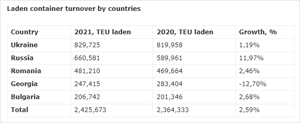

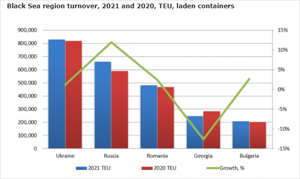

Black Sea Container Market Review 2021: 2M Alliance partners remain the leaders of the region

For more information read here

The U.S. ports are one of the busiest and yet the least efficient. How come? Interesting explanation here:

Competition regulators are going to play big. Major alliances are about to be backed into the corner with a global cartel investigation.

Is it time for big alliances’ last song? The big brother is onto unfair competition and global cartel investigation. As the supply chain crisis continues to intensify and big players keep growing despite the pressing conditions, competition regulators from the US, the UK, Canada, Australia, and New Zealand team up to tame the forming monopoly. The previous investigations have already resulted in big fines in recent years, so the shipping alliances have to buckle up for the coming audit, and this is definitely the new board authority will have to deal with. It is high time to stop further consolidation as it results in nothing but unfair practices, fewer service options, constraints on the supply of space, and market dominance. However, the adopted measures by the governments did not use to have a significant impact, so now when it comes to joint efforts, experts see it as the needed step that can lead to fruitful results on a global scale. The initiative is also backed by forwarders' associations. This is not the only “cleaning up” of the shipping sector that is scheduled. In a more literal sense, Europe is going to take a more confident approach to sustainability. As one of the results of the recent One Ocean Summit, a group of port authorities and stakeholders signed a joint commitment to reduce the environmental impact of port calls with a far greater rollout of shore-side electricity by 2028.

Whatever further steps will be implemented by the shipping community, the positive results will take time to appear. The congestion state remains rather complex and the pandemic is still on, forcing some of the containers to be repurposed as vaccine factories. Although according to the updates, congestion has eased in most parts of Asia, it continues to escalate in North America, where west and east coast ports are reaching new record highs in queueing vessels and waiting time. In response, California’s authorities had to lease several off-dock properties for more capacity to alleviate supply chain bottlenecks. Equipment capacity is also showing zero signs of abating, thus more and more forwarders are turning to shipper-owned containers to minimize the risk of congestion and penalties (that in some cases can reach up to US$30,000 per container) since, so far, this has been the only move and source of containers without any restrictions. It seems like even the ocean itself is reacting to the crisis - recently researchers have announced the most extreme rogue wave ever recorded in the North Pacific. The gigantic size of it was 17.6 m.

This week Europe has become a victim of the storm Eunice as a result of which, railway traffic in some parts of the region has been halted. The disruptions mostly touched the Netherlands, Germany, and Belgium. Meanwhile, the sun is above China as it has started to transport solar panels and modules to India using multimodal transport instead of sticking to a regular route that is now heavily congested. In addition, the country is strengthening its ties with Kazakhstan by welcoming trains carrying agricultural goods. France has also gotten on the list of countries expanding east. CEVA Logistics has added Turkey and Vietnam to its network as both of the counties serve as industrial powerhouses that produce various products and are ideal destinations for exports. The French CMA CGM is going to invest $33m in Beirut port terminal.

However, not everyone's exports are doing so great. The UK is struggling with the post-Brexit syndrome. The majority of the exporters do not believe in the prospects of the trade and co-operation agreement since many companies are failing to adjust to the new regulations. Small firms are the ones struggling the most. However, DP World contributes to positive news by opening a new London Gateway distribution hub. The incentive allows cutting transport costs between port and distribution centre, and between the distribution centre and markets. In the meantime, the Port of Sagunto is trying to adopt a hyperloop way of automating container movement between terminals.

Post-Brexit reality will have everyone in the tight grip for a long time, it seems

https://theloadstar.com/shippers-need-to-wake-up-uk-customs-changes-post-brexit-are-real/

Drewry Shipping Consultants, the leading research and consultancy group specialised in intermodal shipping, has joined the MAXMODAL platform. We look forward to interacting with other users. If you have any questions about Drewry, please contact us.

Great Event!

Dear Philip, happy to see you in MAXMODAL multimodal network!

Interesting take on the current supply chain crisis by Ryan Petersen, CEO of Flexport. For sure, the pressure will persist in 2022 given the current circumstances... What are your thoughts? https://www.youtube.com/watch?v=uygoxDj7aFU