We're offering......

(1) Customs clearance at Nigeria ports, Both air and Sea ports.

(2) Clearing and forwading agent.

(3) Shipping Documents Documentation such as form 'm' process, Son Product certificate, Soncap certificate, NAFDAC, import permit process and other FGN Agency for importation.

(4) Shipping Services surpport.

(5) Logistics provider at Lagos ports Nigeria....... You can contact Omamok Sao shipping and logistics company for your Customs clearance and delivery in Nigeria, We control PAAR.

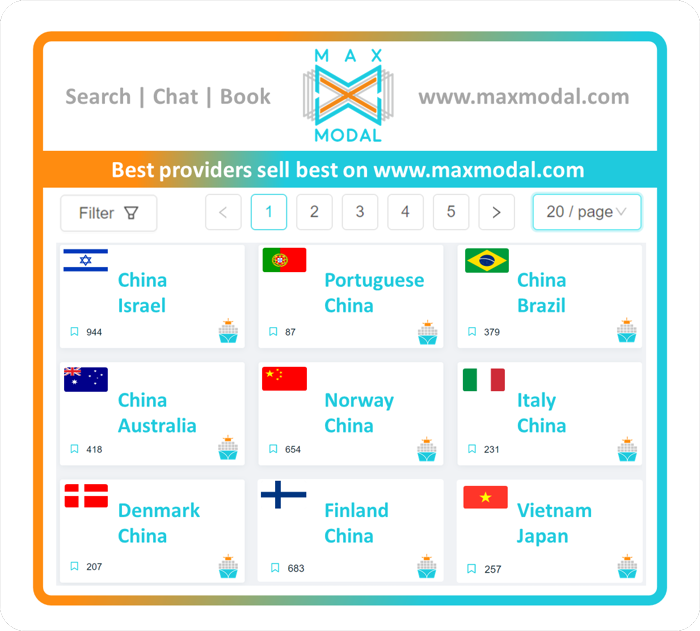

The other day the news about the closure of the Tradelens made it to the headlines, and now world experts are discussing different reasons that led to this decision. However, back in the day in 2017, the founders of MAXMODAL spoke directly with the IBM vice president about the unviability of the Tradelens project for one particular reason: it was not neutral. At that point, this argument was not taken seriously, and the word "neutrality" sounded alienated. But after 5 years, we can witness a bright example of the situation when it does not matter how much market power, technology, money, and other resources you have. Anyone who aims at digitalization as the entire transport and logistics industry altogether, and not just a single company or supply chain, must be neutral. Jens Roemer, the Chair of FIATA’s working group, agrees with us: “…There is no neutrality and, for a tool like this, neutrality is essential.” What does “a neutral digital solution” mean? Let's dive into it.

Firstly, if among the participants of such a solution, there are companies from the industry, then their share must be minor. Otherwise, competitors simply will not trust sensitive data to such a system, which is basically what happened to Tradelens. In 2018, there was extensive criticism of the lack of neutrality of this solution from other shipping lines. Maersk did not listen and decided not to change the format of the Joint Venture, in which it had a share of 51%.

It was decided to prove the neutrality of the solution by involving other significant players, competitors of Maersk. Moreover, the company understood that the inclusion of competitors was a matter of project survival. That's when the media received the news that key competitors (CMA CGM and MSC) joined Tradelens. However, this step not only did not help to solve the problem, but exacerbated it.

Finally, on February 6, 2020, at the level of US antitrust legislation, they were recognized, de facto and de jure, as an alliance of carriers, and not an IT solution. This decision drastically reduced the scope for expanding the functionality of the project. Similarly, Tradelens was perceived as an ordinary alliance under the guise of digitalization by regulators in Europe and China.

Let's go back to neutrality. The second principle of it is the condition that the digital system should not be engaged in the business of its customers at the operational level. What does it mean? It means that all kinds of digital forwarders will not be able to unite the entire industry, simply because they still use the conventional, a century-old business model, where they aim to buy cheaper freight from carriers and sell it for higher prices to cargo owners. The only difference from the past is that now they use digital tools to achieve this goal. This is also true for those who came to the industry externally, for example, such players as Amazon, Alibaba (Cainiao), Flexport, Convoy, and others.

The third principle of neutrality is the universality of a digital solution when it is suitable for all modes of transport and all types of industry participants. In other words, the solution must be multimodal. Are there many such digital solutions on the market today? The answer is “No.” There are mostly monomodal digital platforms and those who claim to have the status of a multimodal solution break the previous two principles. They either operate as forwarders at the operational level and / or are established by industry participants. Therefore, the Global Shipping Business Network and DP World’s Cargoes have little chance of global success.

Now it makes sense to wonder, is it really possible to create a neutral solution? Yes, it is possible and MAXMODAL is a prime example of it. MAXMODAL connects market players worldwide through routes and rates in a digital multimodal network to automate business processes across the industry. Learn more at www.maxmodal.com.

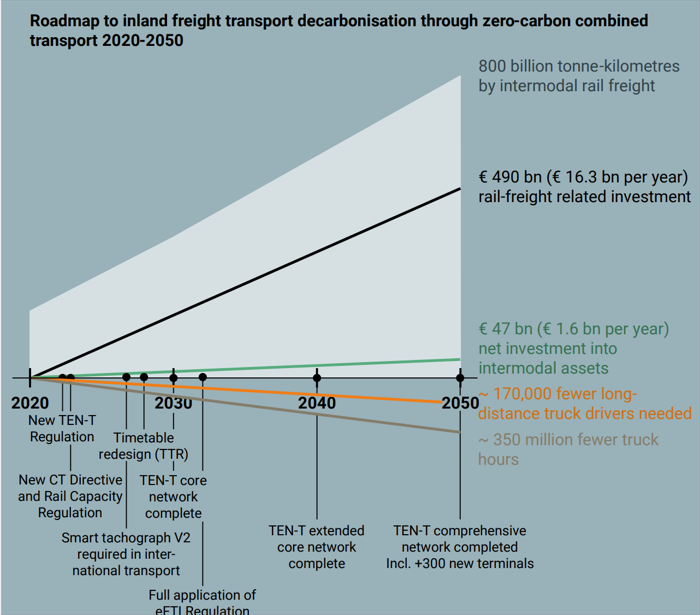

The share of rail freight transport is projected to double until 2050. In order to handle the growing volumes, a public investment of 490 billion euros is needed into the TEN-T rail infrastructure. This comes down to 16.3 billion euros per year. Such is the conclusion of a study called the Roadmap to Zero Carbon Combined Transport 2050, presented by d-fine on behalf of the UIRR on Wednesday 30 November.

Based on the growth prognosis of rail freight in the EU, the rail freight volumes counted in tonne-kilometres are expected to triple by 2050, from 400 in 2020 to 1,150 tonne-kilometre per year. Combined transport will grow even faster: by 360 per cent over the coming 30 years.

As a result of the increasing transport volumes on rail, the number of freight trains is projected to double: from 6,100 in 2020 to 13,800 in 2050. And as the number of truck journeys is expected to decrease, the modal split of rail will grow too: from the current 22 per cent to 44 per cent.

There seems to be nothing ocean carriers can do – or are prepared to do – to stop the rapid slide of container spot rates this side of the Chinese New Year.

Drewry’s WCI Asia-North Europe component lost another 10% this week, dragging the reading down to $1,965 per 40ft, having lost half its value in the past four weeks.

If the rate erosion on the tradelane continues at this pace, spot rates recorded by the WCI will be below $750 a teu by Christmas.

However, notwithstanding that the WCI’s spot rate has dipped below the watershed $2,000 level, expert has received unsolicited rates this week from a China-based forwarder of $1,000 per 40ft for prompt shipment from all main ports in China to the UK ports of Felixstowe, Southampton and London Gateway.

According to Vespucci Maritime CEO Lars Jensen, the liner market is officially experiencing “a hard landing”, with the only light at the end of the tunnel that of the early Chinese New Year on 22 January.

“The present course for the market is for spot rates to reach the bottom after the Chinese New Year,” said Mr Jensen.

The consultant said that, providing the global recession was mild and an inventory correction was the main driver behind the demand collapse, then there could be a cargo surge next summer, leading to a new spot rate spike.

But if the recession turns out to be deeper and more prolonged, Mr Jensen sees a scenario where demand next year is subdued and a cargo surge only materialising in the lead up to the 2024 Chinese New Year.

“In either case, the collapse will cause a large amount of operational turmoil in the next few months, as carriers will continue to blank a large number of sailings in an effort to halt the slide in spot rates,” said Mr Jensen.

We're offering......

(1) Customs clearance at Nigeria ports, Both air and Sea ports.

(2) Clearing and forwading agent.

(3) Shipping Documents Documentation such as form 'm' process, Son Product certificate, Soncap certificate, NAFDAC, import permit process and other FGN Agency for importation.

(4) Shipping Services surpport.

(5) Logistics provider at Lagos ports Nigeria....... You can contact Omamok Sao shipping and logistics company for your Customs clearance and delivery in Nigeria, We control PAAR.

Since August 2020, MSC’s brokers have completed the acquisition of nearly 250 second-hand containerships to usurp 2M partner Maersk as the biggest ocean carrier in capacity terms, suggesting the alliance deal may not be renewed when it expires in April 2024.

According to Alphaliner data, the Geneva-headquartered carrier currently operates 709 vessels, for a capacity of 4.6m teu, compared with Maersk’s 711 ships and 4.3m teu.

However, MSC has a massive orderbook, of 1.75m teu (equivalent to the fleet of fifth-ranked carrier Hapag-Lloyd), while Maersk has just 374,000 teu of capacity on order.

S&P brokers told that MSC was by far the “most aggressive” carrier during the peak of the second-hand tonnage boom, with only CMA CGM’s 85 or so acquisitions threatening its monopoly of the buyer’s market.

Greeting from Omamok Sao shipping company

We're offering.

----------------------

(1) Customs clearance at Nigeria ports, Both air and Sea ports.

(2) Clearing and forwading agent.

(3) Shipping Documents Documentation such as form 'm' process, Son Product certificate, Soncap certificate, NAFDAC, import permit process and other FGN Agency for importation.

(4) Shipping Services surpport.

(5) Logistics provider at Lagos ports Nigeria....... You can contact Omamok Sao shipping and logistics company for your Customs clearance and delivery in Nigeria, We control PAAR.

Our mission

----------------------

To build a long term relationship with our clients and provide exceptional customer services, by pursuing business through inovative and advance to technology regional expansion in the field of logistics, develop a strong base of key customers and to build a good reputation in the logistics field and also become a global key player in the industry,

Your regards

Prince olusegun A. Olowoyeye.

We're offering......

(1) Customs clearance at Nigeria ports, Both air and Sea ports.

(2) Clearing and forwading agent.

(3) Shipping Documents Documentation such as form 'm' process, Son Product certificate, Soncap certificate, NAFDAC, import permit process and other FGN Agency for importation.

(4) Shipping Services surpport.

(5) Logistics provider at Lagos ports Nigeria....... You can contact Omamok Sao shipping and logistics company for your Customs clearance and delivery in Nigeria, We control PAAR.

Get more fresh rates of many providers from across the world. Just search providers and their rates in one #multimodalnetwork to save time on booking and supply chain management.

#Maxmodal is #connectingtheworld of transportation & logistics via routes & rates.

Click on «Search rates on the market».

We're offering......

(1) Customs clearance at Nigeria ports, Both air and Sea ports.

(2) Clearing and forwading agent.

(3) Shipping Documents Documentation such as form 'm' process, Son Product certificate, Soncap certificate, NAFDAC, import permit process and other FGN Agency for importation.

(4) Shipping Services surpport.

(5) Logistics provider at Lagos ports Nigeria....... You can contact Omamok Sao shipping and logistics company for your Customs clearance and delivery in Nigeria, We control PAAR.

Major Chinese export markets are showing signs of a recovery after the steep post-Golden Week holiday decline, led by a rebound in demand for intra-Asia services, according to the latest Asia-Pacific market update from Maersk.

Nevertheless, the “new normal” could see Maersk and its liner peers forced to make radical changes to their networks, as they adapt services to meet a short-to-longer-term reduction in demand.

Maersk said the global economic outlook appeared to be deteriorating against a background of slowing growth and elevated inflation levels.

“As a result, global container volumes are continuing to fall, with negative growth in virtually all the main markets, causing Maersk to reduce capacity on major ocean trades from Asia to match demand,” says the report.

However, Maersk’s regional head of ocean management for the Asia-Pacific region, Morten Juul, remains positive. He said: “The demand for ocean transport is stabilising and we are adjusting our network to match the new reality.”

But the slump in demand resulted in a collapse in container spot rates, which Maersk’s report concedes has been “dramatic”.

We're offering......

(1) Customs clearance at Nigeria ports, Both air and Sea ports.

(2) Clearing and forwading agent.

(3) Shipping Documents Documentation such as form 'm' process, Son Product certificate, Soncap certificate, NAFDAC, import permit process and other FGN Agency for importation.

(4) Shipping Services surpport.

(5) Logistics provider at Lagos ports Nigeria....... You can contact Omamok Sao shipping and logistics company for your Customs clearance and delivery in Nigeria, We control PAAR.

Anti-lockdown protests have broken out across multiple cities in China, and the fresh Covid-restrictions threaten supply chains again.

A fire which killed 10 people in Urumqi, capital of the western Xinjiang region, appears to have triggered the widespread unrest, and strong-arm reprisals from the authorities.

The city had been under lockdown for more than 100 days and protesters took to the streets, blaming Covid-restrictions for delaying the response to the tragedy by emergency services and calling for an end to the lockdown.

Similar protests broke out over the weekend in cities including Shanghai, Beijing, Guangzhou, Wuhan and Chengdu, with videos on social media showing largely peaceful protests and vigils outside universities.

In an unprecedented show of civil disobedience, the protesters in Shanghai chanted: “Down with the Chinese Communist Party, down with Xi Jinping,” Reuters reported.

Other protesters held up blank sheets of white paper to “represent everything they cannot say”, the reports said, some calling it “the biggest act of defiance since Tiananmen Square”.

Contact Omamok Sao shipping and logistics company for your Customs clearance and delivery in Nigeria

Continuous slide of the freight rates is expected to bring them to the pre-COVID level. Shanghai-North Europe freight rates dropped to $2,350/TEU. Shanghai-US East Coast rate is at $3,900/FEU. There are also declines in rates from Shanghai to the Persian Gulf, South America, and Australia.

China, one of the most important countries for shipping demand, has significantly slowed down its industrial growth because of its zero-COVID policy which will have consequences for businesses worldwide. China’s dry bulk commodity import demand has declined by 4.7% year-on-year to 1.6bn tonnes. Moreover, the country’s container volumes have reportedly fallen by -22% year over year.

Trying to halter the drop in rates on trade lanes, companies are scheduling more blank sailings to reduce capacity (for example on the eastbound trans-Pacific trade lane.) However, these steps may not be enough. Liners will idle. In fact, experts predict that idling will reach approximately 1.5m TEU in 2023, or roughly 6% of the end-2022 cellular fleet.

When it comes to carriers, contracts no longer seem to be important anymore, some experts admit. The problem is that they were set high when the carriers tried to lock in shippers on extended deals, but now when the market pivots so unexpectedly, shipping on contracts becomes unsustainable.

Truckers’ strike in South Korea has caused disruptions, in particular, interrupting deliveries of raw and semi-finished materials.

In Austria, a strike is looming over the horizon. All trains will be stopped on Monday unless another decision is made during the negotiations.

Routes and services

- Maersk has added a weekly rail service, the ‘Pratigya Express’, from Sonipat Inland Container Depot to APM Terminals Pipavav Port.

- Ukrainian Railways will add 6 additional border crossings for rail freight to Europe: 3 facilities will be added on the border with Poland (Rawa-Ruska, Grebenne, and Starzhava – Krostsenko), 2 - on the border with Romania (the Delovo-Valea Visheului section), and 1 on the border with Moldova (at Berezino – Basarabeasca).

- Ningbo-Zhoushan Port has opened a new sea-rail transport service to export new energy vehicles.

- The terminals Malaszewicze and Biała Podlaska near the border with Belarus will have more capacity thanks to 13 new additional tracks. It will help to handle longer and heavier trains.

Other

- South Carolina Ports have completed the rail expansion at Inland Port Greer by adding 8,000 feet of new rail to meet cargo demands through 2040. The next phase will be about the expansion of the container yard. The completion of the project is scheduled for 2024.

- After two years, the boxship backlog at Port of Long Beach, Port of Los Angeles has come to an end. No vessels are queuing anymore.

- MSC withdrew from the plan to acquire ITA Airways.

- Rail Cargo Group will expand with a new branch and a new carrier in Serbia and China in 2023. By doing it in Serbia, the company will be able to offer connections towards Turkey and Greece via two alternative routes.

These are only several changes that occurred in more than 250 bn freight rates across 25 million routes with more than 1 million market players. Want to share some news about your company, services, and routes? Just post them on MAXMODAL, a multimodal network that digitally connects routes and rates worldwide to automate sales and operations across container transportation & logistics industry. Join to innovate.