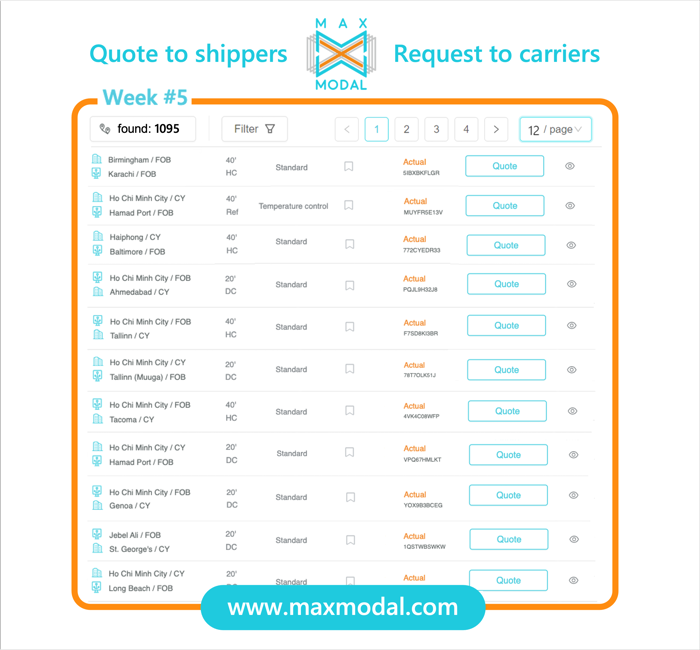

These are just a few examples of new requests at week #5. To get more fresh inquiries and\or the best quotes click here or push the «request management» button in the left menu.

Hey team,

Good day!

I hope this post finds you well!

We are Eminence Logistic Solutions LLC based out of Ohio.

We offer Drayage 20' 40' 45' Containers /Bob-tail /Chassis/ Storage/ Warehousing/ OTR for transloading/ Projects.

We can help with ISO tanks/ Flat beds/ Flat racks/ Step decks and services as per your requirement.

Companies with offices in USA/ Canada will be offered credit line and customers offshore will have to pre pay for 5-6 shipments before issuing credit.

My contact details are as follows:

albert.w@eminencelogistics.com

+1(216)770-6155

I will be happy to know more about your business and offer competitive services.

Hi dear. I am a freight forwarder from China, if you need any help from China pls contact me any ttme : whatsapp+86-15289641032 email:pingan@pingandelivery.com

hi, we need freights from New York. Will you quote?

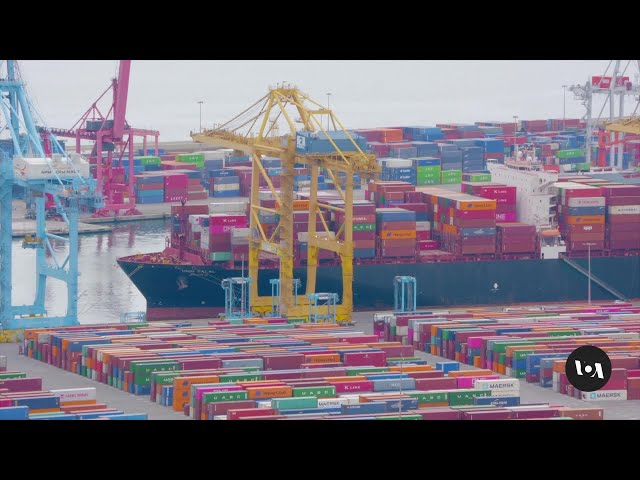

Hundreds of cargo ships traveling from Asia to Europe are now avoiding the Red Sea and the Suez Canal route due to persistent attacks by Houthi militants. The incidents have caused significant disruptions in global trade

Container spot rates from Asia to Europe appear to have reached their elevated peak ahead of Chinese New Year, but transpacific rates are still in the ascendance.

Drewry’s WCI Asia-North Europe component edged up just 1% this week, for an average of $4,984 per 40ft, while Asia-Mediterranean rates were also up 1%, to $6,365 per 40ft.

Nevertheless, spot rates for the two tradelanes are up 186% and 129% respectively on the same week of last year, reflecting the Red Sea crisis-induced huge rate hikes of the past few weeks.

Anecdotal reports suggest carriers are softening their stance on contract allocation coverage and release of equipment, albeit that one shipper contact reported that due to a shortage of haulage in Dalian, China, he had been unable to collect empty containers.

Chinese New Year commences on 10 February, whereafter demand is expected to be much weaker, for North Europe in particular, with for instance AGX, a Singapore-based collaboration platform for forwarders and importers, predicting a significant drop in spot rates.

Indeed, Vespucci Maritime’s Lars Jensen believes that after CNY, not only will there be a drop in demand, but vessels and equipment flows will begin to get back in sync from their revised Cape of Good Hope routings.

“This will still mean rates are much higher than pre-crisis, because the longer routes will soak up large amounts of capacity and carry extra cost, but I expect the spike in spot rates to abate somewhat,” said Mr Jensen.

Elsewhere, on the transpacific, the WCI recorded a 13% week-on-week jump in its Asia to US west coast spot, for an average of $4,344 per 40ft, while for the US east coast there was a 9% increase, taking the spot rate to $6,143 per 40ft.

This represents a massive year-on-year increase of 110% for west coast ports and a 90% increase for the east coast.

Looking for more sales? Just post and share freight rates on Maxmodal. Subscribe to premium and get access to an extended multimodal network with thousands of potential clients on your target routes.

As shippers and forwarders consider a switch to sea-air and airfreight solutions in response to the Cape detours resulting from the Red Sea crisis, another alternative has emerged – a land bridge across the Middle East.

Israeli digital freight marketplace Trucknet Enterprise has teamed up with UAE-based PureTrans, which operates a landline transit network, its partner, DP World, Cox Logistics (Bahrain) and Egypt-based logistics firm WWCS to provide trucking services connecting the Dubai port of Jebel Ali and the port of Mina Salman, in Bahrain.

It goes via Saudi Arabia and Jordan to Haifa in Israel and Port Said in Egypt, from where cargo can continue to Europe and beyond.

Trucknet markets the land bridge as an ‘express’ service, claiming it shortens ocean shipping routes by 10 days.

Normally, a box ship’s journey from the UAE to Haifa takes about two weeks, given that its itinerary usually includes calls at ports en route to unload or load cargo. With the land bridge, a container unloaded at Jebel Ali and transferred to a truck can be in Haifa in only four days.

But the cost is around 15-20% more expensive, estimated Trucknet CEO Hanan Fridman. But he added that the company’s focus on reducing the number of trucks returning empty to the UAE from Israel provided some scope to lower shipping costs.

And he said, taking into account the hikes in ocean freight rates due to the re-routing of ships around Africa and resulting longer transit times, the land bridge could likely be a cheaper option.

As long as they are able to obtain premium rates, ocean carriers could decide to increase the service speed of their ships on the Asia-North Europe tradelane to mitigate the impact of Suez Canal diversions.

With the Red Sea crisis unlikely to be resolved any time soon, shipping alliance members are busy recalibrating their networks to factor-in the longer transit times of rerouting loop vessels around the Cape of Good Hope.

Moreover, in the process, the lines are consulting with their key accounts to determine the impact of the supply chain extensions.

“Nobody wants to be offering the slowest transit times from Asia after Chinese New Year, when we expect demand to be slack again,” a carrier contact told.

“But it’s got to make economic sense and we need all the partners to agree on a strategy – which is far from the case now,” added the contact.

Indeed, the lines will be aware that following a huge surge in Asia-North Europe container spot rates since December, which saw average headhaul prices triple, rates on the route had begun to ease towards the end of last week.

In fact, today’s Ningbo Containerized Freight Index (NCFI) recorded a week-on-week 8% drop in its Asia-North Europe component, as it reported that “carriers had to undersell their space to canvass more shipping orders”.

Meanwhile, Drewry’s Simon Heaney said the lines’ network planners would have to “weigh the trade-offs when redrawing Asia-North Europe services, looking for the sweet spot that minimises additional time, disruption and cost”.

But he added: “Longer distance doesn’t have to mean longer transit times. If carriers want to keep sailing days close to normal when routing around the Cape of Good Hope, they can steam at faster speeds, but that will incur significant extra cost”

Drewry’s research considered two options that the network planners could be considering.

Scenario one is that carriers add two vessels to each alliance loop at the current average service speed of 13 knots, in order to maintain a weekly sailing frequency, thereby increasing round-trip voyages costs by 3%, which Drewry said would be “nearly offset by canal toll savings”.

In the second scenario, if vessels increase their service speed to 19 knots, this would enable last-port-Asia to first-port-North Europe loops to be maintained, but that would entail a substantial 21% increase in round-voyage costs.

“Given that carriers are in cost-saving mode and that there is a surplus of ship capacity, it’s improbable that ships will be set to maximum design speeds,” argued Mr Heaney.

The disruption of one of the world's most vital routes to East-West trade is impacting global commerce, consumers and supply chains

HUBUNGI

Mr. KITO

Mobile : 0857-6377-2482

Telepon : 021-2784-3213

Email : boshokukito@gmail.com

Perkenalkan kami dari PT. BOSHOKUNUSA EXPRESS Perusahaan di bidang Expedisi ( International Freight Forwarders)Specialist Import Door To Door handling import Resmi, undername, borongan (Allin). Kami mengkhususkan diri dalammenyediakan layanan impor door-to-door yang terjangkau dan efisien.Timprofesional kami yang berpengalaman memastikan pengalaman yang lancar danbebaskerumitan bagi klien kami, mengurus semua proses logistik dan bea cukai.Selain layanan impor kami yang komprehensif, kami juga menawarkan layanankhusus untukimpor dari Singapura, Malaysia, Korea, tiongkok china, seoul koreaSelatan, Australia,uk/usa, Canada, timur Tengah, inggris, jerman, itali,belanda, rusia, india, tailand-bangkok,Taiwan, hongkong, jepang, france/Amerika, dan Eropa. Dengan komitmen terhadapkepuasan pelanggan dan jaringanglobal yang kuat.

PT. BOSHOKU NUSA EXPRESS — CHINA DOOR TO DOOR CARGO LOGISTICS adalah pilihan utama untuk segala kebutuhan imporAnda, karena melayani pengiriman sampai depan tempat usaha anda yang ada dikota-kotaTangerang, karawang, cikarang, Bekasi, bogor, banda aceh, medan,pekanbaru, Palembang, lampung, batam,bandung, jawa barat, semarang, jogjakarta,tanjung emas, jawa Tengah, Surabaya,Pelabuhan tanjung perak, jawa timur,Kalimantan, Sulawesi, papua.

BAGI ANDA YANG INGIN TAU CARATITIP BAYAR / BELI BARANG DICHINA VIA E-COMMERCE ALIBABA.COM — 1688.COM DLL,& KITA JUGA YANG BANTUCARIKAN SUPPLIER/SELLER BARANG ANDA SESUAI KEBUTUHANLANGSUNG DARI TANGAN PRODUSENDI CHINA. DAN KITA BANTU JUGA UNTUK PEMBAYARANNYA, ( NO FEE / GRATIS ).PASTINYA HARGA BARANG JAUH LEBIH MURAH.

Jasa Import Door To Door | JasaImport Borongan All-In | Jasa Import Cargo Borongan | Jasa Import Door To DoorMurah | Jasa Import Borongan Undername | Jasa Import Borongan Di Jakarta | JasaEkspedisi Import Borongan |Jasa Import Borongan | Forwarder Import Resmi |JasaImport Resmi |Jasa Sewa Undername Import | Biaya Jasa Undername Import |JasaUndername Import | Jasa Import Barang | Jasa Import Jakarta | Jasa ImportSurabaya | Jasa Import Semarang | Jasa Import Dari China | Jasa Import Door ToDoor Dari China | Jasa Import Door To Door Dari China | Jasa Import Door ToDoor Dari Malaysia | Jasa Import Door To Door Dari Korea | Jasa Import Door ToDoor Dari Thailand | Jasa Import Door ToDoor Jakarta | Jasa Import Door To Door Dari Bangkok | Jasa Import Door To DoorDari Jepang.

HUBUNGI

Mr. KITO

Mobile : 0857-6377-2482

Telepon : 021-2784-3213

Email : boshokukito@gmail.com

Perkenalkan kami dari PT. BOSHOKUNUSA EXPRESS Perusahaan di bidang Expedisi ( International Freight Forwarders)Specialist Import Door To Door handling import Resmi, undername, borongan (Allin). Kami mengkhususkan diri dalammenyediakan layanan impor door-to-door yang terjangkau dan efisien.Timprofesional kami yang berpengalaman memastikan pengalaman yang lancar danbebaskerumitan bagi klien kami, mengurus semua proses logistik dan bea cukai.Selain layanan impor kami yang komprehensif, kami juga menawarkan layanankhusus untukimpor dari Singapura, Malaysia, Korea, tiongkok china, seoul koreaSelatan, Australia,uk/usa, Canada, timur Tengah, inggris, jerman, itali,belanda, rusia, india, tailand-bangkok,Taiwan, hongkong, jepang, france/Amerika, dan Eropa. Dengan komitmen terhadapkepuasan pelanggan dan jaringanglobal yang kuat.

PT. BOSHOKU NUSA EXPRESS — CHINA DOOR TO DOOR CARGO LOGISTICS adalah pilihan utama untuk segala kebutuhan imporAnda, karena melayani pengiriman sampai depan tempat usaha anda yang ada dikota-kotaTangerang, karawang, cikarang, Bekasi, bogor, banda aceh, medan,pekanbaru, Palembang, lampung, batam,bandung, jawa barat, semarang, jogjakarta,tanjung emas, jawa Tengah, Surabaya,Pelabuhan tanjung perak, jawa timur,Kalimantan, Sulawesi, papua.

BAGI ANDA YANG INGIN TAU CARATITIP BAYAR / BELI BARANG DICHINA VIA E-COMMERCE ALIBABA.COM — 1688.COM DLL,& KITA JUGA YANG BANTUCARIKAN SUPPLIER/SELLER BARANG ANDA SESUAI KEBUTUHANLANGSUNG DARI TANGAN PRODUSENDI CHINA. DAN KITA BANTU JUGA UNTUK PEMBAYARANNYA, ( NO FEE / GRATIS ).PASTINYA HARGA BARANG JAUH LEBIH MURAH.

Jasa Import Door To Door | JasaImport Borongan All-In | Jasa Import Cargo Borongan | Jasa Import Door To DoorMurah | Jasa Import Borongan Undername | Jasa Import Borongan Di Jakarta | JasaEkspedisi Import Borongan |Jasa Import Borongan | Forwarder Import Resmi |JasaImport Resmi |Jasa Sewa Undername Import | Biaya Jasa Undername Import |JasaUndername Import | Jasa Import Barang | Jasa Import Jakarta | Jasa ImportSurabaya | Jasa Import Semarang | Jasa Import Dari China | Jasa Import Door ToDoor Dari China | Jasa Import Door To Door Dari China | Jasa Import Door ToDoor Dari Malaysia | Jasa Import Door To Door Dari Korea | Jasa Import Door ToDoor Dari Thailand | Jasa Import Door ToDoor Jakarta | Jasa Import Door To Door Dari Bangkok | Jasa Import Door To DoorDari Jepang.