HUBUNGI

Mr. KITO

Mobile : 0857-6377-2482

Telepon : 021-2784-3213

Email : boshokukito@gmail.com

Perkenalkan kami dari PT. BOSHOKUNUSA EXPRESS Perusahaan di bidang Expedisi ( International Freight Forwarders)Specialist Import Door To Door handling import Resmi, undername, borongan (Allin). Kami mengkhususkan diri dalammenyediakan layanan impor door-to-door yang terjangkau dan efisien.Timprofesional kami yang berpengalaman memastikan pengalaman yang lancar danbebaskerumitan bagi klien kami, mengurus semua proses logistik dan bea cukai.Selain layanan impor kami yang komprehensif, kami juga menawarkan layanankhusus untukimpor dari Singapura, Malaysia, Korea, tiongkok china, seoul koreaSelatan, Australia,uk/usa, Canada, timur Tengah, inggris, jerman, itali,belanda, rusia, india, tailand-bangkok,Taiwan, hongkong, jepang, france/Amerika, dan Eropa. Dengan komitmen terhadapkepuasan pelanggan dan jaringanglobal yang kuat.

PT. BOSHOKU NUSA EXPRESS — CHINA DOOR TO DOOR CARGO LOGISTICS adalah pilihan utama untuk segala kebutuhan imporAnda, karena melayani pengiriman sampai depan tempat usaha anda yang ada dikota-kotaTangerang, karawang, cikarang, Bekasi, bogor, banda aceh, medan,pekanbaru, Palembang, lampung, batam,bandung, jawa barat, semarang, jogjakarta,tanjung emas, jawa Tengah, Surabaya,Pelabuhan tanjung perak, jawa timur,Kalimantan, Sulawesi, papua.

BAGI ANDA YANG INGIN TAU CARATITIP BAYAR / BELI BARANG DICHINA VIA E-COMMERCE ALIBABA.COM — 1688.COM DLL,& KITA JUGA YANG BANTUCARIKAN SUPPLIER/SELLER BARANG ANDA SESUAI KEBUTUHANLANGSUNG DARI TANGAN PRODUSENDI CHINA. DAN KITA BANTU JUGA UNTUK PEMBAYARANNYA, ( NO FEE / GRATIS ).PASTINYA HARGA BARANG JAUH LEBIH MURAH.

Jasa Import Door To Door | JasaImport Borongan All-In | Jasa Import Cargo Borongan | Jasa Import Door To DoorMurah | Jasa Import Borongan Undername | Jasa Import Borongan Di Jakarta | JasaEkspedisi Import Borongan |Jasa Import Borongan | Forwarder Import Resmi |JasaImport Resmi |Jasa Sewa Undername Import | Biaya Jasa Undername Import |JasaUndername Import | Jasa Import Barang | Jasa Import Jakarta | Jasa ImportSurabaya | Jasa Import Semarang | Jasa Import Dari China | Jasa Import Door ToDoor Dari China | Jasa Import Door To Door Dari China | Jasa Import Door ToDoor Dari Malaysia | Jasa Import Door To Door Dari Korea | Jasa Import Door ToDoor Dari Thailand | Jasa Import Door ToDoor Jakarta | Jasa Import Door To Door Dari Bangkok | Jasa Import Door To DoorDari Jepang.

HUBUNGI

Mr. KITO

Mobile : 0857-6377-2482

Telepon : 021-2784-3213

Email : boshokukito@gmail.com

Perkenalkan kami dari PT. BOSHOKUNUSA EXPRESS Perusahaan di bidang Expedisi ( International Freight Forwarders)Specialist Import Door To Door handling import Resmi, undername, borongan (Allin). Kami mengkhususkan diri dalammenyediakan layanan impor door-to-door yang terjangkau dan efisien.Timprofesional kami yang berpengalaman memastikan pengalaman yang lancar danbebaskerumitan bagi klien kami, mengurus semua proses logistik dan bea cukai.Selain layanan impor kami yang komprehensif, kami juga menawarkan layanankhusus untukimpor dari Singapura, Malaysia, Korea, tiongkok china, seoul koreaSelatan, Australia,uk/usa, Canada, timur Tengah, inggris, jerman, itali,belanda, rusia, india, tailand-bangkok,Taiwan, hongkong, jepang, france/Amerika, dan Eropa. Dengan komitmen terhadapkepuasan pelanggan dan jaringanglobal yang kuat.

PT. BOSHOKU NUSA EXPRESS — CHINA DOOR TO DOOR CARGO LOGISTICS adalah pilihan utama untuk segala kebutuhan imporAnda, karena melayani pengiriman sampai depan tempat usaha anda yang ada dikota-kotaTangerang, karawang, cikarang, Bekasi, bogor, banda aceh, medan,pekanbaru, Palembang, lampung, batam,bandung, jawa barat, semarang, jogjakarta,tanjung emas, jawa Tengah, Surabaya,Pelabuhan tanjung perak, jawa timur,Kalimantan, Sulawesi, papua.

BAGI ANDA YANG INGIN TAU CARATITIP BAYAR / BELI BARANG DICHINA VIA E-COMMERCE ALIBABA.COM — 1688.COM DLL,& KITA JUGA YANG BANTUCARIKAN SUPPLIER/SELLER BARANG ANDA SESUAI KEBUTUHANLANGSUNG DARI TANGAN PRODUSENDI CHINA. DAN KITA BANTU JUGA UNTUK PEMBAYARANNYA, ( NO FEE / GRATIS ).PASTINYA HARGA BARANG JAUH LEBIH MURAH.

Jasa Import Door To Door | JasaImport Borongan All-In | Jasa Import Cargo Borongan | Jasa Import Door To DoorMurah | Jasa Import Borongan Undername | Jasa Import Borongan Di Jakarta | JasaEkspedisi Import Borongan |Jasa Import Borongan | Forwarder Import Resmi |JasaImport Resmi |Jasa Sewa Undername Import | Biaya Jasa Undername Import |JasaUndername Import | Jasa Import Barang | Jasa Import Jakarta | Jasa ImportSurabaya | Jasa Import Semarang | Jasa Import Dari China | Jasa Import Door ToDoor Dari China | Jasa Import Door To Door Dari China | Jasa Import Door ToDoor Dari Malaysia | Jasa Import Door To Door Dari Korea | Jasa Import Door ToDoor Dari Thailand | Jasa Import Door ToDoor Jakarta | Jasa Import Door To Door Dari Bangkok | Jasa Import Door To DoorDari Jepang.

HUBUNGI

Mr. KITO

Mobile : 0857-6377-2482

Telepon : 021-2784-3213

Email : boshokukito@gmail.com

Perkenalkan kami dari PT. BOSHOKUNUSA EXPRESS Perusahaan di bidang Expedisi ( International Freight Forwarders)Specialist Import Door To Door handling import Resmi, undername, borongan (Allin). Kami mengkhususkan diri dalammenyediakan layanan impor door-to-door yang terjangkau dan efisien.Timprofesional kami yang berpengalaman memastikan pengalaman yang lancar danbebaskerumitan bagi klien kami, mengurus semua proses logistik dan bea cukai.Selain layanan impor kami yang komprehensif, kami juga menawarkan layanankhusus untukimpor dari Singapura, Malaysia, Korea, tiongkok china, seoul koreaSelatan, Australia,uk/usa, Canada, timur Tengah, inggris, jerman, itali,belanda, rusia, india, tailand-bangkok,Taiwan, hongkong, jepang, france/Amerika, dan Eropa. Dengan komitmen terhadapkepuasan pelanggan dan jaringanglobal yang kuat.

PT. BOSHOKU NUSA EXPRESS — CHINA DOOR TO DOOR CARGO LOGISTICS adalah pilihan utama untuk segala kebutuhan imporAnda, karena melayani pengiriman sampai depan tempat usaha anda yang ada dikota-kotaTangerang, karawang, cikarang, Bekasi, bogor, banda aceh, medan,pekanbaru, Palembang, lampung, batam,bandung, jawa barat, semarang, jogjakarta,tanjung emas, jawa Tengah, Surabaya,Pelabuhan tanjung perak, jawa timur,Kalimantan, Sulawesi, papua.

BAGI ANDA YANG INGIN TAU CARATITIP BAYAR / BELI BARANG DICHINA VIA E-COMMERCE ALIBABA.COM — 1688.COM DLL,& KITA JUGA YANG BANTUCARIKAN SUPPLIER/SELLER BARANG ANDA SESUAI KEBUTUHANLANGSUNG DARI TANGAN PRODUSENDI CHINA. DAN KITA BANTU JUGA UNTUK PEMBAYARANNYA, ( NO FEE / GRATIS ).PASTINYA HARGA BARANG JAUH LEBIH MURAH.

Jasa Import Door To Door | JasaImport Borongan All-In | Jasa Import Cargo Borongan | Jasa Import Door To DoorMurah | Jasa Import Borongan Undername | Jasa Import Borongan Di Jakarta | JasaEkspedisi Import Borongan |Jasa Import Borongan | Forwarder Import Resmi |JasaImport Resmi |Jasa Sewa Undername Import | Biaya Jasa Undername Import |JasaUndername Import | Jasa Import Barang | Jasa Import Jakarta | Jasa ImportSurabaya | Jasa Import Semarang | Jasa Import Dari China | Jasa Import Door ToDoor Dari China | Jasa Import Door To Door Dari China | Jasa Import Door ToDoor Dari Malaysia | Jasa Import Door To Door Dari Korea | Jasa Import Door ToDoor Dari Thailand | Jasa Import Door ToDoor Jakarta | Jasa Import Door To Door Dari Bangkok | Jasa Import Door To DoorDari Jepang.

HUBUNGI

Mr. KITO

Mobile : 0857-6377-2482

Telepon : 021-2784-3213

Email : boshokukito@gmail.com

Perkenalkan kami dari PT. BOSHOKUNUSA EXPRESS Perusahaan di bidang Expedisi ( International Freight Forwarders)Specialist Import Door To Door handling import Resmi, undername, borongan (Allin). Kami mengkhususkan diri dalammenyediakan layanan impor door-to-door yang terjangkau dan efisien.Timprofesional kami yang berpengalaman memastikan pengalaman yang lancar danbebaskerumitan bagi klien kami, mengurus semua proses logistik dan bea cukai.Selain layanan impor kami yang komprehensif, kami juga menawarkan layanankhusus untukimpor dari Singapura, Malaysia, Korea, tiongkok china, seoul koreaSelatan, Australia,uk/usa, Canada, timur Tengah, inggris, jerman, itali,belanda, rusia, india, tailand-bangkok,Taiwan, hongkong, jepang, france/Amerika, dan Eropa. Dengan komitmen terhadapkepuasan pelanggan dan jaringanglobal yang kuat.

PT. BOSHOKU NUSA EXPRESS — CHINA DOOR TO DOOR CARGO LOGISTICS adalah pilihan utama untuk segala kebutuhan imporAnda, karena melayani pengiriman sampai depan tempat usaha anda yang ada dikota-kotaTangerang, karawang, cikarang, Bekasi, bogor, banda aceh, medan,pekanbaru, Palembang, lampung, batam,bandung, jawa barat, semarang, jogjakarta,tanjung emas, jawa Tengah, Surabaya,Pelabuhan tanjung perak, jawa timur,Kalimantan, Sulawesi, papua.

BAGI ANDA YANG INGIN TAU CARATITIP BAYAR / BELI BARANG DICHINA VIA E-COMMERCE ALIBABA.COM — 1688.COM DLL,& KITA JUGA YANG BANTUCARIKAN SUPPLIER/SELLER BARANG ANDA SESUAI KEBUTUHANLANGSUNG DARI TANGAN PRODUSENDI CHINA. DAN KITA BANTU JUGA UNTUK PEMBAYARANNYA, ( NO FEE / GRATIS ).PASTINYA HARGA BARANG JAUH LEBIH MURAH.

Jasa Import Door To Door | JasaImport Borongan All-In | Jasa Import Cargo Borongan | Jasa Import Door To DoorMurah | Jasa Import Borongan Undername | Jasa Import Borongan Di Jakarta | JasaEkspedisi Import Borongan |Jasa Import Borongan | Forwarder Import Resmi |JasaImport Resmi |Jasa Sewa Undername Import | Biaya Jasa Undername Import |JasaUndername Import | Jasa Import Barang | Jasa Import Jakarta | Jasa ImportSurabaya | Jasa Import Semarang | Jasa Import Dari China | Jasa Import Door ToDoor Dari China | Jasa Import Door To Door Dari China | Jasa Import Door ToDoor Dari Malaysia | Jasa Import Door To Door Dari Korea | Jasa Import Door ToDoor Dari Thailand | Jasa Import Door ToDoor Jakarta | Jasa Import Door To Door Dari Bangkok | Jasa Import Door To DoorDari Jepang.

HUBUNGI

Mr. KITO

Mobile : 0857-6377-2482

Telepon : 021-2784-3213

Email : boshokukito@gmail.com

Perkenalkan kami dari PT. BOSHOKUNUSA EXPRESS Perusahaan di bidang Expedisi ( International Freight Forwarders)Specialist Import Door To Door handling import Resmi, undername, borongan (Allin). Kami mengkhususkan diri dalammenyediakan layanan impor door-to-door yang terjangkau dan efisien.Timprofesional kami yang berpengalaman memastikan pengalaman yang lancar danbebaskerumitan bagi klien kami, mengurus semua proses logistik dan bea cukai.Selain layanan impor kami yang komprehensif, kami juga menawarkan layanankhusus untukimpor dari Singapura, Malaysia, Korea, tiongkok china, seoul koreaSelatan, Australia,uk/usa, Canada, timur Tengah, inggris, jerman, itali,belanda, rusia, india, tailand-bangkok,Taiwan, hongkong, jepang, france/Amerika, dan Eropa. Dengan komitmen terhadapkepuasan pelanggan dan jaringanglobal yang kuat.

PT. BOSHOKU NUSA EXPRESS — CHINA DOOR TO DOOR CARGO LOGISTICS adalah pilihan utama untuk segala kebutuhan imporAnda, karena melayani pengiriman sampai depan tempat usaha anda yang ada dikota-kotaTangerang, karawang, cikarang, Bekasi, bogor, banda aceh, medan,pekanbaru, Palembang, lampung, batam,bandung, jawa barat, semarang, jogjakarta,tanjung emas, jawa Tengah, Surabaya,Pelabuhan tanjung perak, jawa timur,Kalimantan, Sulawesi, papua.

BAGI ANDA YANG INGIN TAU CARATITIP BAYAR / BELI BARANG DICHINA VIA E-COMMERCE ALIBABA.COM — 1688.COM DLL,& KITA JUGA YANG BANTUCARIKAN SUPPLIER/SELLER BARANG ANDA SESUAI KEBUTUHANLANGSUNG DARI TANGAN PRODUSENDI CHINA. DAN KITA BANTU JUGA UNTUK PEMBAYARANNYA, ( NO FEE / GRATIS ).PASTINYA HARGA BARANG JAUH LEBIH MURAH.

Jasa Import Door To Door | JasaImport Borongan All-In | Jasa Import Cargo Borongan | Jasa Import Door To DoorMurah | Jasa Import Borongan Undername | Jasa Import Borongan Di Jakarta | JasaEkspedisi Import Borongan |Jasa Import Borongan | Forwarder Import Resmi |JasaImport Resmi |Jasa Sewa Undername Import | Biaya Jasa Undername Import |JasaUndername Import | Jasa Import Barang | Jasa Import Jakarta | Jasa ImportSurabaya | Jasa Import Semarang | Jasa Import Dari China | Jasa Import Door ToDoor Dari China | Jasa Import Door To Door Dari China | Jasa Import Door ToDoor Dari Malaysia | Jasa Import Door To Door Dari Korea | Jasa Import Door ToDoor Dari Thailand | Jasa Import Door ToDoor Jakarta | Jasa Import Door To Door Dari Bangkok | Jasa Import Door To DoorDari Jepang.

HUBUNGI

Mr. KITO

Mobile : 0857-6377-2482

Telepon : 021-2784-3213

Email : boshokukito@gmail.com

Perkenalkan kami dari PT. BOSHOKUNUSA EXPRESS Perusahaan di bidang Expedisi ( International Freight Forwarders)Specialist Import Door To Door handling import Resmi, undername, borongan (Allin). Kami mengkhususkan diri dalammenyediakan layanan impor door-to-door yang terjangkau dan efisien.Timprofesional kami yang berpengalaman memastikan pengalaman yang lancar danbebaskerumitan bagi klien kami, mengurus semua proses logistik dan bea cukai.Selain layanan impor kami yang komprehensif, kami juga menawarkan layanankhusus untukimpor dari Singapura, Malaysia, Korea, tiongkok china, seoul koreaSelatan, Australia,uk/usa, Canada, timur Tengah, inggris, jerman, itali,belanda, rusia, india, tailand-bangkok,Taiwan, hongkong, jepang, france/Amerika, dan Eropa. Dengan komitmen terhadapkepuasan pelanggan dan jaringanglobal yang kuat.

PT. BOSHOKU NUSA EXPRESS — CHINA DOOR TO DOOR CARGO LOGISTICS adalah pilihan utama untuk segala kebutuhan imporAnda, karena melayani pengiriman sampai depan tempat usaha anda yang ada dikota-kotaTangerang, karawang, cikarang, Bekasi, bogor, banda aceh, medan,pekanbaru, Palembang, lampung, batam,bandung, jawa barat, semarang, jogjakarta,tanjung emas, jawa Tengah, Surabaya,Pelabuhan tanjung perak, jawa timur,Kalimantan, Sulawesi, papua.

BAGI ANDA YANG INGIN TAU CARATITIP BAYAR / BELI BARANG DICHINA VIA E-COMMERCE ALIBABA.COM — 1688.COM DLL,& KITA JUGA YANG BANTUCARIKAN SUPPLIER/SELLER BARANG ANDA SESUAI KEBUTUHANLANGSUNG DARI TANGAN PRODUSENDI CHINA. DAN KITA BANTU JUGA UNTUK PEMBAYARANNYA, ( NO FEE / GRATIS ).PASTINYA HARGA BARANG JAUH LEBIH MURAH.

Jasa Import Door To Door | JasaImport Borongan All-In | Jasa Import Cargo Borongan | Jasa Import Door To DoorMurah | Jasa Import Borongan Undername | Jasa Import Borongan Di Jakarta | JasaEkspedisi Import Borongan |Jasa Import Borongan | Forwarder Import Resmi |JasaImport Resmi |Jasa Sewa Undername Import | Biaya Jasa Undername Import |JasaUndername Import | Jasa Import Barang | Jasa Import Jakarta | Jasa ImportSurabaya | Jasa Import Semarang | Jasa Import Dari China | Jasa Import Door ToDoor Dari China | Jasa Import Door To Door Dari China | Jasa Import Door ToDoor Dari Malaysia | Jasa Import Door To Door Dari Korea | Jasa Import Door ToDoor Dari Thailand | Jasa Import Door ToDoor Jakarta | Jasa Import Door To Door Dari Bangkok | Jasa Import Door To DoorDari Jepang.

HUBUNGI

Mr. KITO

Mobile : 0857-6377-2482

Telepon : 021-2784-3213

Email : boshokukito@gmail.com

Perkenalkan kami dari PT. BOSHOKUNUSA EXPRESS Perusahaan di bidang Expedisi ( International Freight Forwarders)Specialist Import Door To Door handling import Resmi, undername, borongan (Allin). Kami mengkhususkan diri dalammenyediakan layanan impor door-to-door yang terjangkau dan efisien.Timprofesional kami yang berpengalaman memastikan pengalaman yang lancar danbebaskerumitan bagi klien kami, mengurus semua proses logistik dan bea cukai.Selain layanan impor kami yang komprehensif, kami juga menawarkan layanankhusus untukimpor dari Singapura, Malaysia, Korea, tiongkok china, seoul koreaSelatan, Australia,uk/usa, Canada, timur Tengah, inggris, jerman, itali,belanda, rusia, india, tailand-bangkok,Taiwan, hongkong, jepang, france/Amerika, dan Eropa. Dengan komitmen terhadapkepuasan pelanggan dan jaringanglobal yang kuat.

PT. BOSHOKU NUSA EXPRESS — CHINA DOOR TO DOOR CARGO LOGISTICS adalah pilihan utama untuk segala kebutuhan imporAnda, karena melayani pengiriman sampai depan tempat usaha anda yang ada dikota-kotaTangerang, karawang, cikarang, Bekasi, bogor, banda aceh, medan,pekanbaru, Palembang, lampung, batam,bandung, jawa barat, semarang, jogjakarta,tanjung emas, jawa Tengah, Surabaya,Pelabuhan tanjung perak, jawa timur,Kalimantan, Sulawesi, papua.

BAGI ANDA YANG INGIN TAU CARATITIP BAYAR / BELI BARANG DICHINA VIA E-COMMERCE ALIBABA.COM — 1688.COM DLL,& KITA JUGA YANG BANTUCARIKAN SUPPLIER/SELLER BARANG ANDA SESUAI KEBUTUHANLANGSUNG DARI TANGAN PRODUSENDI CHINA. DAN KITA BANTU JUGA UNTUK PEMBAYARANNYA, ( NO FEE / GRATIS ).PASTINYA HARGA BARANG JAUH LEBIH MURAH.

Jasa Import Door To Door | JasaImport Borongan All-In | Jasa Import Cargo Borongan | Jasa Import Door To DoorMurah | Jasa Import Borongan Undername | Jasa Import Borongan Di Jakarta | JasaEkspedisi Import Borongan |Jasa Import Borongan | Forwarder Import Resmi |JasaImport Resmi |Jasa Sewa Undername Import | Biaya Jasa Undername Import |JasaUndername Import | Jasa Import Barang | Jasa Import Jakarta | Jasa ImportSurabaya | Jasa Import Semarang | Jasa Import Dari China | Jasa Import Door ToDoor Dari China | Jasa Import Door To Door Dari China | Jasa Import Door ToDoor Dari Malaysia | Jasa Import Door To Door Dari Korea | Jasa Import Door ToDoor Dari Thailand | Jasa Import Door ToDoor Jakarta | Jasa Import Door To Door Dari Bangkok | Jasa Import Door To DoorDari Jepang.

HUBUNGI

Mr. KITO

Mobile : 0857-6377-2482

Telepon : 021-2784-3213

Email : boshokukito@gmail.com

Perkenalkan kami dari PT. BOSHOKUNUSA EXPRESS Perusahaan di bidang Expedisi ( International Freight Forwarders)Specialist Import Door To Door handling import Resmi, undername, borongan (Allin). Kami mengkhususkan diri dalammenyediakan layanan impor door-to-door yang terjangkau dan efisien.Timprofesional kami yang berpengalaman memastikan pengalaman yang lancar danbebaskerumitan bagi klien kami, mengurus semua proses logistik dan bea cukai.Selain layanan impor kami yang komprehensif, kami juga menawarkan layanankhusus untukimpor dari Singapura, Malaysia, Korea, tiongkok china, seoul koreaSelatan, Australia,uk/usa, Canada, timur Tengah, inggris, jerman, itali,belanda, rusia, india, tailand-bangkok,Taiwan, hongkong, jepang, france/Amerika, dan Eropa. Dengan komitmen terhadapkepuasan pelanggan dan jaringanglobal yang kuat.

PT. BOSHOKU NUSA EXPRESS — CHINA DOOR TO DOOR CARGO LOGISTICS adalah pilihan utama untuk segala kebutuhan imporAnda, karena melayani pengiriman sampai depan tempat usaha anda yang ada dikota-kotaTangerang, karawang, cikarang, Bekasi, bogor, banda aceh, medan,pekanbaru, Palembang, lampung, batam,bandung, jawa barat, semarang, jogjakarta,tanjung emas, jawa Tengah, Surabaya,Pelabuhan tanjung perak, jawa timur,Kalimantan, Sulawesi, papua.

BAGI ANDA YANG INGIN TAU CARATITIP BAYAR / BELI BARANG DICHINA VIA E-COMMERCE ALIBABA.COM — 1688.COM DLL,& KITA JUGA YANG BANTUCARIKAN SUPPLIER/SELLER BARANG ANDA SESUAI KEBUTUHANLANGSUNG DARI TANGAN PRODUSENDI CHINA. DAN KITA BANTU JUGA UNTUK PEMBAYARANNYA, ( NO FEE / GRATIS ).PASTINYA HARGA BARANG JAUH LEBIH MURAH.

Jasa Import Door To Door | JasaImport Borongan All-In | Jasa Import Cargo Borongan | Jasa Import Door To DoorMurah | Jasa Import Borongan Undername | Jasa Import Borongan Di Jakarta | JasaEkspedisi Import Borongan |Jasa Import Borongan | Forwarder Import Resmi |JasaImport Resmi |Jasa Sewa Undername Import | Biaya Jasa Undername Import |JasaUndername Import | Jasa Import Barang | Jasa Import Jakarta | Jasa ImportSurabaya | Jasa Import Semarang | Jasa Import Dari China | Jasa Import Door ToDoor Dari China | Jasa Import Door To Door Dari China | Jasa Import Door ToDoor Dari Malaysia | Jasa Import Door To Door Dari Korea | Jasa Import Door ToDoor Dari Thailand | Jasa Import Door ToDoor Jakarta | Jasa Import Door To Door Dari Bangkok | Jasa Import Door To DoorDari Jepang.

Shippers are urgently expediting their orders to mitigate the prolonged transit times from Asia to Europe, caused by the rerouting of vessels around the Cape of Good Hope.

However, the scarcity of equipment in Asia, stemming from delayed backhaul voyages, is severe, leading to constrained container release, primarily catering to large-volume 'VIP contracts' or shippers willing to pay a substantial premium. Despite these efforts, there's no absolute assurance that containers at the quay will be shipped before the Chinese New Year on February 10, as carriers prioritize higher-paying spot cargo and roll over low-rated contracts.

Reports indicate carriers are demanding "eye-watering rates," exceeding $10,000 per 40ft for space on China-North Europe sailings in February. Xeneta chief analyst Peter Sand advises shippers not to feel complacent with relatively low freight rates until the supply chain disruption is resolved. Long-term rate agreements are reportedly not being honored, forcing shippers onto the spot market.

Container spot indices, reflecting short-term rates, continue to climb. The WCI North Europe component increased by 23% this week to $4,406 per 40ft, marking a substantial 164% surge since December 21. Spot rates from Asia to the Mediterranean rose by 25%, representing a 166% increase.

Equipment shortages and Panama Canal draught restrictions have driven up transpacific rates. Asia-US west coast spots rose by about a third in value since December, reaching approximately $2,800 per 40ft. Average rates to the east coast increased by 36% to about $4,200 per 40ft. Carriers are introducing new FAK rates from January 15, targeting $5,000 per 40ft for the US west coast and $7,000 for east and Gulf coast ports.

Transatlantic rates remain relatively stable, with the North Europe to the US east coast spot reading down 1.5% at $1,443 per 40ft. However, impending rate restoration and peak season surcharges, scheduled to begin in February, along with the diversion of empty boxes and surplus vessel capacity for backhaul Asia voyages, are anticipated to drive up transatlantic rates in the coming weeks.

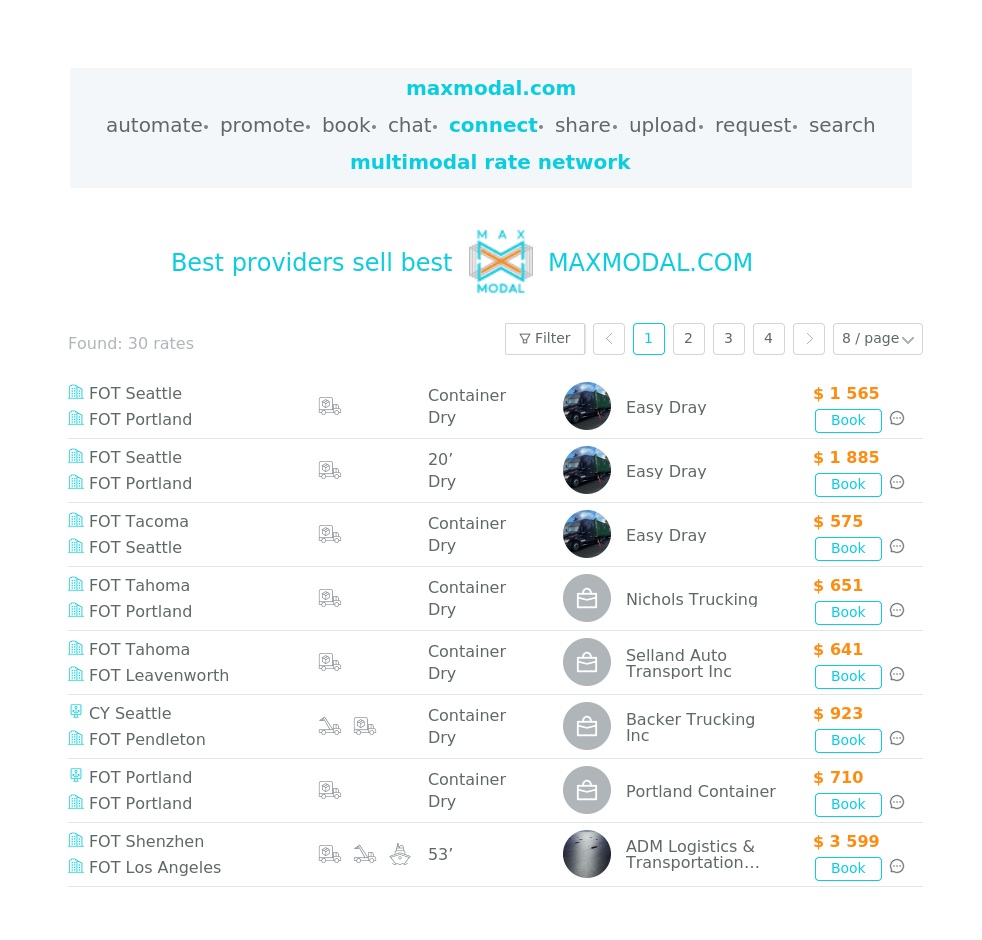

Get the link for freight rates by many providers on maxmodal.com