The Dutch Ministry of Infrastructure has decided to reconstruct the Sluis II multimodal complex near Tilburg, Southern Netherlands, and allow larger ships to pass through it. Sluis II is located on the Wilhelmina Canal and is critical for multimodal connectivity in the broader Benelux area. The latest development is also particularly good news for Barge Terminal Tilburg (BTT) engaging in inland waterways-rail transport.

“You have everything in Tilburg to get freight traffic from the road to inland waterways,” said the outgoing Dutch minister of infrastructure and water management, Mark Harbers, to Dutch media. “There are rail connections, there are pipelines. Then, it is important that we can also start using this, not only for Tilburg but for the whole region. We want to submit the project plan this year and then start the tender. I think it’s realistic that we can start working with a contractor in 2025.”

Harbers’ words will be music to the ears of BTT director Wil Versteijnen. BTT is a family business in sustainable container logistics, with its own barge and rail terminals in Tilburg, Eindhoven and Bergen op Zoom. Goods come to Tilburg from all over the world, and from there, they are transported further by water or rail.

The company has one rail and two inland shipping terminals in the vicinity of Tilburg, southern Netherlands. The company operates 14 ships and two locomotives of its own. Versteijnen compared his company’s business to a kitchen while speaking to Dutch media. “The ports are the cooks; we supply and serve. Without us, the kitchen gets stuck. Rotterdam has signed an environmental covenant stating that by 2030, no less than 65 per cent of containers must enter the country by rail or barge, no longer by truck. That’s only about 40 per cent now.”

Operations at Australia’s largest ports are slowly resuming

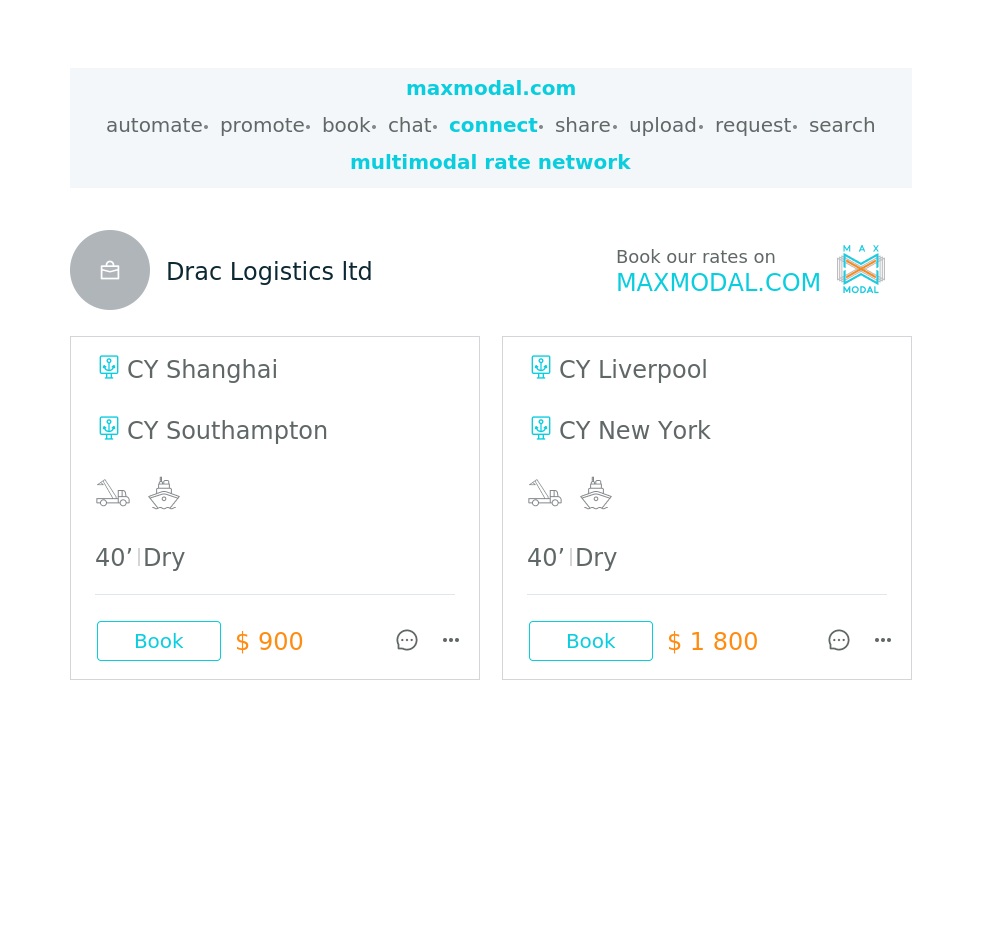

Just post your freight rates on maxmodal to share them worldwide with your clients and partners

Fearing threats to their job security from a potential sale of HMM, carrier employees demonstrated outside the Korea Development Bank building in Seoul today.

The liner’s main shareholders, KDB and Korea Ocean Business Corp, representing the state’s interest, plan to sell a majority stake in HMM, as they feel it is time it was released from government support.

Forty unionised shore-based and seafaring staff denounced attempts by KDB and KOBC to sell HMM to what they deem “mid-sized concerns” a day after due diligence into HMM’s three suitors, Harim Group (working with JKL Partners), LX International and Dongwon Group, was completed.

Jeon Jung-geun, head of HMM’s seafarers’ union, said: “With the acquisition candidates’ questionable ability to raise equity capital, the question is whether the sale will really help national development. There are serious concerns.

“If the bidder focuses only on recovering capital returns, it may lead to poor management that misappropriates HMM’s reserves, so the hasty sale must be stopped immediately. We need an owner that can nurture HMM to prevent the [domestic] shipping industry from being ruined.”

The state took control of HMM after swapping debt for equity in 2016.

KDB and KOBC expect to name a preferred bidder this month and conclude the sale by year-end. They plan to sell a 40.65% stake, which could increase to 57.87%, if KRW1trn ($742m) of bonds are converted to stocks. The sale price is estimated between KRW5 trillion ($3.5bn) and KRW10 trillion ($7.4bn).

Lee Ki-ho, head of HMM’s office finance workers union, said: “The shipping industry has a great impact on the nation. We need to form a consensus so that a hasty sale will not bring shame.”

Reportedly, HMM’s staff have been spooked by Maersk Line’s 10,000 headcount loss as huge Covid-fuelled profits evaporate.

All three of HMM’s suitors have equities that are below the shipping company, resulting in them having to sell assets to raise funds. This has given rise to talk of a “winner’s curse”, as speculation mounts that any new owner will struggle to take HMM forward.

Interesting

The Executive and Supervisory boards of HHLA Hamburg have greenlit MSC’s offer to buy 49,9 per cent of the company’s stakes. Negotiations, including the two parties and the City of Hamburg, deemed the offering adequate. The HHLA boards now recommend that the company’s shareholders accept the offer, which, according to official and binding agreements, will not disrupt HHLA’s business model and will secure several aspects of the business concerning investments, subsidiaries and employees.

The Executive and Supervisory boards of HLA Hamburg were obliged by the German Securities Acquisition and Takeover Act (WpÜG) to “examine the offer carefully, impartially and in the best interests of all the company’s stakeholders” and subsequently proceed to a joined ‘Reasoned Statement’ explaining why the takeover should take place or not.

The offer’s assessment was mainly based on the financial aspect of the transaction, which the HHLA Hamburg boards considered financially adequate and competitive. Specifically, HHLA explained that they are content with MSC’s offer to pay 16,75 euros per Class A share. However, what could be even more critical in accepting this offer is the Business Combination Agreement (BCA) signed by HHLA, MSC and the City of Hamburg, which safeguards HHLA’s future business in different ways.

The Business Combination Agreement

Just days after the announcement of MSC’s intention to acquire 49,9 per cent of HHLA’s shares, protests broke out in Hamburg, with labour unions claiming that the port of Hamburg is not for sale and should remain in public hands. The regime in which the port of Hamburg is subjected, considering that it is a public entity, makes share acquisition a more complex process, igniting fears over operational and business changes that could harm both the city of Hamburg and the port employees.

In this regard, the BCA agreement reached by the three parties involved in the acquisition process could provide some security and assurance for the following steps. First and foremost, one of the BCA’s commitments concerns the HHLA’s workforce. According to the company, the employees should not be alerted of possible redundancies since the BCA excludes reducing personnel due to operational reasons for at least five years. However, it is not binding that this commitment will continue to be applied after this timeframe passes.

discuss the rising risks of droughts on the global shipping industry. Climate crisis may cost shipping billions by 2025

Maersk, the world’s biggest shipping company, said Friday that it plans to eliminate 10,000 jobs due to what it described as a challenging environment for container trade and logistics services.

Post your freight rates here to boost your sales

Chevron Sea Shipping Co. L.L.C is a Shipping and Logistics company and we can provide you with any kind of solution with freight & transportation for your Import procurement, Exports & Customs Clearance.

Our Services are :

- Air /Sea Import from any part of the world.

- Air /Sea Export from any part of the world.

- Land Freight/Transportation within UAE & GCC.

- Custom Clearance.

- Cross Stuffing.

- Warehouse Management.

- Exhibition Handling.

- Special projects cargo handling.

- International Relocation.

- Cross Trade.

- Flexis.

- Reefers.

- Door to Door AIr and Sea Cargo

- Domestic Relocation

- Fabricating Wooden Box