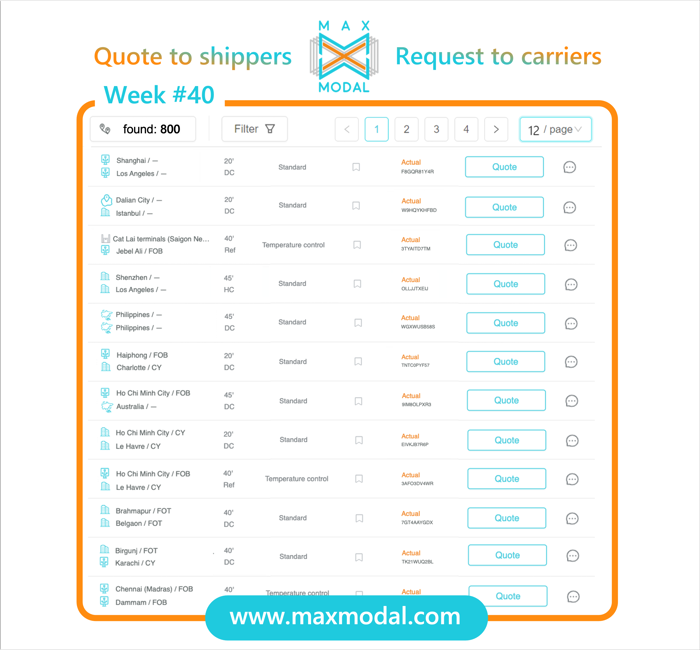

These are just a few examples of new requests at week #40. To get more fresh inquiries and\or the best quotes click here or push the «request management» button in the left menu.

Xi’an International Port Station has handled a total of 20,000 China-Europe freight trains since the China-Europe Freight Train (Xi’an) service was launched in 2013.

On 28 September, a China-Europe freight train loaded with 165 vehicles left Xi’an International Port Station for the Russian capital Moscow, making it the first port station in China to reach the 20,000 mark.

As of Wednesday, the number of inbound and outbound China-Europe freight trains passing through the port station since the beginning of this year reached 3,946, up 29.7 per cent year on year, and the total cargo loaded on these trains reached 3.5 million tonnes, up 34.7 per cent year on year.

This year, an average of 14.7 China-Europe freight trains have departed from or arrived at Xi’an, the capital of Northwest China’s Shaanxi Province, every day, with an average of one train departing or arriving at the port station every one hour and 40 minutes, making it the country’s largest port in terms of China-Europe freight train traffic, according to Bai Kuanfeng, an official at the port station.

I am working in an International NVOCC Shipping and Logistics asset-based Company as an International Sales Executive we have our own inventory of Containers available at different countries and ports and having our own fleet of Customs Bonded Truck and T.I.R license. we do Afghan and CIS landlocked Countries cargo (international road transport)

reach out to me regarding your any relevant queries on WhatsApp: +92 313 2047379

Email: umer.khan@cti-shipping.com

Container lines seem to be giving up hope of raising freight rates for loads from India to the US, as the market is showing no uptick in volume.

Traditionally, carriers wield the most bargaining power during the peak shipping season that gets under way in August. But this year has proved muted for them, after the rate slide began in the middle of last year.

And pessimism is prompting carriers to “undo” rate increase notices already sent out, even though the “asks” had been modest, instead of the usual hefty amounts.

MSC has cancelled peak season surcharges and GRIs which were to have come into force on 1 October. The Geneva-based carrier was intending to implement a PSS of $350 per box and GRIs of $400 per teu and $500 for all other types of loads from India to the US and San Juan (Puerto Rico).

MSC (India) earlier noted that the increases were necessary to “maintain the high level of service reliability and efficiency to meet the needs of customers”.

Other active India-US carriers, including Hapag-Lloyd and CMA CGM, are expected to follow suit in pulling any rate hikes already lined up, according to freight forwarder sources.

MSC has three weekly sailings out of Nhava Sheva and Mundra for the US east coast, while Hapag-Lloyd and CMA CGM jointly offer two Indamex sailings.

Average contract rate levels on the tradelane, the largest by value for India, have been somewhat steady to slightly decreasing over the past two months, despite multiple GRI and PSS attempts by most active carriers.

Over the past year, India-US booking rates have plummeted from pandemic-linked highs and now hover at $1,700 per teu for shipments from West India (Nhava Sheva) to the US east coast, versus about $8,000 per teu in August 2022, industry data shows.

Similarly, India-US west coast rates are down to $1,600 per teu, from about $8,500/teu a year earlier.

Hungary addressed the Belt and Road Initiative (BRI) as a “clear success” despite the drop in China-Europe train volumes this year. On the one hand, the country is envisioned as a future Silk Road rail hotspot. On the other hand, it has also benefited largely from the BRI in terms of investments.

Gyorgy Matolcsy, governor of the National Bank of Hungary (MNB), commented on BRI’s success during the 10-year Belt and Road Initiative anniversary seminar in Budapest this week. He underlined that the BRI provided opportunities for infrastructure development, which led to the development of global economic and financial ties. The trade volume between China and Europe might be another story this year since more and more Chinese trains are directed to Russia instead of the European mainland. However, Hungary, the first European country to sign a BRI agreement with China in 2015, does see an increase in Chinese investments.

Growing investment in Hungary

Hungary is benefiting from investments, especially in the context of nearshoring attempts. “New Foreign Direct Investment (FDI) in Hungary reached an all-time high in 2022,” says CBRE, a real estate company, in a published report. And it “is mostly driven by massive investments of Asian companies into the EV industry”.

CATL, the Chinese company that plans to produce lithium batteries in Hungary, is well-known for its 7.3 billion euro investment. BYD, a major Chinese electric vehicle manufacturer, will invest around 26 million euros in a battery plant near Budapest. And Hungary is paving the way for new factories on the horizon. For example, Debrecen, the city housing battery manufacturers such as CATL, completed the first phase of its railway modernisation in its industrial park worth 168 million euros a few weeks ago, making it accessible by rail.

Hello,

We are handling ATA CARNET in Vietnam.

Pls feel free to contact me. + 84 0908450083 ( Whatsaap , wechat, zalo)

Thanks, and best regrads

Natalie

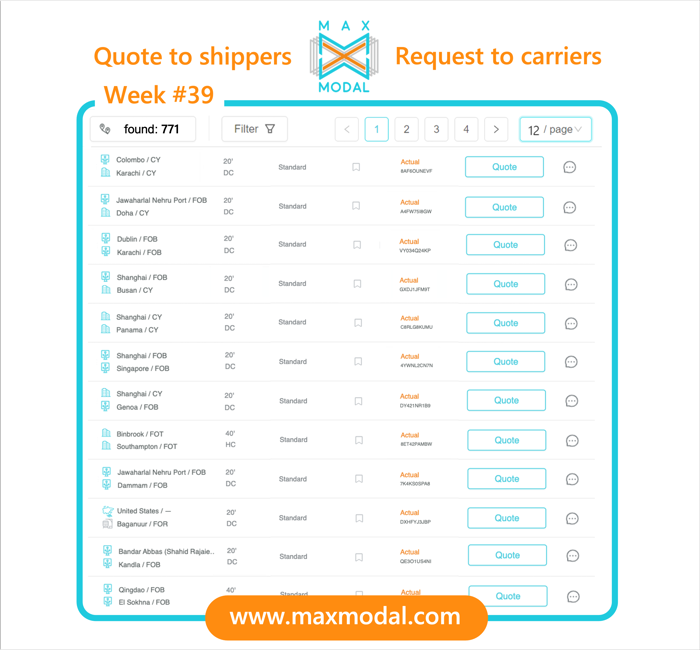

These are just a few examples of new requests at week #39. To get more fresh inquiries and\or the best quotes click here or push the «request management» button in the left menu.

Great. I will quote!

About 77,000 China-Europe freight train trips have been made in the past 10 years, serving 217 cities in 25 European countries, said an official with the Chinese National Development and Reform Commission. This was reported by the Xinhua News Agency.

“In the past 10 years, China-Europe freight trains have transported 7.31 million twenty-foot equivalent unit (TEU) containers of goods worth a total of US$340 billion,” said Cong Liang, deputy head of the commission, at the China-Europe Railway Express Cooperation Forum held in Lianyungang, East China’s Jiangsu Province.

He also stressed the importance of infrastructure construction, improved interconnectivity and diversified transport channels to enhance the competitiveness of China-Europe freight trains in the global market.

Under the theme “Deepening interconnectivity and promoting win-win cooperation”, the forum was hosted by the Commission, the Ministry of Transport, the General Administration of Customs, China State Railway Group and a number of local governments.

The port of Hamburg and HHLA seem destined to be at the centre of attention given every opportunity. This time is not about COSCO buying a stake at a port’s terminal but about the upcoming deal where MSC will acquire a 49.9 per cent stake from HHLA. Protests have taken place this week in the city of Hamburg, with labour unions advocating against the acquisition, perceiving it as a threat to the port’s workforce.

Around 2,500 protestors from the labour union ver.di took to the streets of Hamburg to protest against the port’s infrastructure partial privatisation. Apart from ver.di, the protest was attended by various other workers in an expression of solidarity. Their argument was that the stake acquisition by MSC could endanger the “welfare of workers” while also laying hands on critical public infrastructure.

According to the German publication WELT, the protesters held signs with the message “MSC-mafia shipping company” and chanted the motto “Our port, not your casino”. The message for the port’s employees is clear: The port of Hamburg should remain in the hands of the public, and MSC should stay out of it.

This was also expressed by Maya Schwiegershausen-Güth, one of the ver.di’s representatives, who explicitly said that German seaports are critical infrastructure and should remain in the public sector and not be part of a sell-out. She also accused the city of Hamburg of not safeguarding the port and called upon it to reconsider the decision and align with a collective national port strategy that would protect the future of German seaports and their workforce.

We are proud to announce that this company has the

ability to provide the best services and the most

reasonable prices to all ports in the world. It is our

honor to cooperate with you