M/V Moresby Chief V. 2402E – Direct Vessel to Seattle

SUN CHIEF EXPRESS SERVICE

Hai Phong Ho Chi Minh

SI & VGM 26-Feb 1-Mar

CY cut Off 29-Feb 3-Mar

ETD 2-Mar 5-Mar

Space open for booking, please inbox me for the booking:

Ex Haiphong and Ho Chi Minh to

1) Seattle

2) Chicago

3) Memphis

4) Minneapolis

5) Kansas City

6) Columbus

7) Cleveland.

Contact detail:

Mobile: 093 6433438/ 086 695 2112

PIC: Kevin Tran

Email: kevin.tran@shipuwl.com

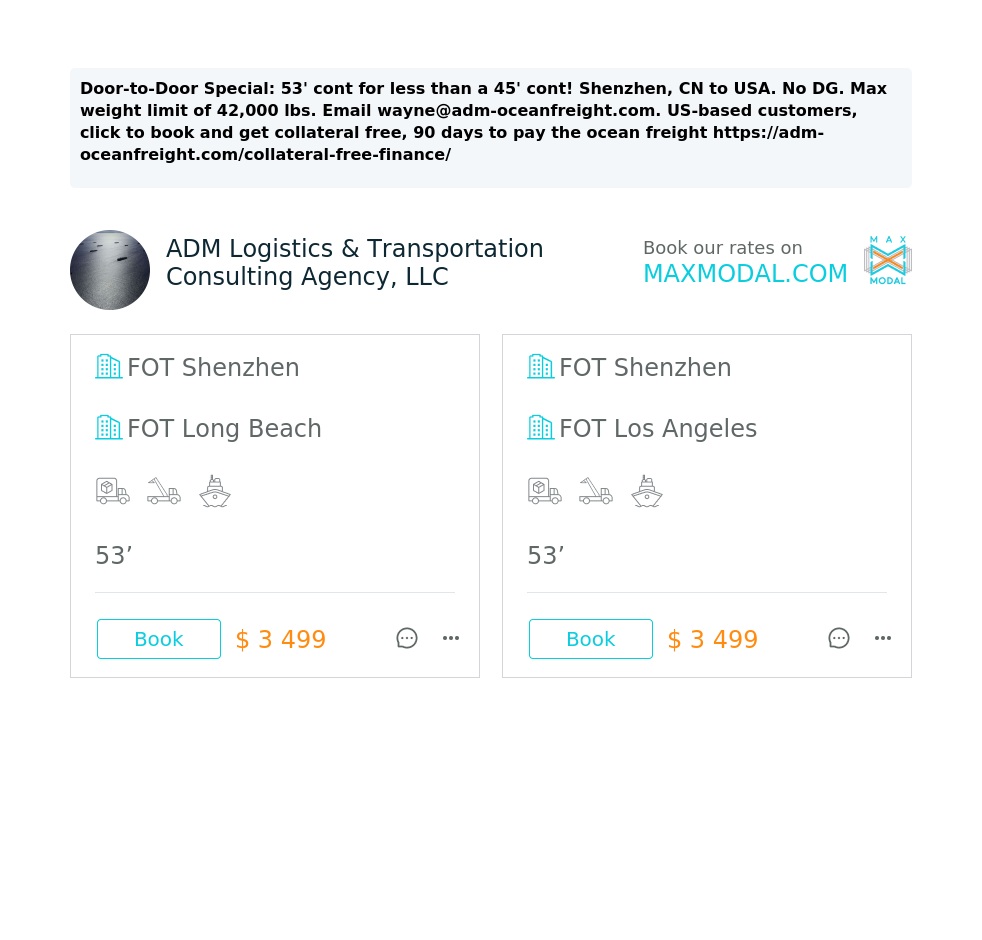

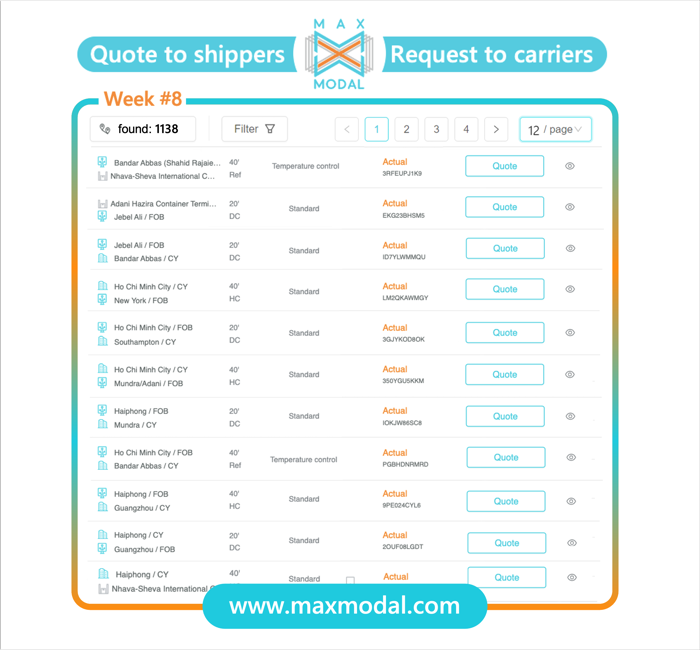

These are just a few examples of new requests at week #8. To get more fresh inquiries and\or the best quotes click here or push the «request management» button in the left menu.

METRANS has just completed the full acquisition of AdriaRail Group. The company had taken over 51 per cent of Adria Rail’s stakes in March 2023, while now it has proceeded to acquire the remaining 49 per cent. “We have reached another important milestone in the expansion of our European network,” commented Peter Kiss, CEO of METRANS.

According to METRANS, Adria Rail will continue carrying out its business as usual, albeit as a METRANS Group subsidiary in the Croatian and Serbian markets. Indicatively, Adria Rail covers 70 per cent of container transport along the Croatia-Serbia corridor and serves traffic to and from the major Croatian port of Rijeka.

Business has already started

On top of the activities mentioned above, Adria Rail also operates the Indija terminal between Belgrade and Novi Sad in Serbia. With the 51 per cent stake acquisition from the company in March 2023, METRANS basically became the terminal’s operator. This was the first-ever rail terminal operated by the HHLA subsidiary in Serbia.

Of course, a new terminal means opportunities for new connections. METRANS did not waste its time, and just a couple of months after taking over the Indija terminal, it launched a new service connecting it with its HUB rail terminal in Budapest.

Almost simultaneously, it started a service between the HUB terminal and the port of Rijeka while also linking Rijeka with Indija, creating a triangular network between Serbia, Croatia, and Hungary. As a result, the network was already there, but with Adria Rail’s complete acquisition, METRANS has taken a decisive step in becoming a leading transport player also in the Balkan region.

I need some help on my order , sea/air shipping from USA to Australia

any one can do it ? pls contact me , thanks

If you ever require OTR, Drayage & Warehousing in the US and Canada we will be happy to assist!

For decades, China reigned supreme as America's top trading partner. But 2023 saw a historic change. Mexico surpassed China, exporting $475 billion of goods to the US, compared to China's $427 billion. This marks a significant break from the past, driven by several factors

Transpacific ocean carriers are holding on to as much of their Red Sea crisis-induced gains as they can, heading into contract talks with BCOs, shippers and forwarders.

Drewry’s WCI Asia-US west coast container spot rate component was flat this week, at an average rate of $4,754 per 40ft, and remains some 140% higher than at the beginning of December.

Rates on the tradelane are being supported by strong US consumer demand, which saw import volumes at the San Pedro Bay ports of Los Angeles and Long Beach spike in January, year on year, by 19% and 23%, respectively.

Moreover, carriers have been judicious with their capacity management in and around Chinese New Year, blanking sailings and allowing other voyages to ‘slide’.

According to Simon Heaney, senior manager container research at Drewry, “it can be claimed as a success story for carriers”.

He added: “The timing of the market resurgence couldn’t have been better for lines, with the annual contracting season fast approaching.”

Indeed, carriers will be on the front foot this year at the JOC TPM conference in early March, the traditional starting point for the annual transpacific contract negotiations.

Wan Hai Lines could fill the gap in THE Alliance left by Hapag-Lloyd’s departure, according to Yang Ming’s ex-chairman Bronson Hsieh.

Last month, Hapag-Lloyd announced it would leave THE Alliance in January 2025, to form the Gemini Cooperation with Maersk and, as the largest member of the grouping the move will no doubt weaken its competitiveness.

Mr Hsieh told ETToday: “Wan Hai has a good number of 13,000 teu ships, so that could make it welcome in an alliance. If Wan Hai relaunches its ambitions of starting services to Europe, it could be invited to join THE Alliance.”

Wan Hai has started taking delivery of a series of 18 13,000 teu ships ordered during Covid and, with more than 592,000 teu of capacity, is the 11th-largest liner operator.

Originally an intra-Asia carrier, Wan Hai launched transpacific services in 2020 and, despite the correction in freight rates post-pandemic, has remained committed to the long-haul market. It has also said it was open to starting Asia-Europe services.

THE Alliance members, Yang Ming, ONE and HMM, declined to comment, although ONE has said an announcement regarding specific service structures would be made in 2025.

A Wan Hai spokesperson told: “Wan Hai doesn’t rule out various ways to improve the efficiency of slot utilisation, and alliances are only one of the possible options. At present, Wan Hai has different partners on certain routes to increase its network through joint services or slot swaps.”

But Linerlytica analyst Tan Hua Joo told The Loadstar Wan Hai’s fleet, being far smaller than the 1.9m teu of Hapag-Lloyd, would be inadequate to plug the gap left by the German operator’s departure from THE Alliance, which will be left with 2.5m teu without Hapag-Lloyd, facing Gemini’s 3.4m teu.

The Spanish railway workers’ unions CCOO and SCF launched a 23-hour strike at midnight on 9 February. The strike is expected to affect traffic throughout the country, with 65 per cent of rail freight services not running. This results from a labour dispute with infrastructure manager Adif concerning the number of working hours per week and the elimination of income categories among employees.

This will not be the first time Spanish railways are affected by industrial action in February. Another union, UGT, has already announced a series of three two-hour-long strikes that will occur on Mondays, 12, 19, and 26 February.

Understandably, those strikes will be less impactful than a 23-hour-long strike impairing most of the freight traffic in the country. Nevertheless, if the dispute between the unions and Adif persists, one cannot exclude the possibility of further escalation, as in France last year and Germany at the beginning of 2024.

The struggle is real for European rail

Strikes are becoming an increasingly pressing issue for railway companies throughout Europe, on top of other persisting problems, including inflation, skyrocketing service prices, increased competition with road transport and unfavourable policies.

Railway operators have been struggling to maintain their market share, with companies stopping services in some cases and ringing the alarm bell for customers turning increasingly to road transport to achieve better prices and more predictability in their supply chains.

Strikes are the cake’s frosting in this sense, adding more pressure to the already strained industry that has protested against them. One such example is Rail Cargo Group, with its CEO Clemens Först commenting that GDL’s strikes in Germany are a significant setback and detour on the journey to a sustainable future, apart from killing business.

Speaking of business, another smaller freight and logistics company, Bentheimer Eisenbahn AG, reportedly lost 10 per cent of their sales in January due to the situation. France, Germany, and now Spain are examples of how disruptions can affect rail supply chains domestically and internationally. The question now is what is left to expect in 2024, which is forecasted to be a very interesting year, hopefully for the right reasons.

Looking for more sales? Just post and share freight rates on Maxmodal. Subscribe to premium and get access to an extended multimodal network with thousands of potential clients on your target routes.