Global multimodal network updates

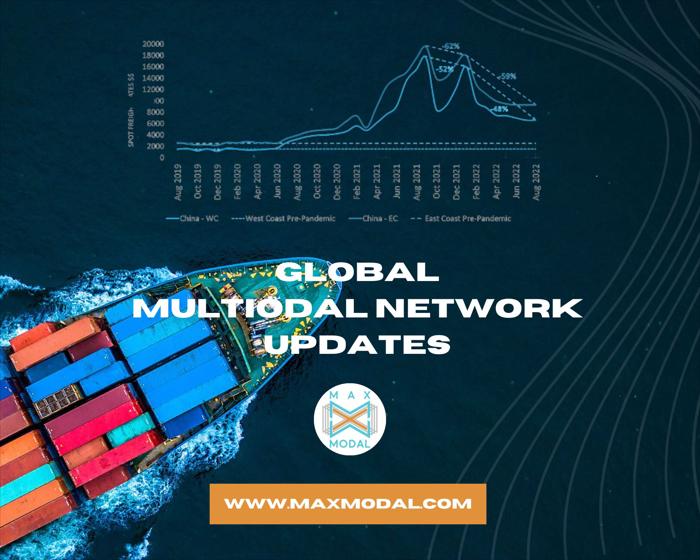

China to the Middle East and intra-Asia routes have faced a collapse in spot rates. There is a 30% drop in Thailand and Vietnam components and a 22% decline in its Middle East index. In Europe, the situation is a bit less intense with a reported 6% decline. As for the transpacific, there is a 7% decline in rates to the US west coast, to $6,149 per 40ft and a 4% decrease to east and Gulf coast ports, to $9,484.Following this dynamic, MSC has dropped its plan to increase new rates on India-US routes, which is great news for MSME exporters that have been struggling with surging rates for many months. Ocean carrier earnings are highly leveraged to average freight rates. While some do well thanks to a diversified service footprint, others (e.g. Zim) underscore their exposure to trans-Pacific spot rates.

Despite this trend, some of the carriers maintain a bullish spirit toward maintaining profitability. Companies say that the demand is there: consumers are buying. However, it might not be for long. There are concerns that the growing inflation and interest rate will cast a shadow on spending habits. The match of the demand against deployed capacity is another hot topic for the market that demonstrated why rates are declining. The utilization right now is below 90% meaning that the market is no longer able to sustain extremely high spot rates.

In this light, the decision of Yang Ming Marine Transport to order almost 19k containers seems debatable. The company explains that it continues to take delivery of newly built ships, while older boxes will have to be scrapped. It will spend US$105 million on the new equipment despite the fact that earlier this year Drewry warned that there is already an oversupply of containers, amounting to 6 million TEU.

In contrast to declining spot rates, equipment shortages have resulted in rising freight rates for reefers. They are competing with high-priced laden dry containers on the return leg from Asia and are struggling with congestion, which slows boxes coming from the US.

New routes and infrustructure:

- A new route on the Silk Road connecting the Chinese eastern port of Lianyungang to Uzbekistan via Kazakhstan. Its a milestone for China in developing this port as a gateway to Central Asia.

- The Port of Thessaloniki has gotten a new regular service with block trains between Thessaloniki and Niš, Serbia.

- Maersk will start the construction of a new Flow Warehouse in Duisburg. the facility will be one of the largest inland logistics hubs in all of Europe. The warehouse’s 84 dock levellers will handle up to 32,000 40-foot containers of customer cargo each year.

Other:

- A fire ripped through the 8,586 teu Zim Charleston has been confirmed. The ship will not leave Colombo port while the investigation is taking place.

- Following the strike in Felixstowe, Cosco will omit its CSCL Brisbane and YM Evolution services. All import containers left on the quay during the strike would continue to accrue detention & demurrage charges after the contracted free period. Other global carriers are contemplating the same steps.

- The planned strikes on the railroad are also prolonging disruptions in the UK. Network Rail will wipeout any meaningful services there. Only Northern Ireland, where transport is organized independently, will escape unscathed.

- Zhonggu Logistics is planning to expand further into intra-Asia shipping via a collaboration agreement with the logistics group Sinotrans regarding freight forwarding and warehousing support in South-east Asia.

These are only several changes that occurred in more than 250 bn freight rates across 25 million routes with more than 1 million market players. Want to share some news about your company, services, and routes? Just post them on MAXMODAL, a multimodal network that digitally connects routes and rates worldwide to automate sales and operations across container transportation & logistics industry. Join to innovate.