Flexport is to cut 20% of its jobs, with impacted people receiving emails in the next few hours in Europe and North America, and tomorrow in Asia.

A letter to employees from co-CEOs Dave Clark and Ryan Petersen began with: “We begin the new year with more optimism than ever about Flexport’s future.”

But it went on to say: “While we are looking forward to what’s to come in 2023, we must also make hard decisions necessary to set us up for long-term success.

“We are overall in a good position, but are not immune to the macroeconomic downturn that has impacted businesses around the world. Our customers have been impacted by these challenging conditions, resulting in a reduction to our volume forecasts through 2023.

“Lower volumes, combined with improved efficiencies as a result of new organisational and operational structures, means we are overstaffed in a variety of roles across the company.”

The letter added that the company would reduce in size, impacting about 20% of its global workforce, some 600 people, under the restructuring.

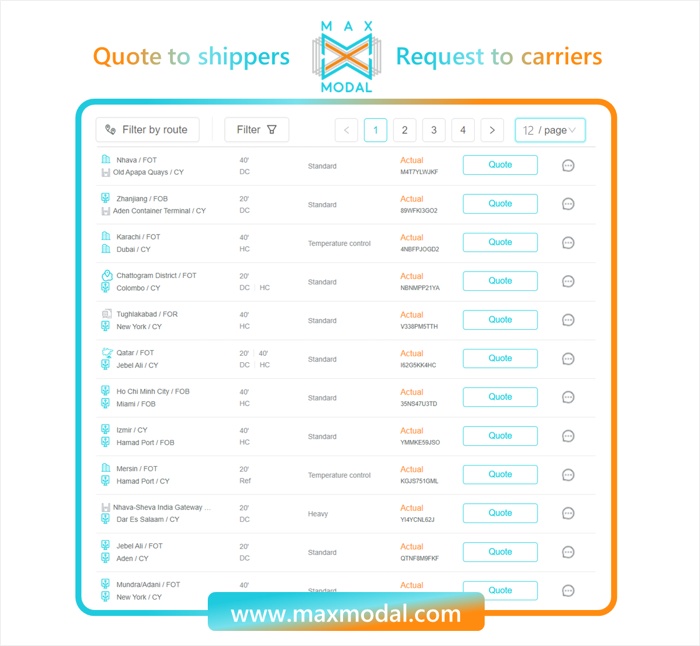

These are just a few examples of new requests of clients from across the world. To get more fresh inquiries and\or best quotes click here or push the «request management» button in the left menu.

Ocean carriers are slowing-down their ships and deploying extra tonnage on more robust routes as they endeavour to soak up surplus capacity.

And the transatlantic tradelane, which has so far avoided the worst of the freight rate collapse contagion affecting export services from Asia, is seen as a good option.

Maersk advised today it would be adding three extra ships during the first quarter on the North Europe and Mediterranean to US east coast and Gulf coast loops it operates together with its vessel-sharing partner MSC within their 2M alliance agreement.

It said during Q1 it would add one ship to the 2M North Europe to US east coast and Gulf coast TA1/NEUATL1 and TA3/NEUATL3 loops, and one to the Mediterranean to US east and Gulf coast TA6/MSC Pearl string.

Mearsk said: “Slowing global demand has left us with extra capacity that we can use to improve the reliability of our services.

“With these changes we can reduce schedule gaps and slidings, boost weekly coverage and allow for more robust supply chain planning,” it added.

And the company was keen to emphasise the reduction in greenhouse gas emissions from the slower service speeds of the ships. It said this would “help us meet our goal of achieving net zero greenhouse gas emissions across our business by 2040”.

Nonetheless, extra capacity on the route will add to the downward pressure on freight rates on the transatlantic, which has begun to see weekly declines of up to 10% across the spot market indices, to levels of around $6,500 per 40ft.

In June last year, spot rates on the route were close to $10,000 per 40ft, with rates boosted by a combination of a capacity crunch, equipment shortages and port congestion in both North Europe and the US.

Hi, Cassie, but the source of information is reliable - Spot light on China, next the report is about recent Covid restriction exposure on major port operations, not about the current time

I just know:most of vessels are depature on time. If it paralyzed, do vessels will depature on time

More than 150 foreign trade routes connect the global.Nansha port of China is to build an international shipping logistics hub.

Hi, this side Mary from AMB. Hope you will fine. We provide pick up & delivery services to and from all ports in US. We handle all loads like as FTL, OTR, Drayage, and Dray van, Reefer, Hazmat and Ocean also. So If possible is there any load for this week or next week? Then let me know your email id and I send you my company details. I can provide you very best and competitive rates. I give my email mary.jane@amblogistic.us . Please get in touch with us for any such requirements. Thank you so much. Have a nice day.

Against a backdrop of an increasingly pessimistic cargo demand outlook, ocean carriers are said to be in talks with shipyards to defer delivery dates for some of the 2.3m teu of newbuild tonnage due this year.

Shipbuilding contracts usually incorporate a clause to facilitate the pushback of completion by six months or more, depending on the stage of construction and pressure from other orders.

But with the container liner industry facing several challenging quarters, the yards may be quite relaxed about rescheduling delivery dates and the postponements will focus on smaller sizes. These are now competing for employment with tonnage usurped by the arrival of newbuild 24,000 teu ULCVs on the Asia-North Europe trade.

And shipping line procurement officers have been instructed to halt orders for new containers and return as much leased equipment as possible to ease the huge storage costs from the empty-container mountains overwhelming depots around the world.

Indeed, container depots will remain overstocked in the first quarter, according to online shipping container platform, Container xChange. CEO Christian Roeloffs added: “There is just not enough depot space to accommodate all the containers.

“With the further release of container inventory into the market, there will be added pressure on depots in the coming months. This will be a key challenge for some and a competitive advantage for others in the business, especially in China because of the empty container positioning there.”

Develop into a lifelong self-learner through voracious reading; cultivate curiosity and strive to become a little wiser every day.

2022 has been extremely successful for the shipping lines with their over-the-roof profits, but 2023 does not seem to promise the same numbers. Experts predict the companies can count on 5% of those mega revenues. However, it does not mean that the container shipping sector will be down bad. Congestions are easing and operational delays are becoming less frequent.

As for the rates, they increased from Asia to North Europe by 10% to $1,874 per teu. Drewry’s World Container Index showed a slight bounce at $2,135. Nevertheless, the demand remains weak with no sign of rebound following post-holiday pressure as carriers struggle to fill their ships. Some services have already seen “ghost ships” for the sake of maintaining sailing in the loops. The cancellation of sailings had been at a record high (17%). The possibility of a surge in demand depends fully on how long the current market downturn will last.

Another distinguishing factor of 2023 is the unusual drop in box rates in China despite the looming Chinese New Year that traditionally pushes the prices higher. On a global scale, both spot and average rates continue to fall.

Therefore, more and more companies start reconsidering their contracts and working towards provisioning softer, more flexible conditions. Lines are adopting a “case-by-case” approach depending on shippers' requests. This trend is expected to last.

Routes & services

- GTS will double the frequency of the trains between Segrate and Marcianise in Italy from Jan 23.

- Turkish Sidra Line has launched a new feeder service from Istanbul to Novorossiysk, Russia. Two chartered ships in the 350 teu size will be used weekly.

- Delta Rail will start a new rail freight service between Chalon-sur-Saone, in eastern France, and Duisburg from Feb 28. Thanks to the company, the opportunities to connect Duisburg and the North of France will properly develop.

- If before the electronic parts produced in Vietnam were delivered to Central Asia by sea, now they will be transported via rail thanks to the first route from Vietnam to Kazakhstan. This new route can compress the itinerary from Vietnam to the Central Asian market to about 25 days.

- Swissterminal starts new connections from Frenkendorf and Niederglatt, in northern Switzerland, to Rotterdam. The weekly roundtrips from the two Swiss hubs to Antwerp will also increase.

- ONE will upgrade its Maputo/Mombasa India Middle East service to a weekly schedule. The rotation remains unchanged: Jebel Ali – Mundra – Mombasa – Maputo – Jebel Ali.

- From February, ONE will also start a new service connecting Arica and Iquique (Chile) from Callao (Peru). The rotation will be: Callao – Arica – Iquique – Callao.

Other

- Since for the past week the rates on the transpacific lane remained unchanged, carriers expressed hopes for a market recovery. However, more cautious opponents warn that it is unclear when the surge in demand will happen. Current market conditions make it difficult to predict but what is certain is that 2023 will be very different from 2022.

- Ship robbery in Asia is on the rise. In 2022 it jumped by 4%. Regional authorities remind ship masters and crews to report all incidents to exercise vigilance.

- Cosco’s entry at a Hamburg container port is reported to be almost completed. Cosco is not expected to gain any exclusive rights to the terminal or access to strategic know-how.

- Maersk has acquired the Danish company Martin Bencher Group specializing in non-containerized project logistics (with an emphasis on the Health sector) and global operations.

- Shanghai achieved the best yearly performance. It is the world’s busiest port with 43.19 million TEU moved in 2022.

- CMA Terminals and Global Ports Investments and PLC (Global Ports) will swap their cash-free shares as part of CMA CGM Group’s divestment of shares in Russia.

These are only several changes that occurred in more than 250 bn freight rates across 25 million routes with more than 1 million market players. Want to share some news about your company, services, and routes? Just post them on MAXMODAL, a multimodal network that digitally connects routes and rates worldwide to automate sales and operations across container transportation & logistics industry. Join to innovate.

Hi, this side Mary from AMB. Hope you will fine. We provide pick up & delivery services to and from all ports in US. We handle all loads like as FTL, OTR, Drayage, and Dray van, Reefer, Hazmat and Ocean also. So If possible is there any load for this week or next week? Then let me know your email id and I send you my company details. I can provide you very best and competitive rates. I give my email mary.jane@amblogistic.us . Please get in touch with us for any such requirements. Thank you so much. Have a nice day.

New European routes are building on the momentum of a post-pandemic shift to rail freight, but strikes in the UK are adding to continental energy cost worries, threatening the change.

In the past month, several new freight services across Europe have begun, including new links between France and Germany, while other providers have expanded the services being offered.

French multimodal operator Delta Rail said it would add a new container service to link Chalon-sur-Saone and Duisburg at the end of February, intended to offer competition to overland routes linking the Rhine with French ports, including Le Havre and Marseilles.

Shippers told the shift was spurred by a combination of greater environmental awareness as well as increasing unreliability linked to China’s long-running zero-covid policies.

Associate professor in supply chain analytics at University of Bradford Dr Kamran Mahroof said the number of new services coming online could be seen as a “good sign”, helping to “boost competition” between modes and addressing climate change.

“However, rail service providers need to show they can be reliable in normal conditions, with confidence particularly low in the UK,” Dr Mahroof told The Loadstar.

“Communicating clearly to customers how procedures within rail freight services, such as heated and insulated points, snow-clearing trains can be more efficient during disruption, is key. The main thing is communication.”

Dr Mahroof pointed out that over the course of the pandemic UK rail freight experienced its own boost with longer services catering for surging demand for healthcare products and food.

This spiking demand has levelled as supply chains have contended with a host of issues, including HGV driver shortages, increased costs, port disruption, supply chain bottlenecks and fallout from Brexit.

Greater investment in rail freight offered a range of economic and social benefits, he said, including removing up to 1.6bn lorry km from the UK supply chain alone, alongside reduction in associated greenhouse gas emissions, but energy worries threaten this.

Hi, this side Mary from AMB. Hope you will fine. We provide pick up & delivery services to and from all ports in all over US. We handle all loads like as FTL, OTR, Drayage, and Dray van, Reefer, Hazmat and Ocean also. So If possible is there any load for this week or next week? Then let me know your email id and I send you my company details. I can provide you very best and competitive rates. I give my email mary.jane@amblogistic.us . Please get in touch with us for any such requirements. Thank you so much. Have a nice day.