Civil unrest in different regions has been keeping the railway industry guessing if major disruptions are around the corner. However, the consequences are not as bad as they were painted.

Without a doubt, civil unrest in Kazakhstan has left the world speechless and the logistics and transportation market in an uneasy state. Everyone expected mass disruptions, however, contrary to the popular belief, no harmful consequences have taken place. In addition, following the emergency alert and the unprecedented satiation, Kazakhstan Railways decided to cancel all fees, fines and charges related to rail freight transport in order to compensate companies for the potential disturbances. KTZ also made an announcement that railway traffic runs as usual through Kazakhstan. When it comes to political uneasiness, there are some other players that keep everyone alarmed – Belarus and Poland in the context of refugee crises. In this case, the situation does not seem to escalate as Belarus has claimed that it will not prevent the transit of Chinese trains and will supply China with products previously supplied by Lithuania, so no troubles for the New Silk Road in the coming months. This is a mass relief for the European industry as volumes are not slowing down their growth.

The dynamic is the same for the shipping sector where ports continue handling tons of TEU. The new data has shown that the Port of Singapore remains the busiest, having registered a record high in container traffic of 37.5 million TEU.Singapore has also been ranked the top Leading Maritime City and is gradually becoming a leader in facilitating digitalization across all its facilities. These improvements definitely set the tone for others as the competition stakes keep increasing. Hong Kong is determined to keep up with the race, but the declining ranking does not promise so, thus the government is planning to enhance its status as an international maritime and logistics hub. The freshly created bureau will be in charge of the transformation and accelerate the adoption of technology, smart logistics and supply chains, and diversification of manufacturing bases. The Port of Antwerp has also joined the list of innovators by signing the first two leaseholders for 100 million euros for its NextGen District, its hotspot for a circular economy that facilitates the transition to a carbon-free future. The objective is to unite leading innovative players in the circular process and manufacturing industries who will give end-of-life products a second or third life, explore circular carbon solutions and develop renewable energy technologies.

A major boost is not far away from The Northwest Seaport Alliance either since for the first time in months terminals are back to handling multiple ships a day despite the slowdown in vessel loading due to holidays. Coming back in business, the port will also receive funds – a $15.7m grant – for expansion and to battle congestion. As for the most overcrowded ports – Long Beach and LA – the authorities have equalized the number of days both rail- and truck-bound cargo can stay on docks before being subject to a threatened per-diem fee. The initiative aims to influence shippers’ behavior since the strategy of threatening the application of the fee has proven to be working. However, the positive results will have to wait since the Chinese New Year is around the corner and overall, Asian and European ports (Felixstowe alone reports a record for the largest exchange of containers on a single vessel) alongside India continue to struggle as the volatility of spot rates and contract rates spills over in 2022. Container prices have risen at most of the major ports in India by at least 12% in January. Experts fear that if not controlled, the soaring rates will trickle down to consumers. The situation is topped with a 33% increase in imports and a 25% drop in production due to the implemented curfews. The practice has shown that where others cry from sky-rocketing rates, shipping lines are flourishing. The beginning of 2022 is no different for Maersk as it has reported a further $1.8bn in Q4 earnings. To illustrate the giant’s earnings for the last year, it is better to look in the retrospective of the past five years – 2021 has exceeded all of them combined, so the company keeps strengthening its presence on the market.

The big players aim to kill two birds with one stone: to facilitate their growth and paint the world green.

No matter how big and ambitious collaborative initiatives in terms of sustainability may be, the big giants will never miss the opportunity to facilitate even more ambitious goals and set the tone for the entire sector. Maersk believes that it will be able to achieve net-zero emissions 10 years early, by 2040. The breakthrough can be possible thanks to its close ties with the aviation sector. This is one of the reasons (or excuses?) why the company has been considering the acquisitions of airfreight assets since the earning has been enormous. The company will also reconsider its supplier relations in order to address emissions from inland transport services and vessel building.

While the US government is still only threatening to impose additional charges to speed up container movement, such companies as Zim chose carrots instead of sticks as an incentive. The program implies that the ocean carrier is offering to pay truckers up to $200 for each dry-van or laden container picked up within four days after it is discharged from the ship. The logistics costs remain at cosmic levels, so importers are forced to look for alternative ways and start using containerships as offshore warehouses. However, not everything is necessarily in the dark hues. Thanks to congestion at the east and west ports, the interest rates are lower than ever, so the companies can finance a surplus amount of inventory and essentially store it at sea for two months. In addition, California’s ports will receive $2.3 billion of investment in the coming couple of years that will be spent on a range of initiatives from the improvement of the infrastructure to the development of the zero-emissions policies. The former is especially important as to what extent the ports are improved will determine how successfully they will be able to handle growing volumes. The unprecedented demand will remain a global issue, therefore, European facilities are trying to anticipate the splurge in demand as well, especially when it comes to premium warehousing space. To address the challenge, DP World is going to speed up the delivery of a speculative green warehouse at London Gateway’s port-centric Logistics Park. In Asia, Thailand aims to boost the inland container ports to serve as trucking links to neighboring countries. Experts point out that among other factors that will define 2022 is also a more than 60% increase of freight rates on the major routes. The data is derived from the current state of affairs. This will have consequences for the shippers’ contract. Even if they manage to sign at a relevantly low price, the value of such agreements will be minimal if the carriers can drop them without serious penalty. Shippers will also have to deal with more delays that by now have become the mundane reality due to the omicron sparks worldwide. For a while, Chinese ports have been facing partial lockdowns but as new ports have to go through it, the more disruptions they bring. This time it is the Port of Tianjin, one of the busiest ports in the world, that is seeing a drastic increase of cases. The dynamic is extremely alarming because as 2021 proved, it is the Chinese ports that influenced the state of the majority of international facilities. In the meantime, the challenges are topped with unpredictable incidents such as container collapse. Madrid Bridge has lost around 30 boxes, which will surely add up to the delays while the company is recovering this issue in respect of any cargo lost overboard. The vessel has to make its way to New York to investigate the damage. Container collapse is a common phenomenon for the winter season, and now companies are perplexed with the question of how to make transportation more secure.

For the rail sector, the New Silk Road has, to some extent, become the beacon of development and this week it has seen another update regarding the Xi’an-Valenton link that is now regular. Without a doubt, the improvement will alleviate the difficulties faced by the ocean freight due to the COVID restrictions. However, the famous route has a rising competitor. North Sea-Baltic Rail Freight Corridor is extensively growing – the addition of three connections has expanded it to Poland, the Netherlands, and Belgium. North-Sea ports are crucial rail freight players that will add value and provide new business opportunities, as well as facilitate a further modal shift to rail. Poland continues to strengthen its presence. On the already mentioned the New Silk Road, it is going to build a new multimodal terminalin Karsznice. The target capacity of the depot storage area is 4,500 TEUs, with a capacity of 220,000 TEU per year. All these initiatives demonstrate that the growing demand will not be solely a shipping sector’s problem. Indian railways will also face this issue, according to the updated forecast. Maersk has witnessed a 43% growth in the movement of containerized goods on rail and a 23% growth in rail for import and export combined in the region. The splurge creates more uncertainty in the already disrupted logistics ecosystem.

The political situation in Kazakhstan did not omit the services related to crucial inland logistics ties. Although passenger and cargo flights have resumed, some companies had to arrange charter flights to deliver urgent cargo, which was complicated to do due to the sudden loss of communication.

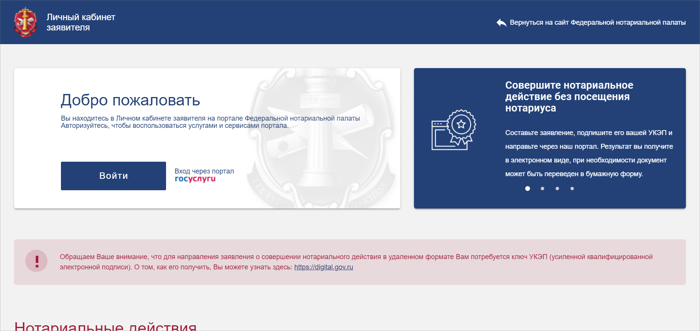

Появился новый способ отменить простую доверенность. С 29 декабря отменить не нотариальную доверенность можно через сайт ФНП. Новый способ позволит значительно сэкономить время: в отличие от публикации сообщения в газете не нужно ждать целый месяц. А сделать это можно по по ссылке: https://lk.notariat.ru

В личном кабинете на сайте нужно заполнить форму. В ней следует указать:

- полное наименование, ИНН или ОГРН, электронную почту доверителя, если это российское юрлицо;

- Ф.И.О., дату рождения, серию и номер удостоверения личности, электронную почту доверителя, если это гражданин;

- Ф.И.О., дату рождения, серию и номер удостоверения личности доверенного лица;

- дату выдачи, номер (если есть) и краткое содержание доверенности.

В случае подачи распоряжения об отзыве доверенности подает представитель, к нему приобщается машиночитаемая доверенность. Ее может изготовить нотариус нотариус. Ее надо заверить квалифицированной ЭЦП доверителя.

Форму перед отправкой подписывает квалифицированной ЭП доверитель или представитель.

Если распоряжение будет оформлено правильно и пройдет проверку на сайте, оно автоматически регистрируется в реестре по московскому времени сп присвоением номера.

Возможность отменить доверенность через газетную публикацию также сохраняется.

Как и раньше, сообщить третьим лицам об отмене простой доверенности можно путем размещения сведений в газете "Коммерсантъ".

In the case of Asia, when one door closes, another one does not open to a great dismay of the common proverb. Further sanitary restrictions are putting supply chains under immense pressure worldwide.

The wind is strong and the waves are big when it comes to Asia as COVID restrictions at ports are tightening in an attempt to contain more contagious variants of the virus. In addition to the introduction of partial lockdowns in Ningbo (although no significant impact has been detected, experts fear that prolonged measures will lead to disruptions), China has put Shenzhen on high alert making it more difficult to leave the city, which directly affects transportation. All the ships arriving in China are now facing strict control measures. However, it is important to keep in mind that ports are not solely about arriving and departing vessels – all the infrastructure related to longshoremen, warehouses, trucks, and rails that enable the flow of trade to move becomes affected by the lockdown disrupting operation of the entire ecosystem. Chinese authorities claim that the state of affairs is stable, but in reality, Ningbo, a digitally automated powerhouse, still needs people and trucks to operate efficiently. In fact, the labor shortage is spreading way beyond Chinaon a global scale. Omicron proves to be more contagious, thus many people call in sick and cannot perform their daily operations. It is severely affecting manufactures and shippers. The former do not have crews to produce products, and the latter cannot transport them since no one is available. The consequences of it did not wait long to show up. The updates of the indexes have clearly demonstrated the pressure that supply chains are under. Analysts have tracked the most important ones to 1997 and concluded that there has been no period of such supply chain pressure in the ensuing 25 years as what has been experienced over the past year. The beginning of the year has not given any clues on the evolution of the sport rates either leaving my players torn between agreeing to fixed long-term contracts and keeping a foot in the door of the spot market in case dynamic changes. If they start having to pay extra charges to get boxes, and more to get them on the ship, then the total charges will skyrocket again. This uncertainty is also pushing shippers and carriers into trade freight forward agreements. Before they were rather reluctant to the introduction of FFA due to the low rates but now their appetite has increased. The perplexing situation in Asian ports due to the sanitary restrictions did not leave the airfreight sector unnoticed either. More international flights were banned in Hong Kong leaving the companies no time and room to adjust. The situation in the EU with airfreight is a bitter better as some companies manage to adjust their freight services in the light of elevated rates and high prices.

Last year already saw the increasing role of government in many countries in attempts to tackle supply chain crises. In the US, it has been especially active in the shipping sector. For instance, currently, Congress is looking to give the government more power over commercial decisions on capacity allocation in the container shipping trade. What will it lead to? Many understand that if the new initiatives are accepted it will be the FMC that is going to dictate the rules regarding capacity. It is a slippery path as no significant progress has been made in establishing fair competition and influencing big lines, so the expansion of the FMC’s authority risks leading to more chaos. If not an authoritative institution should be watching over competition game, then what? The question remains unanswered. Meanwhile, the UK faces a similar problem where BIFA is concerned with practices undertaken by the principal container shipping lines and the assessment of them. In a span of several years, the industry has gotten 15 shipping lines, organized into three major alliances carrying that trade, with some analysts observing that the market share of a single alliance on certain key routes could be over 40%. The recent accomplishment of the MSC surpassing Maersk in terms of their asset sizes serves a proof that the big players are growing vigorously. Although the company claims that it was not competing in size, it is clear that the win has also strengthened its position as a powerhouse. The latest data showed that the shipping industry’s Q3 of 2021 made an enormous $37.24 billion in operating profit. In addition, the country is bracing up against the intensifying pressure on the local importers following the implementation of the post-Brexit border-control procedures. Some of the services crushed on the first day, which lead to delays. Companies note it is not the new regulations that are the problem because the process remains the same; it’s mainly the time frame that was changed. Experts warn that volumes will rise and the pressure risks becoming more tangible.

There have already been signs of the rail freight moving east and even speculations about the possible increasing role of Poland that eventually could become a frontrunner of the intermodal transport. While this premise remains under a question mark, Poland has welcomed Metrans that has extended its network of rail terminals eastwards by acquiring CL Europort. The new terminal will be located in Polish Malaszewicze, which represents a bridge between the EU member states, Russia and China giving the co

The animal farm of the shipping sector: who is going to benefit – bear or bulls? The stakes are high especially with the presence of wild cards.

The end of 2021 was quiet intense with freight indexes hitting new record-highs of $5,046.66 per TEU, so no wonder that after the fireworks commemorating the beginning of the New Year died down, the shipping sector was left with a complicated riddle to solve. Never has the indusrty started chapter 1 out of 365 on such an increase as shippers and carriers remain alarmed about prices, prospects of demand decreasing any time in the coming months, the effect of geopolitics, and COVID consequences. Traditionally, the players can be divided into 3 categories: the bulls, the bears, and the wild cards. For each of them, the perspectives differ. Bulls expect rates to be elevated due to the Chinese New Year, and that they will not drop in spring because during that time the US importers will be restocking their depleted inventories, which will drive the rates up. The bearish view is more positive as they believe that the main driver of the indexes was the US stimulus that will no longer be applied, thus the situation will improve. The main challenge is to solve supply chains inefficiencies that require changes in structure and the way businesses operate, Long story short, the industry needs to stop making congestion a scapegoat. This is where the wild cards come to disrupt, and for 2022, they are COVID, port labor negotiations, and the Taiwan “gray swan.” America, in general, is highly dependent on Chinese ports, and political tension around Taiwan only adds oil into the flames. In addition, the tightening restriction at Ningbo’s port is going to result in production disruptions, including short-term delivery and order fulfillment delay, while the volumes have not dropped. Chinese ports are fighting for their lives as updates show an increase of 7.6% in volumes, compared to the same period of the previous year. The negative aftermaths concern not only American direction. Due to congestion, rates on South Korea – Russia tradelane also ballooned nearly 50% from a year earlier to 81,200 TEU. However, the difficult context in Asia does not prevent the strengthening of some of the companies. This time it is SM Line that has paid $14m to take a 0.49% stake in HMM. A continuous reign of the shipping lines, is it what it is for 2022?

The situation in the US is consequently similar – fundamentals of supply and demand are tight, and the troubled port of LA is demanding shippers to remove empty containers faster under the threat of charging them a hefty surcharge next month. The strategy seemed to work; however, it is some organizational challenges that prevent carries from moving more rapidly. Terminals still do not allow empty returns and loaded import containers to be exchanged at the same facility if they belong to different ocean carriers, have policies that restrict the ability of truckers to secure chassis or make appointments. Some industry experts advocate for a moratorium on this rule. In general, charges relating to container returns are a grey area, and the FMC vs Taiwan’s Wan Hai Lines for possible violations of them is a recent example. The company invoiced their customer more than 20 times for detention charges, when initially, the carrier either offered no return locations, the designated terminal was not accepting the containers’ chassis, or appointments were unavailable for the subject containers. It is yet to be decided whether civil penalties will be applied or not. Overall, the constraints in the major ports are forcing shippers to find safe heavens in niche ports from Port of Hueneme to Montreal or chatter smaller vessels.

Last year has seen many ambitious statements from the companies to go green, and the agenda remains the same for 2022. For many players, it is another ground to establish their influence, so no wonder that it is the big ones introducing major developments. COSCO has brought out online at the Port of Tianjin the world’s first smart green energy system for zero-carbon operations. Taking into account the volumes that Asian ports are currently dealing with, the positive consequences of the implementation of this initiative will be enormous. Meanwhile, Rolls-Royce is working on the development of methanol-based solutions for climate-friendly transportation, as it believes the idea will make them the pioneers in the shipping industry. Clearly, the competition in the green race will be one of the predominant trends of 2022.

Rail has been playing one of the key roles in the shaping of the post-pandemic environment, and as another year has passed, the New Silk Road has proved to be a powerful asset. In the coming months, everyone’s eyes will be on the geopolitical positions of the players with a special role of Lithuania, Belarus, and Russia. The latter has been rigorously investing in the development of the route. Focusing on the quality must be the key factor instead of the ability to handle volumes considering the long transit times and congestion on the corridor. Meanwhile, rail has seen the introduction of new services between China and Azerbaijan and the one linking Argentina and Asia. European direction is doing brighter than The New Silk Road as well. In the UK updates point to a recovery in the rail freight sector. The latest quarterly statistics show traffic has recovered to levels seen before the onset of the pandemic, altho