over the past 26 months; which is forcing industry experts to speak up on the root of it. Liner consolidation remains the top reason. Even the agriculture sector calls for the government to address the unreasonable competition. As for the recent suggestion from the shipping industry to tackle this pressing issue, there was a proposal to introduce a two-year period of notice to allow carriers to use their profits to augment capacity and launch individual services, bringing back more competition. However, the World Shipping Council argues that it should be normalized demand, not regulation, that will solve the supply chain woes. While there are these ongoing debates, the situation will not change and the shipping lines will continue profiting. Although some are against regulations, the congested Port of LA and the Port of Long Beach see the incentives as the means to move empty containers. The new one is supposed to ensure that laden export containers are not deprioritized to make space for empty containers.

Congestion has been a curse for the rail sector too. For example, the one on the Vietnam-China border is causing major disruptions for intra-Asia cargo flows. To address the issue, Alibaba logistics unit Cainiao launched a daily charter flight between Ho Chi Minh City and Nanning, which has provided significant relief and much-needed extra capacity. In addition, land-locked Laos was turned into a land-linked hub that is now serving as a strong alternative to intra-Asia air and ocean freight routes. Besides, Laos railways are cheaper which is a big plus in the current reality of skyrocketing costs. Congestion also disrupted operations of the port of Koper in Slovenia which was devastating especially after it demonstrated spectacular performance a year prior. In 2021, the largest port in the Adriatic region had an annual throughput of 997,477 TEUs.

The Middle corridor is receiving more links too - the new one regards the connection between landlocked Uzbekistan and Azerbaijan to deliver car parts. At the same time, Europe is improving its railweb with Sweden launching a new domestic service as a part of the plan to facilitate further growth above and beyond this in transports on the north-south axis and within Sweden. The initiative aims to switch the old focus on roads to rail as the means to reduce CO2 emissions. There is still a lot to be done to achieve climate targets. Hupac has named three things needed for the European rail to speed up green transition: an energy subsidy for rail, a new bypass on the Rhine-Alpine corridor, and better coordination of construction works. In the coming years, the company is also going to invest 300 million Swiss francs in terminals, rolling stock, and IT systems.

In general, the logistics industry is adopting new technologies to facilitate change. CEVA Logistics offers a wide range of sustainable services that include alternative fuel options, which has caught the attention of Ferrari. Two companies have signed a partnership that serves as an example of how green initiatives are spreading across all sectors.

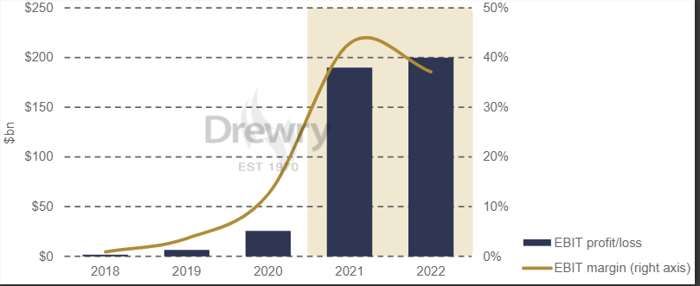

Source: https://www.porttechnology.org/news/2022-carrier-profits-primed-to-hit-200-billion/

In its latest Container Forecaster report, Drewry anticipates that ocean carriers will ride a third year of 15 per cent or higher in annual growth of total revenue in 2022.

Simon Heaney, Senior Manager of Container Research, wrote that global carrier industry sales are expected to exceed $500 billion for the first time.

The gravy train kept on rolling for ocean carriers in 3Q21 as the industry once again exceeded Drewry’s expectations, Heaney wrote. Shipping lines posted an estimated EBIT performance of $70.9 billion – a nine-fold improvement from $7.6bn in the same quarter a year ago.

Drewry again upgraded its annual operating profits forecast for 2021 from the previous guidance of $150bn to $190bn, at a margin of approximately 43 per cent.

The pandemic and ensuing supply chain crisis is the primary driver of the “supercharged carrier profits and share price bonanza,” Heaney wrote. “In simple terms, the longer the congestion lasts, the longer that freight rates and carrier profits will stay extremely high.

“We think that 3Q21 probably represents the peak quarterly earnings for carriers, but that quarterly results in 2022 will stay on a more even keel that will average out slightly higher. Our revised estimate for this year now stands at $200 billion (margin 37 per cent).”

Carriers are building significant free cash flow that will give them “ample room” to allocate future income to dividends, pay down debt, and pursue growth opportunities, Heaney wrote.

Lines are already beginning to expand portfolios with the extra free cash flow: in December, MSC made a $6.4 billion offer to acquire Bolloré Africa Logistics. The same month, A.P. Moller – Maersk (Maersk) reached an agreement to acquire LF Logistics, a Hong Kong-based contract logistics company in the Asia-Pacific region.

The sky-high earnings for carriers have drawn the attention of regulators – notably earlier in Autumn last year year following a new executive order signed by the Biden administration to crack down on anticompetitive behaviour in rail and ocean shipping industries.

Containers

Fast rising inflation, ongoing supply chain bottlenecks and the Omicron COVID-19 variant are conspiring to slow the pace of growth in container handling, forcing Drewry to lower its year-on-year outlook for world port throughput in 2022 to 4.6 per cent.

The full-year 2021 estimate was also downgraded to 6.5 per cent, from 8.2 per cent.

Full-year 2022 estimates will reach just shy of 900 million TEU in global throughput – although this data is subject to change.

It seems like the more we analyze, the more uncertainty gets revealed: is there a new course for shipping stocks or are we just trying to bet on the future?

The unsustainable situation regarding shipping rates is creating even more uncertainty for container stocks. It is a double edge sword - players are excited for the situation to ease (eventually) but at the same time, the roll-in rates and discounting it are always ahead of time. For example, in early cycles, experts in the industry will discount peak valuations and peak earnings and put more emphasis on what they expect to be more normalized midcycle earnings. But as we all know, any indicators about how the future will unfold have been very elusive, and so far it seems that the supercycle will persist. So far, experts report that a lot of positivity has been priced in and they suppose that once things start to turn, players will begin to discount the substantial fleet growth that’s coming into the market in 2023 and 2024. Another contributing factor is how disciplined and tamed the market will be in terms of controlling rate increases. With shipping lines winning the pandemic and them clearly profiting from the challenging context, they do not feel the need to slow down and contribute to return to the “normal” rates. However, there is no guarantee that this permissiveness will last for long. The recent example of South Korea demonstrates that antitrust bodies are after big alliances. But at the same time, big companies are vigorously eliminating any sort of competitors, especially when it comes to small forwarders; Maersk is trying to establish its reign with its space ban. As capacity has become a new gold, everyone’s main objective is to have their cargo shipped. With the new Maersk's policy they can get spot rates only, which means they cannot plan a shipment. Small players simply can never find a space with Maersk, and at the same time, they cannot secure long-term contracts with other lines. For many it means the end, for medium forwarders it means a dark future to say the least. The situation is topped with the lack of containers that are affecting reefer shippers and their import partners. Reefer rates are also on the rise, and as a result, it causes the threat of having fewer and fewer products on the shelves. The food sector, just like any other, is suffering from a tremendous rise in supply chain costs due to congestion and is reconsidering its supplier relations. The construction sector is set to do the same with some companies already diving into diversification of their suppliers and reducing SKUs. This only further proves the strategic decision of Tesco to continue supplying its products by train as the only available alternative. COSCO Shipping follows suit and launches a train service for Jimo Port Station for its electrical goods that used to be transported by sea.

Containerships continue overflooding ports living up the last year's predictions that the situation will persist all the way to 2022. Yantian had to restrict container entry to ease overflow, while such a busy Chinese port as Shenzhen is still suffering from severe congestion complicated by the city's partial lockdowns. Overall, the perplexing situation in Asia is pushing even the big lines to reconsider their priorities. While we saw a major trend for acquisitions in the west, Taiwanese liner operators (Evergreen, Yang Ming, and Wan Hai) have chosen to focus on their core business instead of aiming for the expansion of the logistics sector. They already have their subsidiaries, so there is no need to get into the other sector just for the aimless sake of strengthening their positions. Meanwhile, the US fourth largest Port of Hueneme has started chattering vessels with FedEx as an alternative to transpacific service as it successfully omits congested Porst of LA and Long Beach, where there is no light at the end of the tunnel, especially since shippes are facing the new obstacles due to the increasing trucking rates. In contrast, in the EU there are also improvements port-wise. The new data has shown that despite all the challenges, the Port of Antwerp is back to pre-pandemic levels. The port’s container traffic held steady in 2021, processing over 12 million TEU. The positive dynamic has allowed the port to get into the initiative of merging with the Port of Zeebrugge in Belgium. The former is an important chemical transshipment center, while the latter is Europe’s largest car import port and a vital LNG supply port, so no violation of competition will take place. On the contrary, the merge of two powerful facilities will have a complementary character.

Although the destiny of the railway between North Korea and China remains covered in hues, there are optimistic updates that the traffic has resumed, despite the doubts of some media that the decision is temporary. Reportedly, Chinese traders are already gearing up to load more of the much-demanded goods, in anticipation of the next train. In the meantime, Russia hops on the green train of sustainable development and in unison with other companies seconds that the transition depends on the right infrastructure development. Hence it is currently building a fleet of new hydrogen-based freight locomotives with RZD being a potential customer. For the overall infrastructure development, the country is also planning to build a new container terminal at the Port of Olya in Astrakhan to gain more access to the Caspian