Rail advances are sprawling all over Europe as ocean freight is still not showing promising signs of recovery.

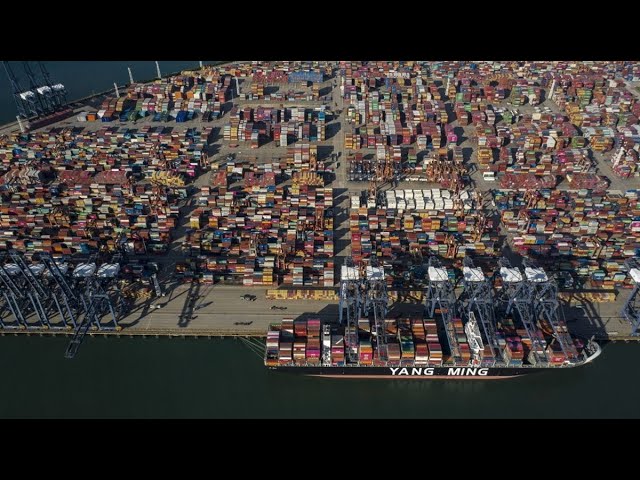

All berths of Yantian including the West Port area will resume normal operations commemorating the end of one of the most damaging congestion. Laden gate-in tractors will be increased to 9,000 per day, and the pickup of empty containers and import laden containers remain normal. However, industry players have different opinions on how much time it will require to clear up the backlog with the best-case scenarios suggesting it could take several weeks to process it. Overall, such disruptors as Yantian and the Suez Canal incident have cost large companies an average of $184 million annually and unexpectedly taken a worldwide domino effect.

The path to a sustainable future is thorny and has never promised to be easy, hence, experts advocate for collaboration, which is why the shipping sector is looking within World Shipping Council framework to find a common carbon-free solution. Carriers want a global decarbonisation system rather than regional regulations from jurisdictions in Asia, Europe and the US. However, taking all factors into account, it is clear that the joint efforts are also subject to the laws of the countries they are in, which makes the process more complex and does not allow bypassing the discussion of jurisdictions.

While the green debates are on the roll, rail freight wastes no time, rigorously moving forward like a locomotive. Recently, CMA CGM has announced it will improve its intermodal coverage of Zaragoza, Spain, adding a new service from the Port of Valencia. The new Valencia — Zaragoza shuttle train is part of CMA CGM's active sales product Switch to Rail focused on development of the rail sector. There is now also a prime time to expand the transport capacity — the new terminal on New Silk Road, Dostyk TransTerminal at the China-Kazakhstan border, is proving to be successful. PTC Cargo LLP is managing it, and for the company it is a real milestone aimed to develop a multifunctional zone and strengthen its presence.

In the wake of rail achievements, the green agenda has not been omitted in this sector. The first zero-emission, fully electric shunting locomotives for the port of Rotterdam are in the production line as a joint initiative of the Netherlands and China that is expected to be implemented by 2024. Meanwhile, Deutsche Bahn will revive 20 lines with a total of 245 kilometres of track with regards to active climate protection.

Even such giants as IKEA are switching to rail understanding where the wind of potential recovery is blowing from. Maersk strives for success — together they are going for a distance of 100 kilometres to and from IKEA’s customer warehouse & distribution centre in Valls, Catalonia.

The UK hops on the rail train since the talks of development of the Great British Railways have been going on for quite some time. The planing has officially begun. The 2023 Periodic Review sets a five-year settlement that will determine the level of funding the network should receive for its activities. Others follow suit with a series of important connections sprawling over Europe. Kombiverkehr and Rail Cargo Group upgrade their services between Hungary and Germany. The two companies will offer six weekly roundtrips between Budapest and Neuss. Three of them will also include intermediate stops in Wels and Wien Süd terminals, both in Austria. The first container block trainconnecting Helsinki in Finland with the Nhava Sheva container port in India has recently departed. For Finland it is an actual momentum of growth — it is history’s first logistics operator that has sent a block train from Europe to India via the Western wing of the International North-South Transport Corridor. A new railway connection between Tilburg in the Netherlands and Kaunas in Lithuania is set to open in July.

Around 21 British logistics companies and associations are seeking Boris Johnson’s urgent intervention regarding the ease of truck drivers shortage. It has already hit the critical point and must be addressed as a priority. In particular, the Road Haulage Association is in need of a temporary work visa to allow hauliers to hire European drivers as the means of solving the staff problems.

Meanwhile, the 2,500 TEU container ship, CMA CGM Neva is under quarantine in Hamburg as five crew members, including the captain and chief officer, tested positive for Covid-19. In addition, according to the reports, it cannot be shifted to another berth or anchorage if there is not either crew replacement or the end of the quarantine period.

With Yantian’s congestion gone, the industry will have to seek an antidote for recovery and the search might take weeks to say the least.

The storm of congestion above Yantian is about to pass after a month-long cut in productivity, however, it is too early to celebrate the release as the aftermath of it has caused such damage that shippers have been warned that it will take many weeks to clear up the immense container backlog. The schedule reliability remains compromised despite the diminishing queue as well. The most challenging part of recovery regards moving the boxes around inside the clogged-up port perimeter and getting ships to berth. On the global scale, the ports will still struggle, meanwhile there is a premise for the Chinese ports to recover sooner — despite the severe fluctuations in container volumes since the beginning of COVID-19, four of the seven ports in the recent reports saw double-digit growth, indicating that the country’s maritime sector is robust. Shenzhen was the best performing port with growth of 29.3%.

The negative effect of the port blockage has resulted in a sharp increase in double sailings. It is the situation when two or more vessels are sailing within the same week on the same service string. It would not have been such a problem under normal market conditions, as such shifts would be of limited impact on the industry, but now due to the mass spread of the congestion, ports do not have buffers that would mitigate the risk. Consequently, spot rates are also expected to rise further on Asia-Europe services. According to experts, there are more blank sailings coming up in June-July and no improvement in equipment status. This most definitely explains why the National Retail Federation actively calls for a meeting with Joe Biden. The House Coast Guard and Maritime Transportation subcommittee will examine the impact of shipping container shortages. However, regardless of plans by Democrats or Republicans, US ports and inland waterways are due for just $17bn in spending under proposals by each of the two parties. That $17bn is a fraction of what ports alone need, so even bigger investments are needed urgently.

The forecasts do not predict any normality till the second quarter of 2022 at the earliest. The reason for it is that apart from inventories being pulled down by strong consumer spending combined, there are problems on both transportation and production sides. The retailers simply have neither the inventory they want, nor the possibility to place orders. The USA, for example, will need to add a lot of warehouse space dedicated to online fulfillment by 2025 in order to keep pace with the expected uptick in e-commerce sales.

One more obstacle has appeared on the way. In Shanghai, authorities have suspended the land transport of containerised non-essential dangerous goods after two recent fires in the port. They started when a reefer spontaneously combusted as it was being loaded onto a vessel.

The final accord of Ever Given deal has been struck. The agreement in principle has been reached over a compensation claim between the SCA and the owners of the ship. The deal follows a recently increased offer from Shoei Kisen to free the ship after an initial offer of $150m.

Meanwhile, Port Houston’s volumes have demonstrated a significant increase by 30% year-over-year in May. It has been driven by the new direct trans-Pacific Asian service and resulted in 288,127 TEUs. In turn, Port of Oakland awaits delivery of a new STS crane. It will improve cargo operations at the Everport marine terminal, run by Everport Terminal Services.

The Busan Port Authority aims at strengthening the logistics competitiveness of the domestic companies by signing a memorandum of understanding with KIFFA. It intends to help local companies enter overseas markets.

Who will drive the market in the long-run?

Important metamorphoses are taking place in the freight industry with DVS Panalpina proposing the takeover of Agility GIL. There is now a clear tendency of the rigorous consolidation in the light of such giants as Maersk, DP World, PSA, COSCO and other “traditional” providers coming back into the spotlight. This is just the beginning. While the ocean carriers hit another record in the schedule failures with additional delays of arrival that amount to 20 or more days in some cases, and seem to be hoping to ride a wave of the high rates with the newly commissioned vessels that will come in the upcoming years (perhaps, saving up for the blank sailings?), the new arguments in favor of developing alternative routes emerge. MSC sets new charges to Antwerp and Valencia from India, Pakistan, and Sri Lanka that will come into effect from July 1. The prices vary from $3250 to$ 3150 for 20 DV and $4800 and $5000 for 40 HR.

Meanwhile, Maerks sets its first block train intermodal service between Europe and China, using Malaszewicze, Poland, as an EU exit point. The Netherlands is vigorously advocating for the launch of the NL Express: a dedicated train between the Netherlands and China with all players onboard. It will allow them to consolidate against the crisis. Meanwhile, the city of Graz in Austria has received its first train from Suzho. RailWatch has secured a new shareholder in the face of Agartha Fund LP from Abu Dhabi. This investment of 3.5 mil. euros opens up the export of its Wayside Monitoring System to countries such as Russia, Kazakhstan, Ukraine, and China. So who is going to be a winner in the long-run?

Not only the alternative routes are being considered, but the ways of transporting containers as well. Elon Musk's Boring Company has developed a 6.4 m wide tunnel concept capable of transporting two lanes of containers.

Experts on sustainability have come to the conclusion that only the joint efforts will bring the world closer to a zero-carbon future. As an example, at the Port of Duqm in Oman, Antwerp has partnered to create a green hydrogen plant as part of an end-to-end pipeline for zero carbon fuels. It is clear that only a collaborative approach will work, otherwise, the green agenda will remain the utopian reality.

Post-Brexit regulations and severe pressure on supply have been keeping the Port of Liverpool in a tight grip for a couple of weeks, however, it is hoping to make a significant breakthrough towards recovery. UK container ports have been struggling at some level with congestion and disruption since the second half of last year, initially at Felixstowe but with some of the issues then spreading to other container ports – including Southampton and London Gateway. Brexit has hit other local industries too — regular rail freight services between Dublin Port and the intermodal terminal at Ballina in the north-west of Ireland have been suspended.

Britain is still struggling with driver shortages. The idea of using the military has been in the talks for a while. The Federation of Wholesale Distributors urged the government to consider putting army trucks on standby to ensure food distribution. However, the question of staff training remains the stumbling rock.

The falling volume is the phenomenon that has spread all over Europe. The ports in Bremen and Bremerhaven have achieved a total of 4.771 million TEU during the Covid-19 hit 2020, which represents a decrease compared with 2019 figures, with the year-on-year downward trend since 2016 to continue.

Europe becomes the target of the U.S. based Lineage Logistics. It has announced its intention to buy the cold storage division of Claus Sørensen Group and expand in Nordic region. Previously the company made some other notable acquisitions. Other companies are also on the rise. COSCO boosts connectivity between its Spanish rail terminals with a new rail freight line between the port of Valencia and the Zaragoza rail terminal. The whole project required investments exceeding 100 million euros by the port authority of Valencia. A new railway between Tilburg in the Netherlands and Kaunas in Lithuania is set to open in July offering a new node for the Silk Road. Additionally, DB Cargo reactivated a 300-metre long siding in the town of Tübingen, Germany. A specific transport route from Egypt to Kazakhstan via the Middle Corridor has been used for the first time. The service included a sea leg between the two ports and then switched to rail using the Trans-Caspian International Transport Route. Hupac keeps adding connections from Rotterdam and Duisburg to Vienna. The service runs with five roundtrips per week starting from 21 June.

Those guys should get 1st place at August Race, I admit !

Молодцы!!! Поздравляем!!! Мы за вас болели!

Shrinking ocean capacity is forcing companies to switch their attention to different sectors for development. It is the matter of time before we see who is adjusting or who is only focused on keeping face.

With the epicenter in Yantian, the ship congesting keeps shaking up the ports around the world bringing a 300% increase in blank sailings just in one month. The numbers spill trouble across the maritime shipping world, and particularly for companies that rely on Asian routes, although even shipments not directly impacted by the Yantian situation could feel the disruption, as carriers adjust their networks to avoid congestion at YICT. As the result, the increased demand and worsening conditions are making the east-west alliance carriers to temporarily adjust their liner service networks. 2M Alliance has decided to change the sailing programs of its network to manage severe port congestions globally. In addition, Hapag-Lloyd has announced a new peak season surcharge from East Asia ports to North American destinations. The new splurge will amount to $1,000 per all 20' container types and 2,000 per all 40'.

Consequently, the perplexed context of the current reality is attracting new players – previously not even associated with trade – as opportunities for development and launches of new serviced emerge. BAL Container Line is set to launch a regular service between China and Los Angeles. Matson has announced the launch of a new seasonal China-US west coast "China-California Express" service for the peak season. The transpacific box shipping market is destined to become more crowded. Overall, the global containership orderbook continues to expand. Recently, Ever Given and SITC ordered more newbuildings. A similar type to the one of Ever Given is now valued at $180m. The global containership orderbook is now over 18% of the active fleet.

Meanwhile, there is hope that the Ever Given deal might move from the deadlock in the near future. UK P&I Club has delivered what it believes will be a satisfactory settlement to its dispute with the Suez Canal Authority – it has offered $150m deal, but experts expect that the level of compensation will likely be higher than that and lower than the $600m demanded by the SCA. The decision is yet to be announced, and again it is going to take a while since the court proceedings have been put on hold.

As ocean capacity keeps shrinking and the ongoing disputes are moving with the speed of a snail, Maersk implements its expansion strategy by launching its first block train intermodal service between Europe and China, using Malaszewicze, Poland, as an EU exit point. Transporting chemical cargo needs extra dedication, as it requires high levels of complexity. In turn, modal shift covers New Zealand’s exporters too, but in a different direction. Since the bottleneck in South China is causing further headaches more of the country’s exporters switch to airfreight to reach crucial overseas markets. Rail Cargo Group in Austria has welcomed its first train from China in the city of Graz.

At the same time, supply chain constraints are pushing up trucking rates. The current picture is worrying – according to recent data, the load-to-truck ratio elevated, increasing almost 220% YoY for vans, 674% YoY for flatbeds, and 324% YoY for reefers. Strong demand resulted in rates continuing to rise MoM and YoY across van, flatbed, and reefer.

Northwest Grains International has opened a new transload operation at Inland Port Dillion to improve the supply chain of containerized agricultural goods through the Port of Charleston.

Despite the splurge in demand, the e-commerce giant, Amazon, is going to launch its megasale, meaning that another mini-peak in sales is inevitable. However, experts argue that most sellers do not have the cash to bring in the inventory the storage of which they have to pay besides working with slim margins.

The green locomotive is rushing forward with the International Maritime Organisation that has adopted a new series of key mandatory measures to cut carbon emissions in container shipping, including a ship rating system to measure carbon intensity. Ships will get a rating of their energy efficiency (A, B, C, D, E – where A is the best). Administrations, port authorities, and other stakeholders are encouraged to provide incentives to ships rated as A or B also sending out a strong signal to the market. The Busan Port Authority has begun a joint study with the Korea Institute of Ocean Science and Technology on the impact of pollutants generated from vessels on air quality. Based on the study, BPA and KOST will be able to identify the impact of operating vessel emissions on the port area.

Ищу Машины Бишкек-Екатеринбург

Бишкек-Челябинск

груз пустой контейнер 20, фут

40 фут

Уважаемый Даниил, добрый день. Рады Вам в MAXMODAL. Размещать запросы могут только компании. Для создания профиля компании необходимо нажать на кнопку "+Корпоративный профиль" и заполнить небольшую форму. здесь можно посмотреть видео как создать профиль компании.

Бишкек Екатеринбург фрак какой?