The amount of containership capacity idled has surged again, the latest survey from Alphaliner reporting 315 vessels (1.18 million teu) in lay-up, representing 4.3% of the global fleet.

In its fortnightly review of the inactive container vessel fleet, the consultant recorded a big jump from the 271 ships, for 942,035 teu, shown as idled two weeks previously.

It said the idle tonnage figures had been boosted by the addition of several larger ships, including four 12,500 to 18,000 teu vessels and three of more than 18,000 teu, either anchored, or sent to shipyards for surveys and repairs.

Hitherto, the main increase in the inactive containership fleet has come from small and medium-sized vessels, but increasingly carriers are deciding to mothball their surplus large ships that have been displaced by even bigger newbuild arrivals.

Moreover, a ratcheting-up of carrier blanking programmes, including introducing winter service schedules to mitigate weak demand prospects, has resulted in de-facto network reductions and a consequential tonnage oversupply.

For example, according to maritime and supply chain intelligence firm eeSea, next week will see the peak of this quarter’s cancelled sailings from Asia to the North American west coast.

“There are 19 blanks in week 43 alone across the major west coast ports (Canada included),” said Destine Ozuygur, head of operations at eeSea.

“I suspect this is the two-to-three-week transit time ‘ripple effect’ of Golden Week blanks coming out of Asia. These week 40 Golden Week blanks on last-load ports out of Asia would be arriving sometime between weeks 42 and 44 and peaking on week 43, if we are looking at their first discharge arrivals into North America,” she said.

The first stage of construction of a China-Kazakhstan industrial park on the territory of the Khorgos – Eastern Gateway Special Economic Zone (SEZ) in the Zhetysu region is underway, the SEZ’s press service reported.

The project is being implemented by the China-Kazakhstan International Industrial City LLP, which has started excavation works.

“The company has started the first stage of construction on the area of 200 hectares, which will include the construction of utilities and the main road,” the statement said on Wednesday.

The press service added that from November 2023 the investors will start building the facilities of the first stage. These will be administrative buildings and a hotel outside the free economic zone.

“The aim of the project is the construction of an industrial park, the organisation of production and logistics services in Khorgos – Eastern Gateway SEZ, as well as the transfer of industrial capacities from China to the territory of Kazakhstan,” the SEZ press service said.

The cost of the project is 330 billion tenge, or just under $692 million at the current exchange rate. The total area of the project is 1,000 hectares. It is expected to create more than 2,000 jobs for residents of nearby settlements.

It was previously reported that the project had been suspended due to the pandemic, but was revived in June this year.

The Khorgos – Eastern Gateway SEZ is located on the border with China in the Zhetysu region, on the route of the Western Europe – Western China highway. The Altynkol freight station and the KTZE-Khorgos Gateway dry port are located on its territory.

Hard capacity management by Asia-North Europe carriers, combined with the threat of huge FAK rate increases, appears to have staunched the container spot rate decline on the route.

Short-term rates are beginning to edge up, albeit from very low levels, after several consecutive weeks of 10% declines.

The proposed circa-$1,800 per 40ft FAK rate increases from 1 November, and the reduced service “winter schedule” announced by 2M alliance partners Maersk and MSC this week, are understood to have swayed the sentiment and could be the driver for a modest rate recovery on the tradelane.

However, it remains to be seen whether all alliance carriers will have the necessary discipline to desist from further rate discounting in the slack booking weeks to come.

Today’s reading of the Freightos Baltic Exchange (FBX) North Europe component shows a 3% uptick, for an average rate of $946 per 40ft.

And the Ningbo Containerized Freight Index (NCFI) market commentary said space for sailings to North Europe this week was “tight”, adding that rates had stopped falling and were “showing an upward trend”.

Nevertheless, this week some sources received several unsolicited rate offers from China-based forwarders quoting rates from Shanghai to Rotterdam, Hamburg and Felixstowe down to $620 per 40ft, valid to 23 November.

But according to a UK-based NVOCC contact, these rates are unlikely to have been agreed with the carriers in advance.

“There are a lot of chances out there gambling that once they have secured your booking the carrier will agree the rate, but eventually they will come unstuck and you could have a problem that the carrier will refuse the booking, and you end up paying a much higher rate,” he warned.

Meanwhile, backhaul rates from North European ports to Asia have become loss-leaders for carriers, with market rates no longer covering terminal handling charges.

However, it is the cheapest way for carriers to reposition their non-urgently required equipment back to China.

Additionally, subsidising export bookings has the benefit of taking surplus boxes out of storage at empty-container depots, thereby easing some of the cost pressure on lines.

Asia-Mediterranean rates were stable this week, with the FBX reading flat, at $1,480 per 40ft. And on the transpacific, the NCFI commentary said carriers had “slightly lowered” their rates this week, due to weak demand and a “sufficient supply of space”.

Indeed, this week’s Asia-US west coast average spot rate ticked down 2.5%, to $1,767 per 40ft, having lost around 20% in value since early September. And on the Atlantic side, Asia-US east coast spot slipped 2%, to $2,630, which is 70% lower than for the same week of last year.

Transatlantic carriers saw another week of falling spot rates with, for example, the FBX coming close to dipping below the $1,000 watershed, as the average spot reading fell another 12%, to $1,035 per 40ft.

Short-term rates on the route have declined by around 80%, year on year, and are now roughly half of their historical levels.

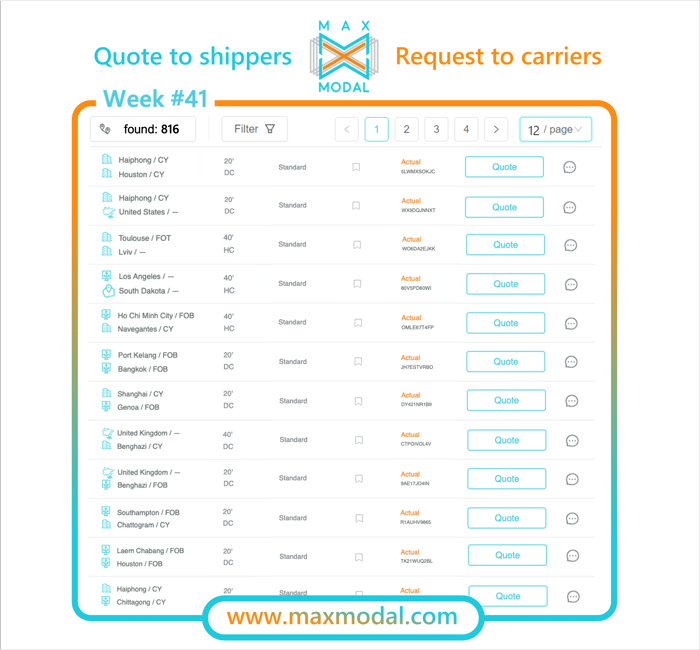

Oh, Do you have LCL services from Ho Chi Minh , Vn to Mongolia , Tran

Oh, Do you have LCL services from Ho Chi Minh , Vn to Mongolia , Tran

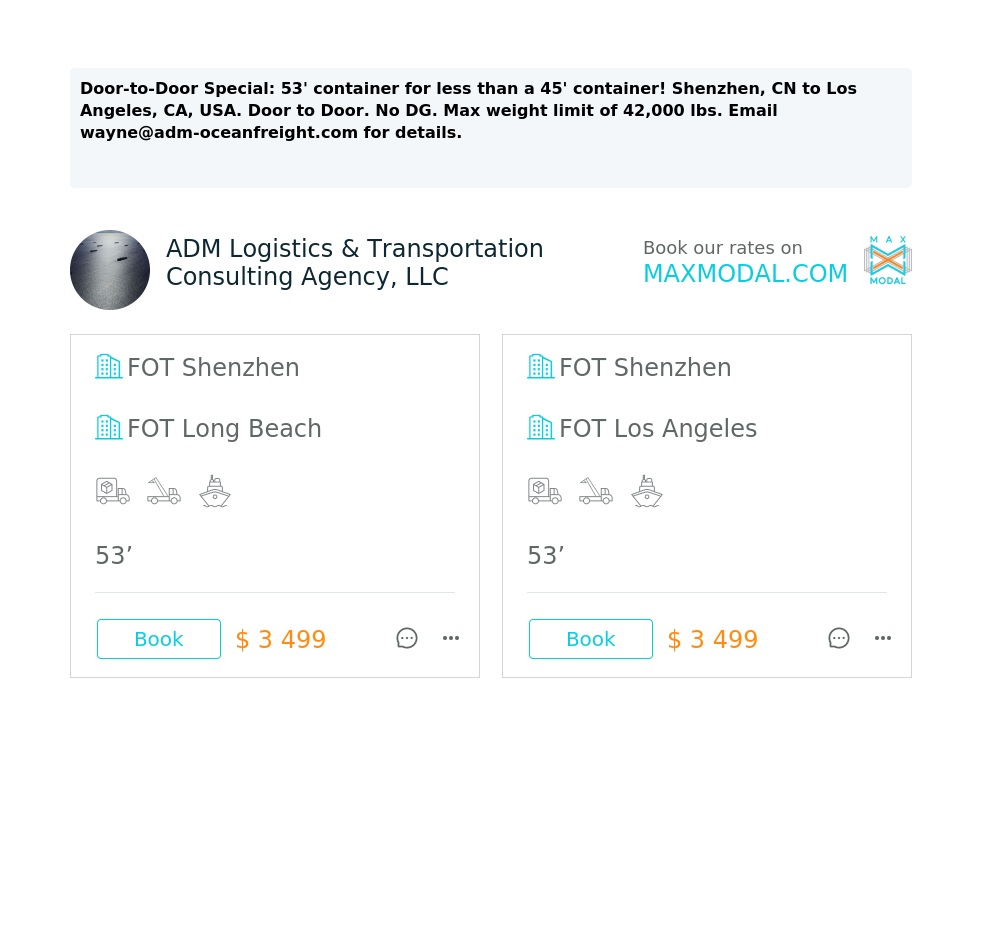

These are just a few examples of new requests at week #41. To get more fresh inquiries and\or the best quotes click here or push the «request management» button in the left menu.

The brand Danzas AEI Emirates is to disappear, after DHL Global Forwarding said today it had agreed to buy the remaining 60% of its shares from Investment Trading Group. DHL has pledged jobs will be safe.

Danzas AEI had been run as a joint-venture between holding company Al Tayer Group and DHL GF, with DHL already owning 40% of the company. Danzas AEI will now be folded into DHL GF’s Middle East and Africa operation.

“In the many years of close and trusting partnership with the Investment Trading Group, we have made Danzas more and more successful and stronger,” said Tim Scharwath, CEO of DHL Group.

“We are proud and grateful for what we have achieved together. With DHL on course for growth in the region, the combination of the two organisations will create a compelling proposition for customers that promotes efficiency and sustainability.”

DHL said the integration, which remains subject to approval, will see shared management services, synergies and efficiencies, and “seamless collaboration”. DHL added that “nothing will change for the existing employees, except that they will become 100% part of the DHL family”.

According to Al Tayer Group, Danzas has 1,200 employees. It owns and operates 20 facilities across Dubai and the northern Emirates, with key sites in Jebel Ali Free Zone, Dubai World Central and Dubai Airport Free Zone. It offers air, ocean and road products, and claims to be the regional market leader in customs brokerage. Its warehouse capacity exceeds 240,000sq metres.

“Dubai has become an important logistics hub in recent years,” said Matar Humaid Al Tayer, vice chairman & board member of Al Tayer Group.

Małaszewicze, the major European border crossing for Silk Road trains, has experienced a 24,3 per cent drop in Westbound volumes, reaching 57,180 TEU for H1 2023, according to the Polish Road Transport Institute. Eastbound volumes have shrunk even more significantly in the same period, dropping by 91 per cent compared to last year.

The 91 per cent drop in Eastbound Silk Road train volumes via Małaszewicze resulted in 824 TEU transported towards China for the first half of the year. Though the Eastbound drop came as sharp as it could be, it did not necessarily impact the overall trade volume via China Europe trains as much as the Westbound volume drop did. The Westbound volumes in the first half year experienced around 8,000 TEU drop compared to last year.

Shifting Silk Road focus

One explanation for the volume drop at Małaszewicze could be the changing strategy and emphasis of Silk Road trains. This year, there is a destination shift for Silk Road trains departing from China, mainly attributed to the war in Ukraine and related sanctions imposed on Russia. For example, China Railways are promoting trains that end up in cities like Moscow and St. Petersburg in Russia, as well as Astana and Atkau in Kazakhstan. For example, Chinese forwarders have shared that in their operations, 80 per cent of international freight trains leaving China are directed to Russia.

We do LTL FTL AND DRAYAGE TRUCKING ALL OVER THE USA

Sure, click on requests button to find loads for US trucking