Greetings of the day,

I hope you are doing well,

We would like to introduce ourselves as one of the leading transportation providers in the USA, MX & Canada. Our management team has significant experience of more than 25 years in Loading, hauling & transporting commercial goods. We specialize in Light & Heavy Freight, OTR, and Drayage work.

We want to set up with you as your trucking partner.

- What we cover:- "All states of the USA, MX, and Canada".

- What we specialize in:- "Dry vans, Flat and Open Bed Trailers, Intermodal, and Reefer Vans, Double Drop Trailers, Extendable Flat Beds, Box Trucks, Steering Dollies, and Power only, etc."

- What we have:- "7000 Grade 'A' Trucking Companies for freight services, Hold of more than 15,000 draymen, and a sister concern company with the name of Best Bay Trucking Corp. that owns 115 trucks"

- Our customers:- "Tesla Motors, DSV, Porche, Legier, and we are proudly serving over 700 customers across the USA and Canada"

I am looking forward to hearing from you for loads. Give us a try, we will give you the best.

Contact details,

augustus@bestbaylogistics.com // +1 9098439689

The Bay Area freight train arrives in Duisburg in 16 days, providing stable links between European countries and industrial centres in southern China

According to statistics from Shenzhen Customs, the China-Europe freight train “Bay Area” has made a total of 516 trips in the past three years, transporting 361,100 tonnes of goods with a cargo value of RMB 10.8 billion (USD 1.48 billion).

The Greater Bay Area (GBA) covers part of Guangdong Province and the Hong Kong and Macau Special Administrative Regions in southern China at the mouth of the Pearl River into the South China Sea. With cities such as Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing, the GBA includes some of China’s most economically powerful cities.

On 18 August 2020, the first train of “Bay Area” departed from Shenzhen Pinghu Logistics Hub to Duisburg, Germany. On 18 August this year, the “Bay Area” China-Europe freight train loaded with microwave ovens, electric ovens, electric sockets and other goods left for Central and Eastern Europe. The goods will arrive in Duisburg, Germany, in 16 days, saving about 15 days of transport time compared to traditional sea transport.

Over the past three years, the number of trips made by the China-Europe “Bay Area” freight train has increased year on year. The logistics service continues to expand, with routes covering Germany, France, Italy, Belarus and other 41 countries. It has become an important trade and transport corridor, closely linking the countries along the route with the Guangdong-Hong Kong-Macau Bay Area.

In recent years, the export product categories of “Made in Bay Area” continue to enrich. In addition to home appliances, garments, footwear and hats and other traditional products, exports of electronic equipment, machinery and equipment, new energy vehicles, fuel vehicles and other high value-added products have also shown significant growth.

Get ready to share your freight rates with the world with new advanced features coming

PEK-SIN BY SQ AIR FREIGHT

Delivery completed 🌹

If you also need a Chinese goods agent, please feel free to contact me.

Email:winni-cllcn@outlook.com

WhatsAPP:8618898311210

#freightforwarder #import #export #FCL #LCL #AIR

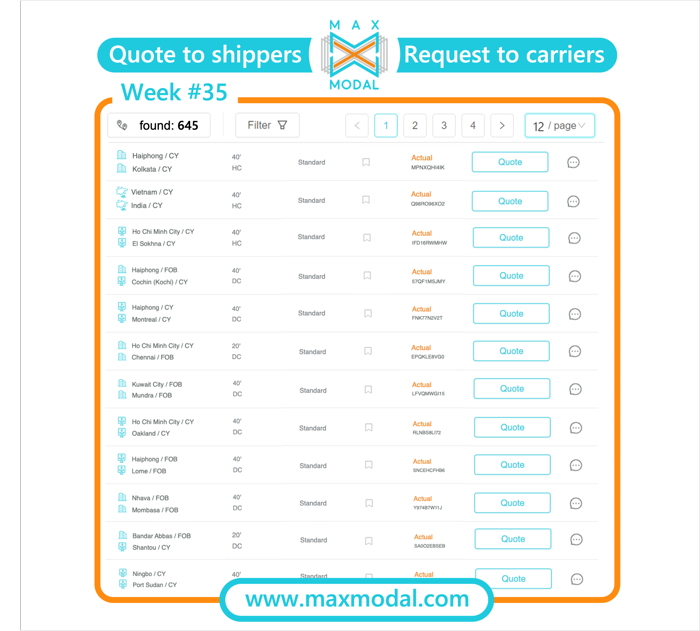

These are just a few examples of new requests at week #35. To get more fresh inquiries and\or the best quotes click here or push the «request management» button in the left menu.

Tôi cần giá của HPH - KOLKATA, Yêu cầu $ 1050, 30x40 'Tháng Chín

Ocean carriers are giving back their recent Asia-North Europe FAK rate increases via heavy discounts for October shipments from China.

Indeed, shippers are receiving rate offers from major carriers, valid until 15 October, from China to Antwerp, Rotterdam and Hamburg at less than $1,000 per 40ft – with rates for UK ports further discounted.

The container spot rate indices appear to be behind the curve on the rate erosion, albeit Xeneta’s XSI Asia-North Europe component slipped 7% this week, to an average of $1,585 per 40ft.

With a prediction that the rate increases on the tradelane would “relatively quickly run out of steam”, the August edition of MSI’s Horizon report cites the “gargantuan supply influx” of newbuild ultra-large container vessels being phased into service loops as the principal cause.

“A combination of dramatically increased scrapping, blank sailings and possibly idling of vessels will be necessary for carriers to keep rates at a sustainable level in the coming two to three quarters, since cargo volumes will be lower,” says the report.

Meanwhile, MSC’s much-blanked standalone Swan loop will finally get going, with a departure from China on 5 September that will now include a call at Felixstowe, as well as Bremerhaven and the Polish ports of Gdansk and Gdynia, “providing a fast, direct route between Yantian and the UK”, said MSC.

The more robust Asia-Mediterranean tradelane was reported to be stable this week, despite significant capacity upgrades by carriers. For example, Drewry’s WCI spot reading edged up 1%, to $2,086 per 40ft.

On the transpacific, carriers are more optimistic that they can hold on to their rate increase gains, and are said to be preparing a fresh wave of GRIs for mid-September – and they appear to be more disciplined in terms of capacity management.

For example, Maersk and MSC have announced they will blank their TP1/Maple loop in week 37 – “in line with lower demand” – with cargo being transferred to the 11,000 teu Gerda Maersk, scheduled to depart China on 18 September.

Meanwhile, spot rates from Asia to the US west coast are holding firm, for now, with the XSI component actually putting on 3% this week, to $2,149 per 40ft.

On the Atlantic coast, spot rates continued to tick up due to the Panama Canal draught restrictions. Maersk said it had deployed additional vessels on the route to mitigate the impact.

“Besides adding extra loaders, we work closely with the canal to ensure we have access to the needed transit slots,” said Maersk.

If you want to get the best things in the world,you have to let the warld see the best of you. You don't have to turn against the wind,but you must be born to the sun. Hard work is difficul,but always remember,if you do not work hard,it will always be difficult,do not choose a lifetime of hardship because of a moment of ease,the purpose of shipbuilding is never to stop in the harbor,but to impact the wind and waves.

#weekend #happy #Enjoy #relax

ASEAN-China trade has grown rapidly in recent years, highlighting the important role of logistics in facilitating trade. Road transport has become one of the fastest growing modes of transport in the ASEAN freight market, with countries such as Thailand and Vietnam looking to further invest in infrastructure to develop their cross-border trade with China.

In 1991, China and ASEAN officially launched a dialogue process. Over the past 30 years, China-ASEAN relations have grown significantly, with bilateral trade growing from less than US$8 billion in 1991 to US$975.34 billion in 2022, just one step away from US$1 trillion. China and ASEAN have been each other’s largest trading partners for three consecutive years.

In the first seven months of this year, total imports and exports between China and ASEAN reached 3.59 trillion yuan, up 2.8 per cent year-on-year, accounting for 15.3 per cent of China’s total trade.

On the other hand, from the perspective of the international environment, the “China+1” supply chain strategy adopted by European and American companies is accelerating the creation of industrial value chains in Southeast Asia. European and American companies are setting up factories in Southeast Asia, and Chinese companies are also accelerating their layout in Southeast Asia, on the one hand, to strive for better conditions and serve the local market, and on the other hand, to reasonably avoid potential geopolitical and sanctions risks.

Such changes in industrial layout will also lead to further flows of raw materials and products between the Chinese and Southeast Asian markets.

Geodis expects the size of Asia Pacific’s expanding logistics industry to reach US$4.5 trillion by 2029, with a projected growth of 5.24 per cent from 2023 to 2029.

“ASEAN and China are two of the fastest growing economies in the world. As the region remains poised for growth, GEODIS sees the extension of our Road Network to China as an opportunity to enhance our multimodal solutions and connectivity across major air hubs and seaports to give customers greater flexibility and reliability. We have made significant investments to our security, infrastructure and capabilities to ensure a safe and efficient flow of goods for our customers. Ultimately, we want to provide them with a competitive advantage to grow their business,” said Onno Boots, Regional President and CEO of GEODIS Asia Pacific and Middle East.