The Meltdown? MAXMODAL digest

Shanghai is reopening, but will the market follow the rules? Are we in for the rates meltdown or a rebound?

According to the officials, restrictions in Shanghai will be lifted by May 20, but what consequences this lockdown has had on the market? As for now, the shipping volumes to the US dropped by 20%. Happag Lloyd has reduced its volumes by 20-25%, and the experts predict that it will take up to eight weeks for the operations in Shanghai to resume properly. Everyone from shippers to manufacturers is desperately waiting for the reopening, and the latter have been voicing their frustrations about how poorly the government has been dealing with the Shanghai outbreak since the early days. Even with the companies that have already resumed production, their output is still less than 30% of capacity. Although the industry players want to stay in the Chinese market for the rebound, the circumstances are throwing shade on these plans, and experts warn that if the situation persists, it will drive people out of the country. It is reported that nearly 28% of foreign employees are ready to leave.

After the reopening, the Chinese rebound will be temporary, although it makes sense for getaway terminals in the US and Europe to brace up for the whiplash effect when the surge of queuing ships will come with new force. Despite that, the demand will soon start decreasing - even to the level prior to clearing of congestion - which will offset the gains of the reopening and peak season.

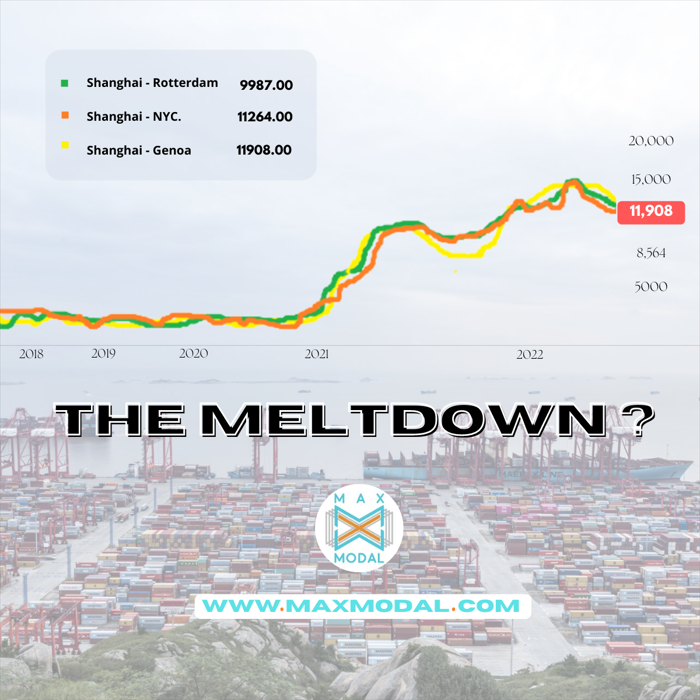

The elevated levels of congestion do not prevent spot rates from a further drop, and the market predicts a significant decline to occur in the second half of 2022. That being said, companies are betting on long-term contracts to safeguard their earnings. Carries are also opting for blank sailings in order to manage the drop, but neither of these actions prevents spot rates from falling even more. Although it might seem paradoxical, but even with the present congestion, rates are particularly weak out of China. Why paradoxical? Traditionally, congestion drives spot rates higher by reducing effective transport supply (and this is what the world saw before), but now it is the opposite (low rates, how congestion) because of the softening demand. Experts call it a transitional period:

- Drewry’s container index has fallen by 0.9% to $7,657.20 per 40ft container but it still remains 33.7% higher than a year ago.

- Spot rates from Asia to Europe and the US west coast have dropped by more than 20%

The slide is expected to stop eventually as soon as capacity stabilizes. Some of the forecasts anticipate it happening in the coming weeks, however, Hapag Lloid foresees a different scenario with spot rates going below long-term rates way later, in 2023. What is also expected next year is that the container-ship newbuilds will hit the water. New orders were being placed all the way through Q1, pushing the orderbook to fleet ratio to around 25%. Therefore, next year, the capacity influx will consequently increase. Taking these factors into account, it can be concluded, as for now, that the peak of the freight rates’ growth may pass already in the first quarter and the market can expect a decreasing dynamic afterward.

On MAXMODAL, it is easy to find the most suitable rate, place customized requests, keep an eye on the fluctuating market thanks to updates, and much more. MAXMODAL is a multimodal network that digitally connects routes and rates worldwide to automate sales and operations. Join to innovate.

#multimodalnetwork #connectingtheworld